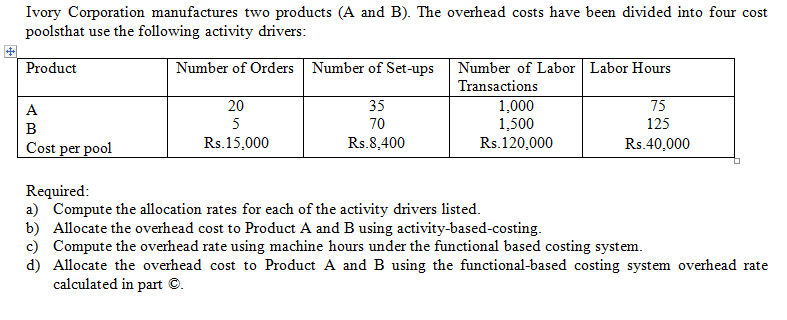

Ivory Corporation manufactures two products (A and B). The overhead costs have been divided into four cost poolsthat use the following activity drivers: Product Number of Orders Number of Set-ups | Number of Labor Labor Hours Transactions 1,000 1,500 Rs.120,000 20 35 75 A 5 70 125 Cost per pool Rs.15,000 Rs.8,400 Rs.40,000 Required: a) Compute the allocation rates for each of the activity drivers listed. b) Allocate the overhead cost to Product A and B using activity-based-costing. c) Compute the overhead rate using machine hours under the functional based costing system. d) Allocate the overhead cost to Product A and B using the functional-based costing system overhead rate calculated in part

Critical Path Method

The critical path is the longest succession of tasks that has to be successfully completed to conclude a project entirely. The tasks involved in the sequence are called critical activities, as any task getting delayed will result in the whole project getting delayed. To determine the time duration of a project, the critical path has to be identified. The critical path method or CPM is used by project managers to evaluate the least amount of time required to finish each task with the least amount of delay.

Cost Analysis

The entire idea of cost of production or definition of production cost is applied corresponding or we can say that it is related to investment or money cost. Money cost or investment refers to any money expenditure which the firm or supplier or producer undertakes in purchasing or hiring factor of production or factor services.

Inventory Management

Inventory management is the process or system of handling all the goods that an organization owns. In simpler terms, inventory management deals with how a company orders, stores, and uses its goods.

Project Management

Project Management is all about management and optimum utilization of the resources in the best possible manner to develop the software as per the requirement of the client. Here the Project refers to the development of software to meet the end objective of the client by providing the required product or service within a specified Period of time and ensuring high quality. This can be done by managing all the available resources. In short, it can be defined as an application of knowledge, skills, tools, and techniques to meet the objective of the Project. It is the duty of a Project Manager to achieve the objective of the Project as per the specifications given by the client.

Trending now

This is a popular solution!

Step by step

Solved in 4 steps