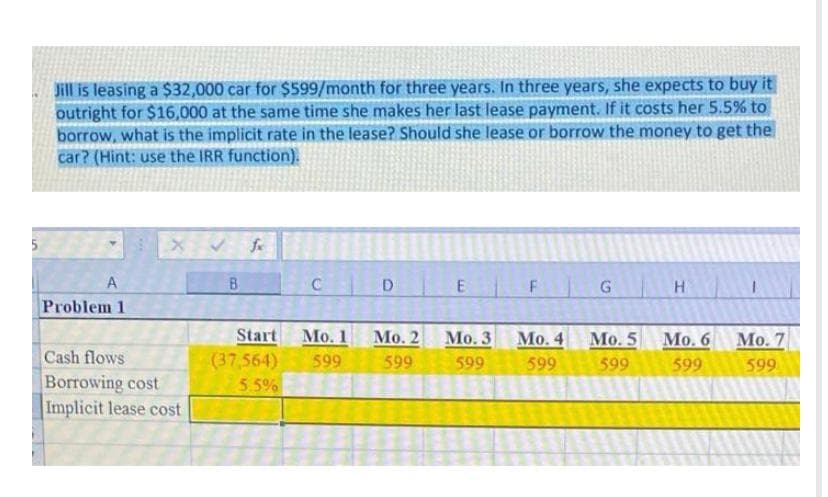

Jill is leasing a $32,000 car for $599/month for three years. In three years, she expects to buy it outright for $16,000 at the same time she makes her last lease payment. If it costs her 5.5% to borrow, what is the implicit rate in the lease? Should she lease or borrow the money to get the car? (Hint: use the IRR function).

Jill is leasing a $32,000 car for $599/month for three years. In three years, she expects to buy it outright for $16,000 at the same time she makes her last lease payment. If it costs her 5.5% to borrow, what is the implicit rate in the lease? Should she lease or borrow the money to get the car? (Hint: use the IRR function).

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 1P

Related questions

Question

Transcribed Image Text:Jill is leasing a $32,000 car for $599/month for three years. In three years, she expects to buy it

outright for $16,000 at the same time she makes her last lease payment. If it costs her 5.5% to

borrow, what is the implicit rate in the lease? Should she lease or borrow the money to get the

car? (Hint: use the IRR function).

B.

C D

F

G

Problem 1

Start

Mo. 1

Мо. 2

Мо. 3

Мо. 4

Mo. 5

Мо. 6 Мо. 7

Cash flows

(37,564)

599

599

599

599

599

599

599

Borrowing cost

Implicit lease cost

5.5%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning