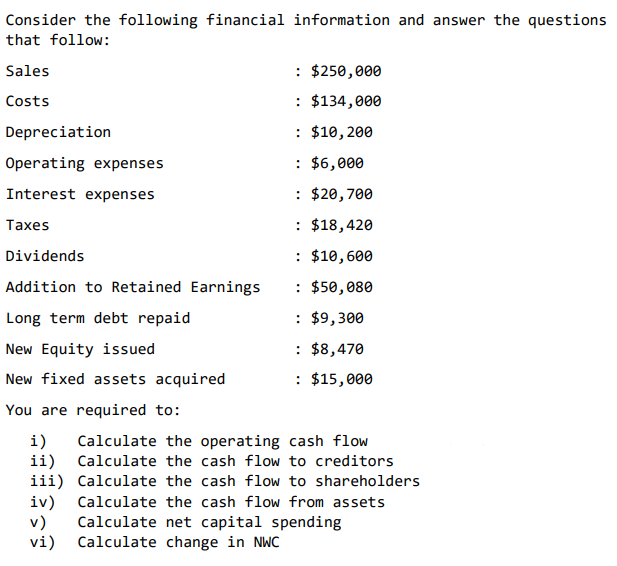

Consider the following financial information and answer the questions that follow: Sales Costs Depreciation Operating expenses Interest expenses Taxes Dividends Addition to Retained Earnings Long term debt repaid New Equity issued New fixed assets acquired You are required to: i) ii) iii) iv) v) vi) : $250,000 : $134,000 : $10,200 : $6,000 : $20,700 : $18,420 : $10,600 : $50,080 : $9,300 : $8,470 : $15,000 Calculate the operating cash flow Calculate the cash flow to creditors Calculate the cash flow to shareholders Calculate the cash flow from assets Calculate net capital spending Calculate change in NWC

Consider the following financial information and answer the questions that follow: Sales Costs Depreciation Operating expenses Interest expenses Taxes Dividends Addition to Retained Earnings Long term debt repaid New Equity issued New fixed assets acquired You are required to: i) ii) iii) iv) v) vi) : $250,000 : $134,000 : $10,200 : $6,000 : $20,700 : $18,420 : $10,600 : $50,080 : $9,300 : $8,470 : $15,000 Calculate the operating cash flow Calculate the cash flow to creditors Calculate the cash flow to shareholders Calculate the cash flow from assets Calculate net capital spending Calculate change in NWC

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter2: Financial Statements, Cash Flow,and Taxes

Section: Chapter Questions

Problem 1Q: Define each of the following terms:

Annual report; balance sheet; income statement

Common...

Related questions

Question

Transcribed Image Text:Consider the following financial information and answer the questions

that follow:

Sales

Costs

Depreciation

Operating expenses

Interest expenses

Taxes

Dividends

Addition to Retained Earnings

Long term debt repaid

New Equity issued

New fixed assets acquired

You are required to:

i)

ii)

iii)

iv)

v)

vi)

: $250,000

: $134,000

: $10,200

: $6,000

: $20,700

: $18,420

: $10,600

: $50,080

: $9,300

: $8,470

: $15,000

Calculate the operating cash flow

Calculate the cash flow to creditors

Calculate the cash flow to shareholders

Calculate the cash flow from assets

Calculate net capital spending

Calculate change in NWC

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 3 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Transcribed Image Text:iv) Calculate the cash flow from assets

v) Calculate net capital spending

vi) Calculate change in NWC

Solution

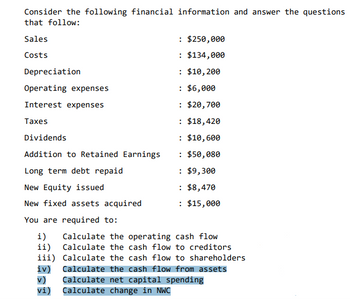

Follow-up Question

Kindly answer the highlighted questions

Transcribed Image Text:Consider the following financial information and answer the questions

that follow:

Sales

Costs

Depreciation

Operating expenses

Interest expenses

Taxes

Dividends

Addition to Retained Earnings

Long term debt repaid

New Equity issued

New fixed assets acquired

: $250,000

: $134,000

iv)

v)

vi)

: $10, 200

: $6,000

: $20,700

: $18,420

: $10,600

: $50,080

: $9,300

: $8,470

: $15,000

You are required to:

ii)

i) Calculate the operating cash flow

Calculate the cash flow to creditors

Calculate the cash flow to shareholders

Calculate the cash flow from assets

Calculate net capital spending

iii)

Calculate change in NWC

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning