Jason's earned income credit

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 10PB: Use Figure 12.15 to complete the following problem. Roland Inc. employees monthly gross pay...

Related questions

Question

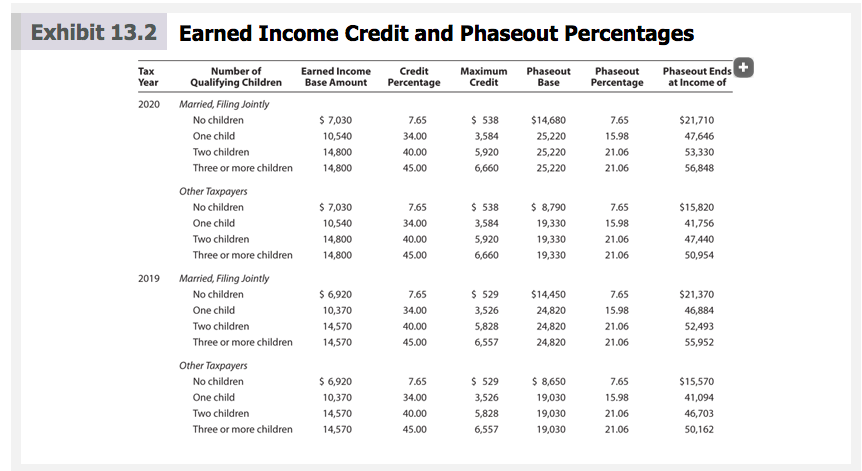

Jason, a single parent, lives in an apartment with his three minor children, whom he supports. Jason earned $27,400 during 2020 and uses the standard deduction.

Calculate the amount, if any, of Jason's earned income credit. $___________

Transcribed Image Text:Exhibit 13.2 Earned Income Credit and Phaseout Percentages

Таx

Year

Phaseout Ends+

at Income of

Number of

Earned Income

Base Amount

Credit

Maximum

Credit

Phaseout

Base

Phaseout

Qualifying Children

Percentage

Percentage

2020 Married, Filing Jointly

No children

$ 7,030

7.65

$ 538

$14,680

7.65

$21,710

One child

10,540

34.00

3,584

25,220

15.98

47,646

Two children

14,800

40.00

5,920

25,220

21.06

53,330

Three or more children

14,800

45.00

6,660

25,220

21.06

56,848

Other Taxpayers

No children

$ 7,030

7.65

$ 538

$ 8,790

7.65

$15,820

One child

10,540

34.00

3,584

19,330

15.98

41,756

Two children

14,800

40.00

5,920

19,330

21.06

47,440

Three or more children

14,800

45.00

6,660

19,330

21.06

50,954

2019

Married, Filing Jointly

No children

$ 6,920

7.65

$ 529

$14,450

7.65

$21,370

One child

10,370

34.00

3,526

24,820

15.98

46,884

Two children

14,570

40.00

5,828

24,820

21.06

52,493

Three or more children

14,570

45.00

6,557

24,820

21.06

55,952

Other Taxpayers

No children

$ 6,920

7.65

$ 529

$ 8,650

$15,570

7.65

One child

10,370

34.00

3,526

19,030

15.98

41,094

Two children

14,570

40.00

5,828

19,030

21.06

46,703

Three or more children

14,570

45.00

6,557

19,030

21.06

50,162

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning