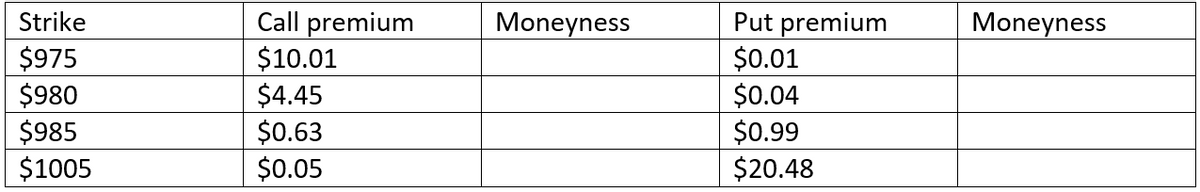

Jaleel is holding some Tesla shares (NASDAQ: TSLA) and The TSLA stocks are currently trading at $985 on the Nasdaq. Given TSLA stocks are very volatile, Jaleel wishes to protect the value of his investments. He seeks your advice on using option contracts and presents a list of options for you to choose from. Assume the number of underlying shares per contract is 100 shares. Please specify the moneyness of the image options. Are they in the money, at the money, or out of the money? Identify what kind of risk Jaleel is facing and to hedge this risk, whi

Jaleel is holding some Tesla shares (NASDAQ: TSLA) and The TSLA stocks are currently trading at $985 on the Nasdaq. Given TSLA stocks are very volatile, Jaleel wishes to protect the value of his investments. He seeks your advice on using option contracts and presents a list of options for you to choose from. Assume the number of underlying shares per contract is 100 shares. Please specify the moneyness of the image options. Are they in the money, at the money, or out of the money? Identify what kind of risk Jaleel is facing and to hedge this risk, whi

Chapter5: Operating Activities: Purchases And Cash Payments

Section: Chapter Questions

Problem 3.9C

Related questions

Question

Jaleel is holding some Tesla shares (NASDAQ: TSLA) and The TSLA stocks are

currently trading at $985 on the Nasdaq. Given TSLA stocks are very volatile, Jaleel

wishes to protect the value of his investments. He seeks your advice on using option

contracts and presents a list of options for you to choose from. Assume the number of

underlying shares per contract is 100 shares.

Please specify the moneyness of the image options. Are they in the money, at

the money, or out of the money?

Identify what kind of risk Jaleel is facing and to hedge this risk, which option

would you suggest that Jaleel should purchase? Why?

Transcribed Image Text:Strike

$975

$980

$985

$1005

Call premium

$10.01

$4.45

$0.63

$0.05

Moneyness

Put premium

$0.01

$0.04

$0.99

$20.48

Moneyness

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you