January 1....... Average for the year. December 31.... $0.25 - 1 rand 0.28 = 1 0.31 = 1 %3D %3D

January 1....... Average for the year. December 31.... $0.25 - 1 rand 0.28 = 1 0.31 = 1 %3D %3D

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter4: Accounting For Retail Operations

Section: Chapter Questions

Problem 4.2MBA: Sales transactions Using transactions listed in P4-2, indicate the effects of each transaction on...

Related questions

Question

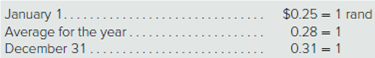

Yang Corporation starts a foreign subsidiary on January 1 by investing 20,000 rand. Yang owns all of the shares of the subsidiary’s common stock. The foreign subsidiary generates 40,000 rand of net income throughout the year and pays no dividends. The rand is the foreign subsidiary’s functional currency. Currency exchange rates for 1 rand are as follows:

In preparing consolidated financial statements, what translation adjustment will Yang report at the end of the current year?

a. $400 positive (credit).

b. $1,000 positive (credit).

c. $1,400 positive (credit).

d. $2,400 positive (credit).

Transcribed Image Text:January 1.......

Average for the year.

December 31....

$0.25 - 1 rand

0.28 = 1

0.31 = 1

%3D

%3D

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning