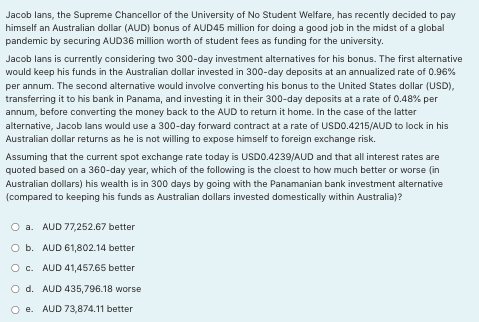

Jacob lans, the Supreme Chancellor of the University of No Student Welfare, has recently decided to pay himself an Australian dollar (AUD) bonus of AUD45 million for doing a good job in the midst of a global pandemic by securing AUD36 million worth of student fees as funding for the university. Jacob lans is currently considering two 300-day investment alternatives for his bonus. The first alternative would keep his funds in the Australian dollar invested in 300-day deposits at an annualized rate of 0.96% per annum. The second alternative would involve converting his bonus to the United States dollar (USD), transferring it to his bank in Panama, and investing it in their 300-day deposits at a rate of 0.48% per annum, before converting the money back to the AUD to return it home. In the case of the latter alternative, Jacob lans would use a 300-day forward contract at a rate of USD0.4215/AUD to lock in his Australian dollar returns as he is not willing to expose himself to foreign exchange risk. Assuming that the current spot exchange rate today is USD0.4239/AUD and that all interest rates are quoted based on a 360-day year, which of the following is the cloest to how much better or worse (in Australian dollars) his wealth is in 300 days by going with the Panamanian bank investment alternative (compared to keeping his funds as Australian dollars invested domestically within Australia)? O a. AUD 77,252.67 better O b. AUD 61,802.14 better OC. AUD 41,457.65 better O d. AUD 435,796.18 worse Oe. AUD 73,874.11 better

Jacob lans, the Supreme Chancellor of the University of No Student Welfare, has recently decided to pay himself an Australian dollar (AUD) bonus of AUD45 million for doing a good job in the midst of a global pandemic by securing AUD36 million worth of student fees as funding for the university. Jacob lans is currently considering two 300-day investment alternatives for his bonus. The first alternative would keep his funds in the Australian dollar invested in 300-day deposits at an annualized rate of 0.96% per annum. The second alternative would involve converting his bonus to the United States dollar (USD), transferring it to his bank in Panama, and investing it in their 300-day deposits at a rate of 0.48% per annum, before converting the money back to the AUD to return it home. In the case of the latter alternative, Jacob lans would use a 300-day forward contract at a rate of USD0.4215/AUD to lock in his Australian dollar returns as he is not willing to expose himself to foreign exchange risk. Assuming that the current spot exchange rate today is USD0.4239/AUD and that all interest rates are quoted based on a 360-day year, which of the following is the cloest to how much better or worse (in Australian dollars) his wealth is in 300 days by going with the Panamanian bank investment alternative (compared to keeping his funds as Australian dollars invested domestically within Australia)? O a. AUD 77,252.67 better O b. AUD 61,802.14 better OC. AUD 41,457.65 better O d. AUD 435,796.18 worse Oe. AUD 73,874.11 better

Chapter14: Multinational Capital Budgeting

Section: Chapter Questions

Problem 34QA

Related questions

Question

Transcribed Image Text:Jacob lans, the Supreme Chancellor of the University of No Student Welfare, has recently decided to pay

himself an Australian dollar (AUD) bonus of AUD45 million for doing a good job in the midst of a global

pandemic by securing AUD36 million worth of student fees as funding for the university.

Jacob lans is currently considering two 300-day investment alternatives for his bonus. The first alternative

would keep his funds in the Australian dollar invested in 300-day deposits at an annualized rate of 0.96%

per annum. The second alternative would involve converting his bonus to the United States dollar (USD),

transferring it to his bank in Panama, and investing it in their 300-day deposits at a rate of 0.48% per

annum, before converting the money back to the AUD to return it home. In the case of the latter

alternative, Jacob lans would use a 300-day forward contract at a rate of USD0.4215/AUD to lock in his

Australian dollar returns as he is not willing to expose himself to foreign exchange risk.

Assuming that the current spot exchange rate today is USD0.4239/AUD and that all interest rates are

quoted based on a 360-day year, which of the following is the cloest to how much better or worse (in

Australian dollars) his wealth is in 300 days by going with the Panamanian bank investment alternative

(compared to keeping his funds as Australian dollars invested domestically within Australia)?

O a. AUD 77,252.67 better

O b. AUD 61,802.14 better

O c. AUD 41,457.65 better

O d. AUD 435,796.18 worse

AUD 73,874.11 better

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning