Jack and Jill's Place is a nonprofit nursery school run by the parents of the enrolled children. Since the school is out of town, it has a well rather than a city water supply. Lately, the well has become unreliable, and the school has had to bring in bottled drinking water. The school's governing board is considering drilling a new well (at the top of the hill, naturally). The board estimates that a new well would cost $3,32 and save the school $700 annually for 10 years. The school's hurdle rate is 8 percent. Use Appendix A for your reference. (Use appropriate factor(s) from the tables provided.) Required: Compute the new well's net present value. Should the governing board approve the new well? (Round your final answer to the nearest dollar amount.) Net present value Approve? Yes

Jack and Jill's Place is a nonprofit nursery school run by the parents of the enrolled children. Since the school is out of town, it has a well rather than a city water supply. Lately, the well has become unreliable, and the school has had to bring in bottled drinking water. The school's governing board is considering drilling a new well (at the top of the hill, naturally). The board estimates that a new well would cost $3,32 and save the school $700 annually for 10 years. The school's hurdle rate is 8 percent. Use Appendix A for your reference. (Use appropriate factor(s) from the tables provided.) Required: Compute the new well's net present value. Should the governing board approve the new well? (Round your final answer to the nearest dollar amount.) Net present value Approve? Yes

Chapter5: Gross Income: Exclusions

Section: Chapter Questions

Problem 44P

Related questions

Concept explainers

Question

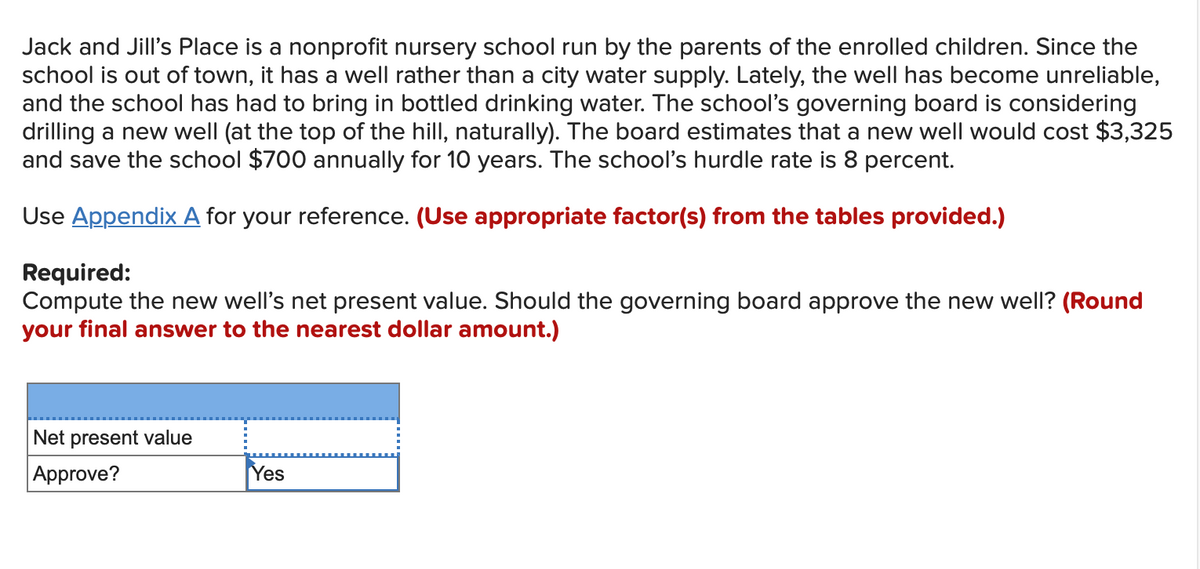

Transcribed Image Text:Jack and Jill's Place is a nonprofit nursery school run by the parents of the enrolled children. Since the

school is out of town, it has a well rather than a city water supply. Lately, the well has become unreliable,

and the school has had to bring in bottled drinking water. The school's governing board is considering

drilling a new well (at the top of the hill, naturally). The board estimates that a new well would cost $3,325

and save the school $700 annually for 10 years. The school's hurdle rate is 8 percent.

Use Appendix A for your reference. (Use appropriate factor(s) from the tables provided.)

Required:

Compute the new well's net present value. Should the governing board approve the new well? (Round

your final answer to the nearest dollar amount.)

Net present value

Approve?

Yes

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT