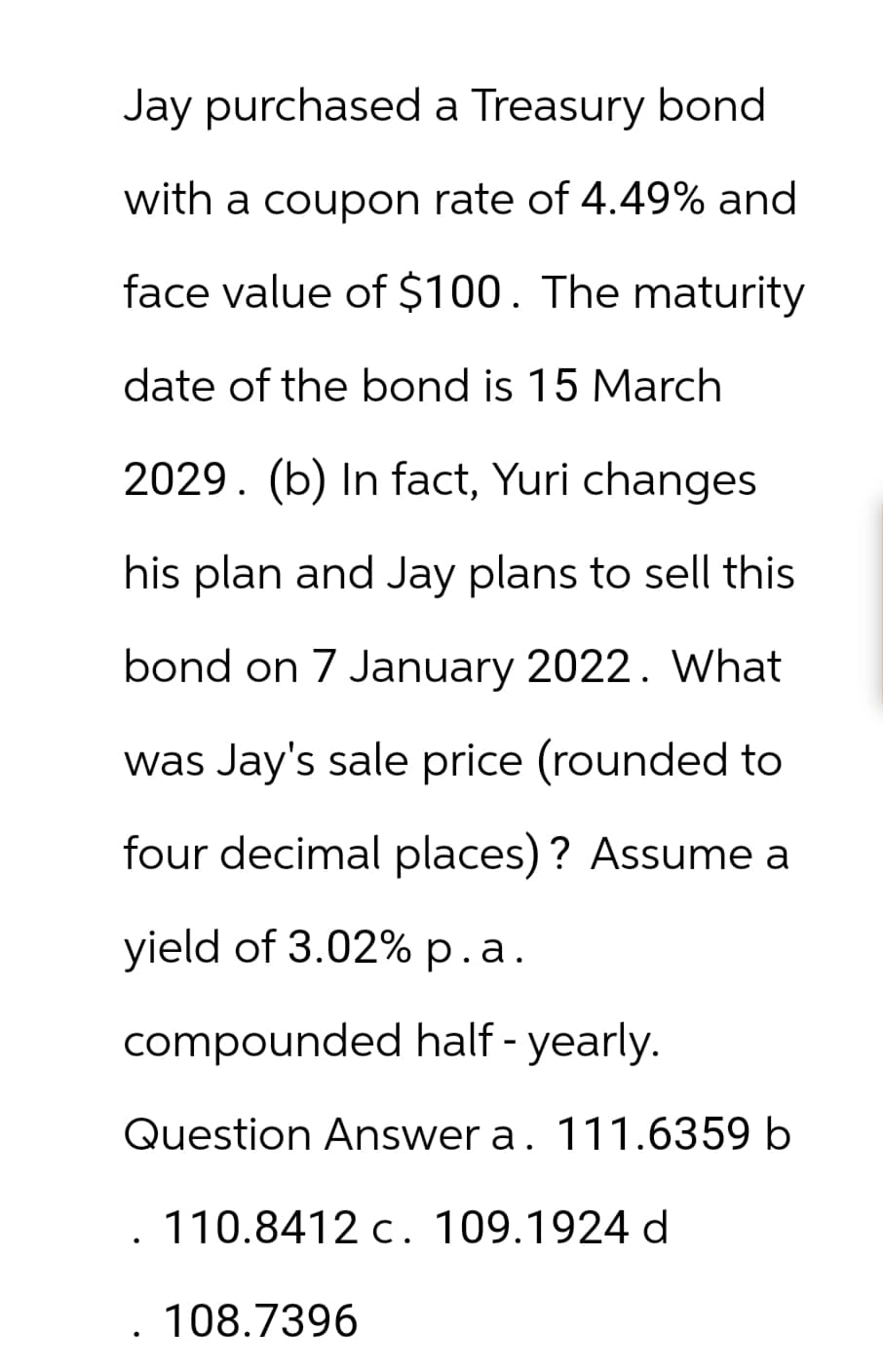

Jay purchased a Treasury bond with a coupon rate of 4.49% and face value of $100. The maturity date of the bond is 15 March 2029. (b) In fact, Yuri changes his plan and Jay plans to sell this bond on 7 January 2022. What was Jay's sale price (rounded to four decimal places)? Assume a yield of 3.02% p.a. compounded half - yearly. Question Answer a. 111.6359 b 110.8412 c. 109.1924 d .108.7396

Q: Following is Information on two alternative Investment projects being considered by Tiger Company.…

A: Net Present Value (NPV) is a financial measure used to analyze the profitability of an investment by…

Q: Kiran has already saved $575,000 as a deposit for a new waterfront villa in the Hamptons. It will…

A: Monthly mortgage paymentA monthly mortgage payment is the regular amount of money you pay to a…

Q: You are planning on buying a new vehicle in 5 years after you receive your PhD. You plan on…

A: You will buy the car after 5 years.The car costs = $35,600henceYou need $35,600 after 5 years.You…

Q: Washington Mutual was a US Bank which went bankrupt at the end of 2008 due to a number of risk…

A: The objective of this question is to understand the concept of credit risk from both an individual…

Q: Elmo's Burger's has a bond outstanding with an annual coupon rate of 3.9% and a face value of…

A: annual coupon = par value x coupon rate

Q: A new computer system will require an initial outlay of $20,000, but it will increase the firm's…

A: Initial outlay = $20,000Cash flow = $4,300Number of years = 8 years

Q: The preferred stock of Dallas platinum exchange has a par value of $52 and pays a 9% dividend per…

A: Par value of Dividend = $52Dividend rate = 9%Beta of stock = 1.94Risk-free rate = 2.6%Market return…

Q: Problem #3: A loan of amount $19316.84 is repaid in 15 annual payments beginning 1 year after the…

A: The Effective Annual Rate (EAR) considers the effect of compounding on the nominal interest rate,…

Q: Nikita Enterprises has bonds on the market making annual payments, with 14 years to maturity, a par…

A: Years = 14Par value = 1000Selling price = 953Yield = 9.4%/100 = 0.0940 in decimals

Q: A company has determined that its optimal capital structure consists of 34 percent debt and the rest…

A: WACC stands for Weighted Average Cost of Capital. It represents the average rate of return a company…

Q: OMG Corporation just paid a $2.50 annual dividend on each share. It is planning on Increasing its…

A: The value of share is the sum of present value of all future dividends and the present value of…

Q: Compute the monthly payments for a vehicle that costs $14 comma 10014,100 if you financed the…

A: Loan amortization is the process of paying off a debt over time through regular payments. With each…

Q: Suppose an individual invests $24,000 in a load mutual fund for two years. The load fee entails an…

A: The annual return on the mutual funds over the two years investment period is 10.234 %Explanation:…

Q: Mr. John Backster, a retired executive, desires to invest a portion of his assets in rental…

A: Adjusted net present value:The adjusted net present value (ANPV) is a refined financial metric…

Q: Given the following cash flow, what would be the value of P if the inflows and outflows balance each…

A: Present value is the current value of the future sum of money, at a specified rate of return.Present…

Q: hedule detailing the weekly total production of per week, and the cost of each unit of capital is tz…

A: The objective of this question is to calculate the value marginal product (VMPL) of the 7th worker.…

Q: Madetaylor Inc. manufactures financial calculators. The company is deciding whether to introduce a…

A: Initial cash outflow or investment made at the beginning is the total cost that needs to be incurred…

Q: Project Bono Project Edge Project Clayton Capital investment $172,000 $190,000 $214,000 Annual net…

A: Payback period:The payback period in finance signifies the duration it takes for an investment to…

Q: You have been asked to analyze three technology companies and have been provided with the following…

A: Cheapest Technology Company AnalysisThe least expensive of the three corporations would be the…

Q: 1) Today is your 30th birthday and you must choose between two retirement options. The first option…

A: Since you have posted multiple questions, we will provide the solution only to the first question as…

Q: Profitability Ratios Gross Margin -14.69057% 7.38478% 65.561% 8.27882% Operating Margin -49.27989%…

A: The objective of the question is to analyze the profitability ratios provided and identify any…

Q: Suppose a firm has 16.5 million shares of common stock outstanding and six candidates are up for…

A: In cumulative voting, shareholders are allowed to cast all their votes for a single candidate or…

Q: With the growing popularity of casual surf print clothing, two recent MBA graduates decided to…

A: The NPV of a project is used to measure the profitability of the project. It is done by discounting…

Q: What annual rate of return is earned on a $10,000 investment when it grows to $15,000 in 10 years?…

A: It is a case of finding the rate of return on a lump sum.A single deposit [lump sum] is made and the…

Q: 1. You have two options to purchase a car. Your first option is to purchase the car at $26.200 and…

A: The objective of this question is to compare two options for purchasing a car: financing the car…

Q: Sheridan Company is considering three long-term capital investment proposals. Each investment has a…

A: Payback period:The payback period in finance signifies the duration it takes for an investment to…

Q: Information about three securities appears next. Stock 1 Stock 2 Bond 1 Beginning-of-Year Price $…

A: The holding period return is the rate of return on an investment over a period.The holding period…

Q: A computer printer in a large administrative office has a printer buffer (memory to store printing…

A: 1. To find the probability that a computer user will be told to resubmit a print job at a later…

Q: Troy is interested in buying a particular stock whose current dividend is $1.35, and whose dividend…

A: Current Dividend (D0) = $1.35Growth rate for first two years = 5% or 0.05Constant growth rate after…

Q: Internal rate of return and modified internal rate of return For the project shown in the following…

A: The Internal Rate of Return (IRR) is a financial measure used to analyze the profitability of an…

Q: The city planning committee is allocating funds for a sustainable urban development project. e total…

A: The city planning committee has a total budget of $3,000,000 (without GST) that needs to be divided…

Q: virtually zero, how much must the company make annually in years 1 through 10 to recover its…

A: Capital recovery is an economic term used to earn back the initial funds that is put into an…

Q: Ramakrishnan, Incorporated, reported 2024 net income of $20 million and depreciation of $3,400,000.…

A: The cash flow from operating activities is the cash generated by the company from its regular day to…

Q: Calculate the monthly payments of a 3030-year fixed-rate mortgage at 6.006.00 percent for $136…

A: Mortgage loan=$136000Period= 30 yearsInterest rate=6%

Q: As a financial analyst for a firm looking to make an investment in its operations, you are tasked…

A: The optimum capital structure refers to the use of financial sources in such a way as to reduce the…

Q: Year Cash Flow (A) Cash Flow (B) 01234 -$40,000 14,000 18,000 17,000 11,000 -$55,000 11,000 13,000…

A: Payback period: The amount of time to recover the cost of an investment project.The shorter…

Q: Graft Hair Salon has three barbers to provide service in a neighborhood of downtown Santa Fe.…

A: 1. L\=μλWhere:* λ\\lambdaλ = Arrival rate (customers per hour)* μ\\muμ = Service rate…

Q: Plz complete solution without excel

A: The objective of the question is to calculate the accrued interest on a loan with variable interest…

Q: Continuing Case 15. Personal Balance Sheet Jamie Lee Jackson, age 24, now a busy full-time college…

A: A Balance sheet is a financial statement that shows the postion of Assets , Liabilities and net…

Q: The 2020 balance sheet of Osaka’s tennis shop, incorporated, showed long-term debt of $3.5 million,…

A: Calculating Osaka's Tennis Shop Operating Cash Flow (OCF) for 2021We can estimate Osaka's Tennis…

Q: Micro, Inc., started the year with net fixed assets of $76,175. At the end of the year, there was…

A: b. $35,685 (Not in the right choices, the correct amount in the explanation field.)Explanation:Step…

Q: Big Old Serious Supermarket (BOSS) is a retail company that manages a chain of supermarkets,…

A: Ratio analysisThe process of measuring the performance of the company in various aspects is called…

Q: Douglas needs to borrow $15, 600 today for his tuition bill. He agrees to pay back the loan in a…

A: Definition-In the context of the formula r=(FVPV)1n−1, the interest rate (r) represents the periodic…

Q: Complete solution 6. The Green Spaces project involves purchasing equipment worth $300,000. Assuming…

A: A recurrence relation is a way of defining a sequence of numbers or functions by specifying its…

Q: What monthly compounded nominal rate would put you in the same financial position as 7.0% compounded…

A: Let the monthly compounded nominal rate of interest = iIt is given that the effective rate of the…

Q: Cabaret Co. has issued stock options (warrants) to its employees, some of which will come to…

A: The objective of the question is to calculate the effect on Earnings Per Share (EPS) after the stock…

Q: 5) A 10-year municipal bond yields 4.8%. Your marginal tax rate (including state and federal taxes)…

A: After-tax return is the earnings on an investment or asset after accounting for taxes paid on those…

Q: For each of the following annuities, calculate the annual cash flow: Note: Do not round intermediate…

A: The Time Value of Money takes into account the opportunity cost of having money now versus in the…

Q: A mutual fund manager has a $20 million portfolio with a beta of 1.6. The risk-free rate is 5.5%,…

A: The CAPM model refers to the relationship between the systematic risk faced by the investment and…

Q: 2. The quoted price of a bond with a coupon rate of 4.5%, payable semi-annually, maturing on March…

A: The objective of the question is to calculate the total price that must be paid for a bond, given…

Unlock instant AI solutions

Tap the button

to generate a solution

Click the button to generate

a solution

- Krystian Inc. issued 10-year bonds with a face value of $100,000 and a stated rate of 4% when the market rate was 6%. Interest was paid semi-annually. Calculate and explain the timing of the cash flows the purchaser of the bonds (the investor) will receive throughout the bond term. Would an investor be willing to pay more or less than face value for this bond?Today is 1 July, 2022, Georg plans to purchase a corporate bond with a coupon rate of j2 = 1.69% p.a. and a face value of $100. This corporate bond matures at par. Its maturity date is 1 January, 2025. The yield rate is assumed to be j2 = 10.9% p.a. Assume that this corporate bond has a 6% chance of default in any six-month period during its term. Assume, also, that, if default occurs, Georg will receive no further payments at all. Calculate Georg's purchase price. Round your answer to three decimal places. Answer a. $59.319 b. $81.541 c. $80.092 d. $53.631Today is 1 July, 2022, Georg plans to purchase a corporate bond with a coupon rate of j2 = 6.96% p.a. and a face value of $100. This corporate bond matures at par. Its maturity date is 1 January, 2025. The yield rate is assumed to be j2 = 2.2% p.a. Assume that this corporate bond has a 11% chance of default in any six-month period during its term. Assume, also, that, if default occurs, Georg will receive no further payments at all. Calculate Georg's purchase price. Round your answer to three decimal places.

- Loïc is planning to purchase a Treasury bond paying a (j2) coupon rate of 4.94% p.a. The face value of the bond is $100. Its maturity date is 15 March 2033; the bond matures at par. If Loïc purchased this bond on 8 March 2020, what is his purchase price (rounded to four decimal places)? Assume a yield rate of 9.32% p.a., compounded half-yearly. Loïc needs to pay 11.1% of coupon payments and capital gains in tax. Assume that all tax payments are delayed by a half-year.Iolanda purchased a Treasury bond with a coupon rate of 4.59% and face value of $100. The maturity date of the bond is 15 April 2029. (a) Luciana plans to purchase Iolanda's Treasury bond on 12 April 2018. What price will Luciana pay (rounded to four decimal places)? Assume a yield of 2.54% p.a. compounded half-yearly. a. 119.5663 b. 119.5414 c. 119.5404 d. 118.7648Today is 1 July 2021, William plans to purchase a corporate bond with a coupon rate of j2 = 3.65% p.a. and face value of 100. This corporate bond matures at par. The maturity date is 1 January 2024. The yield rate is assumed to be j2 = 4.5% p.a. Assume that this corporate bond has a 9.6% chance of default in any six-month period during the term of the bond. Assume also that, if default occurs, William will receive no further payments at all. Calculate the purchase price for 1 unit of this corporate bond. Round your answer to three decimal places. a.99.016 b.97.191 c.55.030 d.60.418

- Consider an investor who, on January 1, 2XX1, purchases a TIPS bond with an original principal of $174,000, an 9 percent annual coupon rate, and 17 years to maturity.If the semiannual inflation rate during the first six months is 0.5 percent and the semiannual inflation rate for the second six-month period is 1.7 percent, calculate the coupon payment to the investor for the second six-month period. (Do not round intermediate calculations. Round your answers to 2 decimal places. (e.g., 32.16))Assume today is June 23, 2023 and you have purchased a corporate bond issued by the Tangier Company. The bond matures on December 31 2042, bears a coupon rate of 5.6 percent, is redeemable at 100% of par value and has a current YTM of 5.1 percent. Based on a 30/360 day-count method, the interest accrued since the last interest payment (rounded to the nearest whole dollar) is a. $26 b. $27 c. $28 d. $29 e. $30Qing bought an Australian Treasury bond with a coupon rate of j2 = 2.57% p.a. and a face value of $100. The maturity date of the bond is 15 May 2033. If Qing purchased this bond on 6 May 2018, what was his purchase price (rounded to four decimal places)? Assume a purchase yield of j2 = 2.92% p.a. a. $96.9884 b. $96.9895 c. $97.1016 d. $95.7043

- On 1 July 2019, an investor buys a corporate bond issued by Jeanius plc, which is repayable at par on 1 July 2039 and has an annual coupon rate of 3% payable twice yearly in arrears. (a) Assuming that the gross redemption yield on the bond is 6.0% per annum calculate the purchase price per £100 nominal. (b) Jeanius plc experiences financial problems leading to a falling bond price. On 1st of September 2022 the gross redemption yield on the bond is 11% per annum. On the same day, a bank makes an offer to buy the company if bond holders accept an immediate payment of £48 per £100 nominal. Calculate the price of the bond on 1st of September 2022 and explain whether or not the investor should accept this offer.Hercules bought an Australian Treasury bond with a coupon rate of j2 = 4.17% p.a. and a face value of $100. The maturity date of the bond is 15 May 2033. If Hercules purchased this bond on 4 May 2018, what was his purchase price (rounded to four decimal places)? Assume a purchase yield of j2 = 4.72% p.a. a. 94.0019 b. 96.0839 c. 96.2203 d. 96.0862Do all 3 parts Its 1 July 2020. Greg is planning to purchase a corporate bond with a coupon rate of j2 = 1.68% p.a. and face value of 1000. This corporate bond matures at par. The maturity date is 1 July 2022. The yield rate is assumed to be j2 = 6.15% p.a. Assume that this corporate bond has a 3.69% chance of default in the first six-month period (i.e., from 1 July 2020 to 31 December 2020) and this corporate bond has a 3.01% chance of default in any six-month period during the term of the bond except the first six-month (i.e., 3.01% chance of default in any six-month from 1 January 2021 to 1 July 2022). Assume also that, if default occurs, Greg will receive no further payments at all. Australian bonds (a) What is the expected coupon payment on 1 January 2021? a. 7.8487 b. 8.1472 c. 8.0900 d. 7.8465 (b) What is the expected coupon payment on 1 January 2022? a. 6.9494 b. 7.8465 c. 7.6103 d. 7.5570 (c) Calculate the purchase price of this corporate bond. Round your answer to…