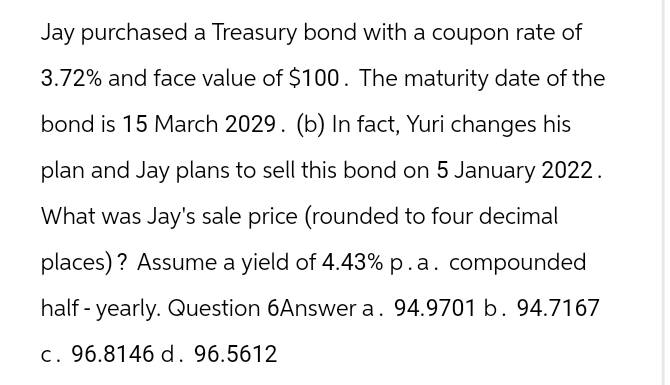

Jay purchased a Treasury bond with a coupon rate of 3.72% and face value of $100. The maturity date of the bond is 15 March 2029. (b) In fact, Yuri changes his plan and Jay plans to sell this bond on 5 January 2022. What was Jay's sale price (rounded to four decimal places)? Assume a yield of 4.43% p.a. compounded half-yearly. Question 6Answer a. 94.9701 b. 94.7167 c. 96.8146 d. 96.5612

Q: You are considering opening a copy service in the student union. You estimate your fixed cost at…

A: a) The break-even point in dollars for the copy service can be calculated by dividing the fixed…

Q: K You are considering how to invest part of your retirement savings. You have decided to put…

A: The objective of the question is to calculate the new value of the portfolio, the return earned by…

Q: The following table indicates yearly returns for different asset classes in the past 10 years.…

A: Beta refers to the systematic risk of the stock, it tracks the expected move of the underlying stock…

Q: Suppose nu=5%, TH=13%, and b₁ = 1.9. a. What is n, the required rate of return on Stock I? Round…

A: CAPM model is one of the model that investors have used for determining the cost of equity or the…

Q: Madetaylor Inc. manufactures financial calculators. The company is deciding whether to introduce a…

A: Ovpportunity cost refers to the potential benefit that is foregone when one alternative is chosen…

Q: Consider the following two projects: Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7…

A: Net present value is the difference between the present value of the cash inflows and cash…

Q: Give correct typing answer with explanation

A: One share of this stock is worth approximately $28.04 when the required rate of return is 13%…

Q: Cabaret Co. has issued stock options (warrants) to its employees, some of which will come to…

A: The objective of the question is to calculate the effect on Earnings Per Share (EPS) after the stock…

Q: You are trying to purchase a condo and are looking at various options to finance the purchase.Your…

A: The better option for your condo purchase is Option II: 11.75% APR compounded daily. Here's…

Q: Suppose you want to borrow $20,000 for a new car. You can borrow 8% per year, compounded 8 monthly…

A: A monthly payment on a loan is a fixed amount of money that a borrower is required to repay to the…

Q: An investor is considering 4 investments, A, B, C, and D (leaving his money in the bank). The payoff…

A: To solve this decision problem, we'll first calculate the Expected Monetary Value (EMV) for each…

Q: PQR Co. has semiannual-pay 6.66 percent coupon bonds with a YTM of 5.74 percent. The current yield…

A: Coupon rate = 6.66%YTM = 5.74%Current yield = 5.77%To find: bond maturity

Q: Liquidating Value Claims Trade credit Secured mortgage notes Senior debentures Junior debentures…

A: Distribution of liquidating value:The distribution of liquidating value refers to the allocation of…

Q: What is the present value of a 10-year bond that has 4 years left-to-maturity (N), 7% annual…

A: The objective of the question is to calculate the present value of a bond that has 4 years left to…

Q: Alternative Financing Plans Desmond Co. is considering the following alternative financing plans:…

A: Earnings per share for a stock refers to the overall net income that is available for a stockholder…

Q: Mike wants to donate S5, 000, 000 to establish a fund to provide an annual scholarship in…

A: The amount of the annual scholarship, rounded to two decimal places, is $313,037.32.The correct…

Q: A mutual fund manager has a $20 million portfolio with a beta of 1.6. The risk-free rate is 5.5%,…

A: The CAPM model refers to the relationship between the systematic risk faced by the investment and…

Q: Problem 11-27 Scenario Analysis [LO2] Consider a project to supply Detroit with 27,000 tons of…

A: Initial cost = $5,300,000Number of units = 27,000 tonsFixed cost = $1,275,000Variable cost = $240…

Q: hich one is not an incentive for a bank to Securitize its mortgage loans? A) Reduce insurance…

A: The objective of the question is to identify which among the given options is not a reason for a…

Q: Washington Mutual was a US Bank which went bankrupt at the end of 2008 due to a number of risk…

A: The objective of this question is to understand the concept of credit risk from both an individual…

Q: virtually zero, how much must the company make annually in years 1 through 10 to recover its…

A: Capital recovery is an economic term used to earn back the initial funds that is put into an…

Q: Kansas Corporation, an American company, has a payment of €5.9 million due to Tuscany Corporation…

A: Scenario 1: Spot Rate = 0.85 €/SStrategy 1: Forward ContractCost of €5.9 million at forward rate:…

Q: The company uses an interest rate of 8 percent on all of its projects. Calculate the MIRR of the…

A: The modified internal rate of return is similar to examining an investment's actual profit while…

Q: Winett Corporation is considering an investment in special-purpose equipment to enable the company…

A: Equipment cost = $196,000Revenue = $301,000Expenses = $252,000Increase in net income = $49,000To…

Q: Seven years ago Barbour Bakeries issued 20-year bonds to fund a portion of its capital investments.…

A: YTM stands for Yield to Maturity, a measure representing the total return anticipated on a bond if…

Q: The Lawrence Company has a ratio of long term debt to long term debt plus equity of .39 and a…

A: 1.Current ratio is calculated as follows:-Current ratio = 2.profit margin is calculated as…

Q: As an analyst at an investment bank, you are asked to compare the monthly returns of the two stocks…

A: The objective of the question is to compare the monthly returns of Tesla and Apple Inc. stocks from…

Q: Problem 24-9 (Algo) Consider the two (excess return) Index-model regression results for stocks A and…

A: Market return = 11%Risk free rate = 4%To find: Alpha, Information ratio, Sharpe ratio, and Treynor…

Q: Inc. which currently has a capital structure that is 40% debt and 60% equity has an asset beta of…

A: Asset beta = 1.55Debt = 40% or 0.40Equity = 60% or 0.60We know the formula ,Here tax rate is ignored…

Q: rates for types of loans in 2021. Assume monthly payments and compounding periods. HINT [See…

A: The time value of money is a concept in finance that recognizes the idea that a sum of money has…

Q: Andrew is an analyst at a wealth management firm. One of his clients holds a $7,500 portfolio that…

A: The investment allocation in the portfolio along with the contribution of risk from each stock is…

Q: Easy Car Corp. is a grocery store located in the Southwest. It paid an annual dividend of $3.00 last…

A: The cost of equity refers to the average expense that the company bears to employ the equity capital…

Q: Latin Cuisine is considering the purchase of new food processing technology, which would cost…

A: Initial investment = $1,800,000Annual cost savings = $300,000Useful life = 10 years

Q: a. Compute earnings per share for both firms. Assume a 20 percent tax rate. Note: Round your answers…

A: Although there are guidelines of solving 1 question, i am solving 2 questions/parts here1.EPS means…

Q: I compute the EAC for both machines.

A: The equivalent annual cost is comparable to calculating an item's annual cost, even if it is a…

Q: The preferred stock of Dallas platinum exchange has a par value of $52 and pays a 9% dividend per…

A: Par value of Dividend = $52Dividend rate = 9%Beta of stock = 1.94Risk-free rate = 2.6%Market return…

Q: XYZ has an expected Free Cash Flow of $109M next year and will remain the same in perpetuity. It has…

A:

Q: A stock just paid a dividend of $2.46. The dividend is expected to grow at 24.61% for five years and…

A: Recently paid dividend (D0) = $2.46Growth rate for first five years = 24.61% or 0.2461Constant…

Q: Calculate the required rate of return for Mudd Enterprises assuming that investors expect a 3.4%…

A: The objective of this question is to calculate the required rate of return for Mudd Enterprises. The…

Q: Synovec Co. is growing quickly. Dividends are expected to grow at a rate of 30 percent for the next…

A: As per dividend discount model price of stock will be equal to the present value of the future…

Q: After a 1 year investment you receive 7.5% interest (nominal) from your bank. However, looking at…

A: The International Fisher Effect (IFE) is an economic theory that suggests changes in exchange rates…

Q: The 2020 balance sheet of Osaka’s tennis shop, incorporated, showed long-term debt of $3.5 million,…

A: Calculating Osaka's Tennis Shop Operating Cash Flow (OCF) for 2021We can estimate Osaka's Tennis…

Q: The city of Kelowna, British Columbia, is considering various proposals regarding the improvement of…

A: The Benefit-Cost Ratio (B/C Ratio) is a financial metric used to evaluate the profitability or…

Q: The management of Byrge Corporation is investigating buying a small used aircraft to use in making…

A: Annual benefit refers to the total financial gain or benefit that is expected to be received each…

Q: Alp Bilgin deposits $33.000 in asaving account that pays 9%interest compounded monthly.Four years…

A: Alp Bilgin invests money in a savings account with monthly compounding interest. Here's a breakdown…

Q: 19. Jennifer and Rex both receive a dividend from their 401(k) retirement plan every 6 months. The…

A: The effective interest rate (EIR), also known as the annual equivalent rate (AER) or annual…

Q: Jay purchased a Treasury bond with a coupon rate of 4.49% and face value of $100. The maturity date…

A: Coupon rate = 4.49%Face value = $100Yield = 3.02%To find: Bond price received by Jay on 7th January.

Q: (Bond valuation) You own a bond that pays $120 in annual interest, with a $1,000 par value. It…

A: A bond is a fixed-income security that offers the investor a constant flow of periodic coupon…

Q: Ski Boards, Inc., wants to enter the market quickly with a new finish on its ski boards. It has…

A: A brief explanation is given below.Explanation:Solution:TC = fixed cost + variable cost * quanity…

Q: Baghiben

A: The objective of this question is to calculate the issue price of a callable bond. A callable bond…

Please give Answer with correct and incorrect option explanation

Unlock instant AI solutions

Tap the button

to generate a solution

Click the button to generate

a solution

- Suppose a 10-year, 10% semiannual coupon bond with a par value of 1,000 is currently selling for 1,135.90, producing a nominal yield to maturity of 8%. However, the bond can be called after 5 years for a price of 1,050. (1) What is the bonds nominal yield to call (YTC)? (2) If you bought this bond, do you think you would be more likely to earn the YTM or the YTC? Why?Loïc is planning to purchase a Treasury bond paying a (j2) coupon rate of 4.94% p.a. The face value of the bond is $100. Its maturity date is 15 March 2033; the bond matures at par. If Loïc purchased this bond on 8 March 2020, what is his purchase price (rounded to four decimal places)? Assume a yield rate of 9.32% p.a., compounded half-yearly. Loïc needs to pay 11.1% of coupon payments and capital gains in tax. Assume that all tax payments are delayed by a half-year.Iolanda purchased a Treasury bond with a coupon rate of 4.59% and face value of $100. The maturity date of the bond is 15 April 2029. (a) Luciana plans to purchase Iolanda's Treasury bond on 12 April 2018. What price will Luciana pay (rounded to four decimal places)? Assume a yield of 2.54% p.a. compounded half-yearly. a. 119.5663 b. 119.5414 c. 119.5404 d. 118.7648

- Today is 1 July, 2022, Georg plans to purchase a corporate bond with a coupon rate of j2 = 1.69% p.a. and a face value of $100. This corporate bond matures at par. Its maturity date is 1 January, 2025. The yield rate is assumed to be j2 = 10.9% p.a. Assume that this corporate bond has a 6% chance of default in any six-month period during its term. Assume, also, that, if default occurs, Georg will receive no further payments at all. Calculate Georg's purchase price. Round your answer to three decimal places. Answer a. $59.319 b. $81.541 c. $80.092 d. $53.631Today is 1 July, 2022, Georg plans to purchase a corporate bond with a coupon rate of j2 = 6.96% p.a. and a face value of $100. This corporate bond matures at par. Its maturity date is 1 January, 2025. The yield rate is assumed to be j2 = 2.2% p.a. Assume that this corporate bond has a 11% chance of default in any six-month period during its term. Assume, also, that, if default occurs, Georg will receive no further payments at all. Calculate Georg's purchase price. Round your answer to three decimal places.Qing bought an Australian Treasury bond with a coupon rate of j2 = 2.57% p.a. and a face value of $100. The maturity date of the bond is 15 May 2033. If Qing purchased this bond on 6 May 2018, what was his purchase price (rounded to four decimal places)? Assume a purchase yield of j2 = 2.92% p.a. a. $96.9884 b. $96.9895 c. $97.1016 d. $95.7043

- Hercules bought an Australian Treasury bond with a coupon rate of j2 = 4.17% p.a. and a face value of $100. The maturity date of the bond is 15 May 2033. If Hercules purchased this bond on 4 May 2018, what was his purchase price (rounded to four decimal places)? Assume a purchase yield of j2 = 4.72% p.a. a. 94.0019 b. 96.0839 c. 96.2203 d. 96.0862Alvin has bought a bond from Company ABC at RM1,020 in year 2020. The face value of the bond is RM1,000 with the coupon rate of 5%. One year later, Alvin liquidated the bond with the price of RM1,100. Calculate the expected return of the corporate bond.Today is 1 July 2021, William plans to purchase a corporate bond with a coupon rate of j2 = 3.65% p.a. and face value of 100. This corporate bond matures at par. The maturity date is 1 January 2024. The yield rate is assumed to be j2 = 4.5% p.a. Assume that this corporate bond has a 9.6% chance of default in any six-month period during the term of the bond. Assume also that, if default occurs, William will receive no further payments at all. Calculate the purchase price for 1 unit of this corporate bond. Round your answer to three decimal places. a.99.016 b.97.191 c.55.030 d.60.418

- On 5th December 2020, Jerome purchases a government bond worth $400, with a maturity of 3 years, face value of $500, and a coupon rate of 5% paid annually. The first coupon payment will be received a year from now (i.e., on 5th December, 2021). The yield to maturity offered by equally risky bonds is currently 7%. Such a yield to maturity stays constant over the next two years. On 5th December 2022, Jerome decides to sell this bond after receiving the second coupon payment. It turns out that, on that day, the new yield to maturity offered by equally risky bonds is 1.5%. At what price will Jerome be able to sell his bond?Last year, Sally purchased a $1,000 face value corporate bond with an 11.2 percent annual coupon rate and a 12-year maturity. At the time of the purchase, it had an expected yield to maturity of 11.9 percent. If Sally sold the bond today for $949.88, what rate of return would she have earned for the past year? a. 11.02% b. 11.20% c. 11.10% d. –0.69% e. 10.51%Giuseppe is planning to purchase an Australian Treasury bond with a coupon rate (j2) of 2.68% and face value of $100. The maturity date of the bond is 15 May 2033. If Giuseppe purchased this bond on 2 May 2018, what is his purchase price (rounded to four decimal places)? Assume a yield rate of 1.94% p.a. compounded half-yearly, allowing for taxation. Giuseppe needs to pay tax at rate 21.9% on coupon payments. Assume the tax on coupon is paid immediately on the coupon payment date. a. 101.9133 b. 102.9603 c. 102.9591 d. 102.9019