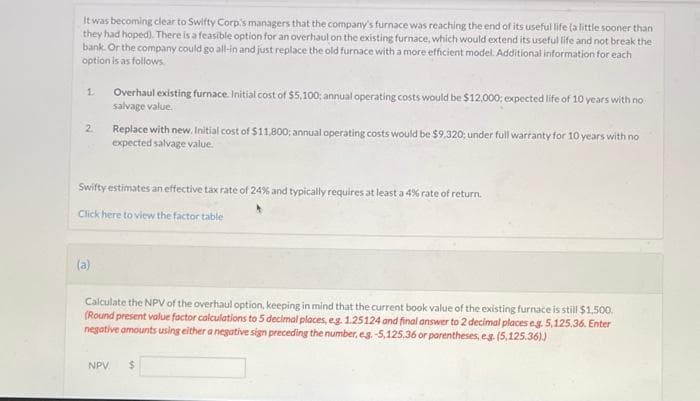

It was becoming clear to Swifty Corp's managers that the company's furnace was reaching the end of its useful life (a little sooner than they had hoped). There is a feasible option for an overhaul on the existing furnace, which would extend its useful life and not break the bank. Or the company could go all-in and just replace the old furnace with a more efficient model. Additional information for each option is as follows. 1 2 Overhaul existing furnace. Initial cost of $5,100; annual operating costs would be $12,000; expected life of 10 years with no salvage value. (a) Replace with new. Initial cost of $11,800; annual operating costs would be $9,320; under full warranty for 10 years with no expected salvage value. Swifty estimates an effective tax rate of 24% and typically requires at least a 4% rate of return. Click here to view the factor table Calculate the NPV of the overhaul option, keeping in mind that the current book value of the existing furnace is still $1,500. (Round present value factor calculations to 5 decimal places, eg. 1.25124 and final answer to 2 decimal places eg. 5,125.36. Enter negative amounts using either a negative sign preceding the number, eg -5,125.36 or parentheses, e.g. (5,125.36).) NPV $

It was becoming clear to Swifty Corp's managers that the company's furnace was reaching the end of its useful life (a little sooner than they had hoped). There is a feasible option for an overhaul on the existing furnace, which would extend its useful life and not break the bank. Or the company could go all-in and just replace the old furnace with a more efficient model. Additional information for each option is as follows. 1 2 Overhaul existing furnace. Initial cost of $5,100; annual operating costs would be $12,000; expected life of 10 years with no salvage value. (a) Replace with new. Initial cost of $11,800; annual operating costs would be $9,320; under full warranty for 10 years with no expected salvage value. Swifty estimates an effective tax rate of 24% and typically requires at least a 4% rate of return. Click here to view the factor table Calculate the NPV of the overhaul option, keeping in mind that the current book value of the existing furnace is still $1,500. (Round present value factor calculations to 5 decimal places, eg. 1.25124 and final answer to 2 decimal places eg. 5,125.36. Enter negative amounts using either a negative sign preceding the number, eg -5,125.36 or parentheses, e.g. (5,125.36).) NPV $

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter12: Capital Budgeting: Decision Criteria

Section: Chapter Questions

Problem 20P: The Aubey Coffee Company is evaluating the within-plant distribution system for its new roasting,...

Related questions

Question

Transcribed Image Text:It was becoming clear to Swifty Corp's managers that the company's furnace was reaching the end of its useful life (a little sooner than

they had hoped). There is a feasible option for an overhaul on the existing furnace, which would extend its useful life and not break the

bank. Or the company could go all-in and just replace the old furnace with a more efficient model. Additional information for each

option is as follows.

1

2

Overhaul existing furnace. Initial cost of $5,100; annual operating costs would be $12,000; expected life of 10 years with no

salvage value.

(a)

Replace with new. Initial cost of $11,800; annual operating costs would be $9,320; under full warranty for 10 years with no

expected salvage value.

Swifty estimates an effective tax rate of 24% and typically requires at least a 4% rate of return.

Click here to view the factor table

Calculate the NPV of the overhaul option, keeping in mind that the current book value of the existing furnace is still $1,500.

(Round present value factor calculations to 5 decimal places, eg. 1.25124 and final answer to 2 decimal places eg. 5,125.36. Enter

negative amounts using either a negative sign preceding the number, e.g. -5,125.36 or parentheses, e.g. (5,125,36).)

NPV $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning