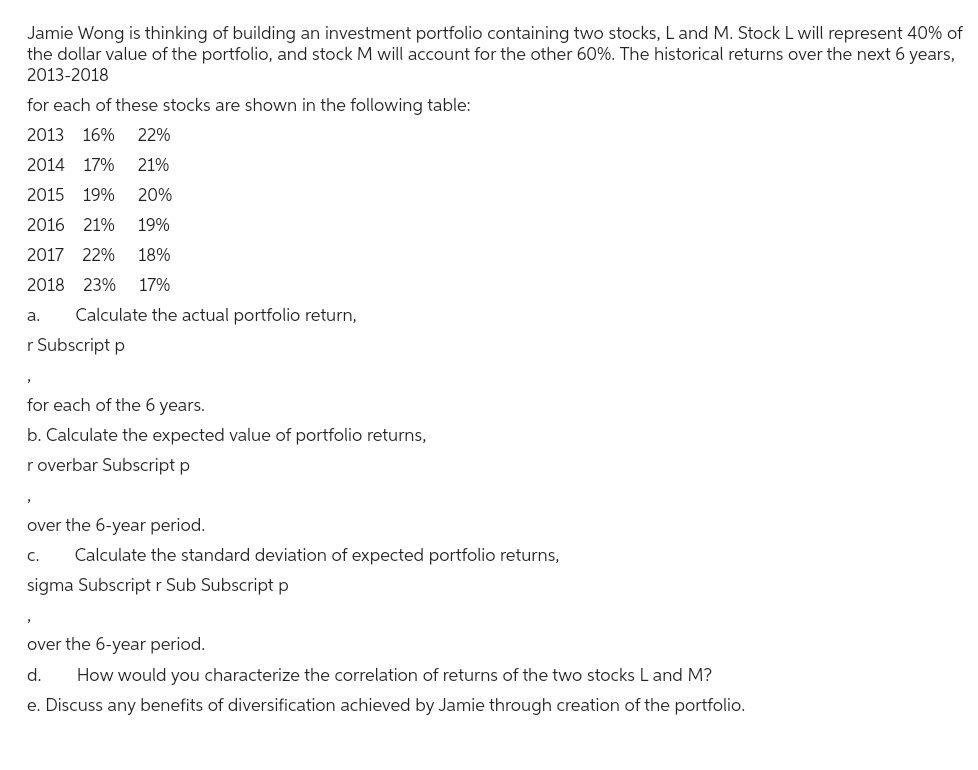

Jamie Wong is thinking of building an investment portfolio containing two stocks, L and M. Stock L will represent 40% of the dollar value of the portfolio, and stock M will account for the other 60%. The historical returns over the next 6 years, 2013-2018 for each of these stocks are shown in the following table: 2013 16% 22% 2014 17% 21% 2015 19% 20% 2016 21% 19% 2017 22% 18% 2018 23% 17% a. Calculate the actual portfolio return, Subscript p

Q: You own a portfolio consisting of 100 shares of Stock A (Beta A = 1), 150 shares of Stock B (Beta B…

A: A customized portfolio comprising of stock A, stock B and risk free assets has been created. The…

Q: ONLY NEED PART B ANSWERED House of Haddock has 5,090 shares outstanding and the stock price is $149.…

A: B) Under the new policy of House of Haddock, the company will distribute half of its cash in the…

Q: Carson Trucking is considering wether to expand its regional service center. The exapnsion will…

A: NPV is a capital budgeting techniques which help in decision making on the basis of future cash…

Q: Required information Benchmark Assignment - Coca-Cola Co. & Pepsico Inc. You will need to use the…

A: Certainly, here are the ratio computations for Coca-Cola and PepsiCo based on the data provided:…

Q: MHF believes the price of Amazon is going to fall substantially over the next 8 months. MHF uses an…

A: The price of the stock is expected to fall in future. The investor is trying to hedge using options.…

Q: Only typing. .... . A strip is a variation of a straddle involving two puts and one call.…

A: A strip is a bearish options trading strategy that involves selling two puts and buying one call…

Q: The costs of leasing are a. the down payment b. the lease payments. c. the buyout. d.…

A: As part of a financial agreement known as leasing, a lessor (usually a leasing company) allows a…

Q: If I invest P10,387 today and expect a reimbursement every 6 months with a rate of 11.54% compounded…

A: Total Investment = P10,387 Interest Rate = 11.54% Compounded Semi-Annually = 2 Total no. of years =…

Q: O A risk-averse investor does not like risk and so would prefer to invest in the portfolio…

A: A rational investor wants more returns for a given level of risk or lower risk for a given level of…

Q: can you tell me 4 various types of budgets used in a large organisation please? thank you :)

A: An annual budget refers to a financial plan that covers a period of one year. It is a comprehensive…

Q: Fatoumata is going to invest in an account paying an interest rate of 1.7% compounded continuously.…

A: Compound interest refers to the method of interest calculation where the interest earned in each…

Q: Project C0 C1 C2 C3 C4 A -5000 +1000 +1000 +3000 0 B -1000 0 +1000 +2000 +3000 C -5000 +1000 +1000…

A: NPV is a capital budgeting techniques which help in decision making on the basis of future cash…

Q: Nelson is faced with a conundrum as a hedge fund manager. He could choose to invest a new client’s…

A: Return: The profit or loss realised over a period of time on an investment, expressed as a…

Q: 44 A company is about to invest in a joint venture research and development project with another…

A: a)Here is a cash flow diagram to illustrate the situation: there are no incoming cash flows in…

Q: Brian is a salesman at a furniture store. He is paid a weekly salary of $450 plus a 10% commission…

A: According to bartleby guidelines, if multiple questions are asked, then 1st question needs to be…

Q: How are investors of zero-coupon bonds compensated for making such an investment? A. Such bonds…

A: Bond are debt instruments issued by companies. Zero coupon bonds, as the name indicates, do not pay…

Q: A trader buys a put option with strike $85 and buys a call option with a strike of $95, both with…

A: To calculate the breakeven share prices, we need to add and subtract the premiums paid for the call…

Q: Ten annual returns are listed in the following table: (Click on the following icon in order to copy…

A: Arithmetic average return is calculated as shown below. Arithmetic average…

Q: What is market efficiency? How is the concept of market efficiency an important part of shareholder…

A: Introduction: Market efficiency-It is a term and it refers to any metric that helps in measuring…

Q: Ned Tech Corporation is considering replacing one of its machines with a more efficient one. The old…

A: 1. Net present value (NPV) is computed by deducting initial investment from present value of cash…

Q: At the present time, t = 0, your company has assets-in-place and $200m in cash. One period from now,…

A: To answer this question, we need to calculate the expected value of the company's assets at t=1,…

Q: Interpret the following stock price quote. In addition, what is Sizzler's approximate earnings per…

A: A stock price quote refers to the current or most recent trading price of a particular stock on a…

Q: The 2020 Arizona graduated tax rate is given in the table below for those filing status is single or…

A: Taxable income is the amount of income subject to tax. The income tax is calculated as per the slabs…

Q: finance Question 4 The Smiths spend 2% of their monthly income on movies. Their income in May was…

A: The monthly expenditure on movies can be calculated by finding out the percentage expenditure on…

Q: Calculate the accrued interest (in $) and the total proceeds (in $) of the bond sale. (Round your…

A: Coupon rate = 10.425% Face value = $1,000 Market price = $1,000×77/100 = $770 Time since last…

Q: The Trucking Company enters an agreement with the Oil Corporation to purchase 500,000 gallons of…

A: A forward contract represents an agreement among parties for the purchase or sale of the underlying…

Q: Following is the forecast of Tintin Company (FY2021 – 2023)? EPS is Earnings per Share, DPS denoted…

A: To calculate the implied growth rate, we can use the Gordon Growth Model formula: Market Price per…

Q: Machine X has an intial cost of $10,000. It is expected to last 12 years, to cost $200 per year to…

A: Equivalent Annual Cost (EAC) is often used for capital budgeting decision and is the annual cost of…

Q: Toyota will bring hybrid electric automobiles to market next year priced at $33,000 (this includes a…

A: Data given: Price difference= $3120 No. of years required to recoup the difference in price=8 years…

Q: 6-18. (Required rate of return using CAPM) a. Compute an appropriate rate of return for Intel common…

A: Cost of equity(KE) is the return expected by the holders of common stock, they are paid an…

Q: You have saved $14000 for a down payment on a house. Your bank requires a minimum down payment of…

A: A down payment is a sum of money that the borrower contributes up ahead towards the cost of a loan…

Q: 3. How much should I expect a lump sum from a deal at the end of 3 years if I start investing today…

A: Compound = quarterly = 4 Time = t = 3 * 4 = 12 Payment = p = P5800 Interest rate = r = 15 / 4 =…

Q: Financial analysts have estimated the returns on shares of the Goldday Corporation and the overall…

A: The returns from a stock or returns from the market are not always the same. It varies as per the…

Q: Sato Company is considering an investment in equipment that is capable of producing more efficiently…

A: To compute the payback period, we need to find out the time it takes for the initial investment to…

Q: You will receive a gift of $90,791 in 10 years. If the correct discount rate is 6 percent, what is…

A: As per the given information: Amount to be received = $90,791Period = 10 yearsDiscount rate = 6% To…

Q: The Callway Cattle Company is considering the construction of a feed-handling system. The new system…

A: Discounted pay back period is a Capital budgeting techniques which help in decision making on the…

Q: Medhurst Corporation issued $88,000 in bonds for $85,100. The bonds had a stated rate of 8% and pay…

A: Journal entry: Journal entry is the book of original entry where first transactions are recorded in…

Q: Cullumber Corp, is considering purchasing one of two new diagnostic machines. Either machine would…

A: Capital budgeting involves making decisions about long-term investments that have significant…

Q: Jaxon invested $710 in an account paying an interest rate of 87% compounded quarterly. Jason…

A: Here, Particulars Jaxon Jason Amount invested (PV) $710.00 $710.00 Interest rate 8.875…

Q: 3. You are considering taking out a loan for $17,000 to buy a new car. The annual interest rate is…

A: Compound = monthly = 12 Present value = pv = $17,000 Interest rate = r = 9.5 / 12% Time = t = 4 * 12…

Q: Please explain how to answer these questions, including the formulas I should use, the steps I…

A: 1.5 To calculate the sustainable growth rate for Top Harvest, we need to use the following formula:…

Q: 1. If the market-risk premium were 4% and a security's beta coefficient were 2.0, what would be the…

A: 1 ) Required rate of return = Risk free + Beta × Risk Premium Risk Free Rate = 6% Risk Premium =…

Q: Identify the future route for corporate governance from a global perspective and ways in which a…

A: Corporate governance has become increasingly important in recent years, as companies have become…

Q: Chinook, Inc. purchases components from a Japanese company that requires payment in yen (Y); it…

A: Cost is Y6,890,000 Selling Price is $150,000 Exchange Rates are as follows: $1 = Y106.0 $1 = E0.84

Q: In a conventional interest rate swap agreement,the fixed-rate payer is attempting to transform the…

A: An interest rate swap is a financial contract between two parties, typically corporations or…

Q: Find the amount of each payment to be made into a sinking fund earning 5% compounded monthly to…

A: A sinking fund is a fund created for paying off debt obligation by setting aside specific amount…

Q: you

A: a) The expected dividends for the next 4 years are: Year 1: $3.00 x 1.08 = $3.24 Year 2: $3.24 x…

Q: Finance John and John Plc. is a midsized electronics manufacturing company in the West of Scotland.…

A: To calculate the statement of after-tax cash flows attributable to the project, we need to take into…

Q: Finance Draw payoff diagrams for the following portfolios entered into at times: ( a) A long…

A: a) Payoff diagram for a long position in one stock: where S is the price of the stock at…

Q: Teams MSFT Corporation has the following information: Inventory conversion period 79.02 days…

A: To determine the length of time (days) for Microsoft Corporation to cycle cash, we can use the cash…

Step by step

Solved in 3 steps

- Jamie Wong is thinking of building an investment portfolio containing two stocks, L and M. Stock L will represent 40% of the dollar value of the portfolio, and stock M will account for the other 60%. The historical returns over the last 6 years, 2013–2018, for each of these stocks are shown in the following table. Expected return. Year Stock L Stock M 2013 14 20 2014 14 18 2015 16 16 2016 17 14 2017 17 12 2018 19 10 A. Calculate the actual portfolio return,, for each of the 6 years. B. Calculate the average return for each stock and for the portfolio over the 6-year period. C. Calculate the standard deviation of returns for each asset and for the portfolio. How does the portfolio standard deviation compare to the standard deviations of the individual assets? D. How would you characterize the correlation of returns of the two stocks L and M? E. Discuss any benefits of diversification achieved by Jamie through creation of the portfolio.Jamie Wong is thinking of building an investment portfolio containing two stocks, L and M. Stock L will represent 20%of the dollar value of the portfolio, and stock M will account for the other 80%. The historical returns over the next 6 years, 2013−2018, for each of these stocks are shown in the following table: ( see attached table a. Calculate the actual portfolio return, rp, for each of the 6 years. b. Calculate the expected value of portfolio returns, rp, over the 6-year period. c. Calculate the standard deviation of expected portfolio returns, σrp, over the 6-year period. d. How would you characterize the correlation of returns of the two stocks L and M? e. Discuss any benefits of diversification achieved by Jamie through creation of the portfolio.Jamie Wong is thinking of building an investment portfolio containing two stocks, L and M. Stock L will represent 50% of the dollar value of the portfolio, and stock M will account for the other 50%. The historical returns over the next 6 years, 2013−2018,for each of these stocks are shown in the following table: (see attached table) a. Calculate the actual portfolio return, rp, for each of the 6 years. b. Calculate the expected value of portfolio returns, rp, over the 6-year period. c. Calculate the standard deviation of expected portfolio returns, σrp, over the 6-year period.

- Jamie Wong is thinking of building an investment portfolio containing two stocks, L and M. Stock L will represent 50% of the dollar value of the portfolio, and stock M will account for the other 50%. The historical returns over the next 6 years, 2013−2018,for each of these stocks are shown in the following table: (see attached table) d. How would you characterize the correlation of returns of the two stocks L and M? e. Discuss any benefits of diversification achieved by Jamie through creation of the portfolio.You are considering an investment in either individual stocks or a portfolio of stocks. The two stocks you are researching, Stock A and Stock B, have the following historical returns: Year r ̄A r ̄B 2014 -20.00% -5.00% 2016 42.00 15.00 2017 20.00 -13.00 2018 -8.00 50.00 2019 25.00 12.00 Calculate the average rate of return for each stock during the 5-year period. Suppose you had held a portfolio consisting of 50% of Stock A and 50% of Stock B. What would have been the realized rate of return on the portfolio in each year? What would have been the average return on the portfolio during this period? Calculate the standard deviation of returns for each stock and for the portfolio. Suppose you are a risk-averse investor. Assuming Stocks A and B are your only choices, would you prefer to hold Stock A, Stock B,…You are considering an investment in either individual stocks or a portfolio of stocks. The two stocks you are researching, Stock A and Stock B, have the following historical returns: Year rA rB 2014 -20.00% -5.00% 2016 42.00 15.00 2017 20.00 -13.00 2018 -8.00 50.00 2019 25.00 12.00 a. Calculate the average rate of return for each stock during the 5-year period. b. Suppose you had held a portfolio consisting of 50% of Stock A and 50% of Stock B. What would have been the realized rate of return on the portfolio in each year? What would have been the average return on the portfolio during this period? c. Calculate the standard deviation of returns for each stock and for the portfolio. d. Suppose you are a risk-averse investor. Assuming Stocks A and B are your only choices, would you prefer to hold Stock A, Stock B, or the portfolio? Why?

- James had an equity portfolio that contains $40,000 investment in Tesla (TSLA) and $60,000 investment in Microsoft (MSFT) since 2018. After seeing the stock market turmoil sparked by coronavirus, he contacted you and seek for some approaches to measure the expected losses of his portfolio. As his investment adviser, you decided to use the model building approach to measure the risk of James’ portfolio. What is the 10-day 97% value at risk for TSLA and MSFT, respectively?James had an equity portfolio that contains $40,000 investment in Tesla (TSLA) and $60,000 investment in Microsoft (MSFT) since 2018. After seeing the stock market turmoil sparked by coronavirus, he contacted you and seek for some approaches to measure the expected losses of his portfolio. As his investment adviser, you decided to use the model building approach to measure the risk of James’ portfolio. What is the 10-day 97% value at risk for the portfolio?Suppose you have portfolio of four stocks Stock A, B, C and D, Total investment in these stocks is equal to 2019331015 $, Beta of these stocks is 1.5, (0.5), 1.25, and 0.75 and proportion invested is 22%, 20%, 30%, and remaining in D. If the Risk free rate is 6% and market rate of return is 15%. Calculate a) Investment in each stock. b) Market premium c) Required Rate of return for each stock. d) Required rate of return of Portfolio. e) If expected rate of return of stock A is 10%, what do you think if it is overvalued or undervalued.

- Of the $10,000 invested in a two-stock portfolio, 30 percent is invested in Stock A and 70 percent is invested in Stock B. If Stock A has a beta equal to 2.0 and the beta of the portfolio is 0.95, what is the beta of Stock B?please step by step and formulaAssume that you bought 200 stock B in your portfolio for total investment of $1200, now the market price of the stock is $75, the dividend paid for this stock is $2 each year. How much is the capital gain of this stock? Assume that the following data available for the portfolio, calculate the expected return, variance and standard deviation of the portfolio given stock A accounts for 45% and stock B accounts for 55% of your portfolio? A B Expected return 12.5% 18.5% Standard Deviation of return 15% 20% Correlation of coefficient (p) 0.4Using the data in the following table, Year 2010 2011 2012 2013 2014 2015 Stock A -10% 20% 5% -5% 2% 9% Stock B 21% 7% 30% -3% -8% 25% consider a portfolio that maintains a 50% weight on stock A and a 50% weight on stock B. What is the return each year of this portfolio? Based on your results from part