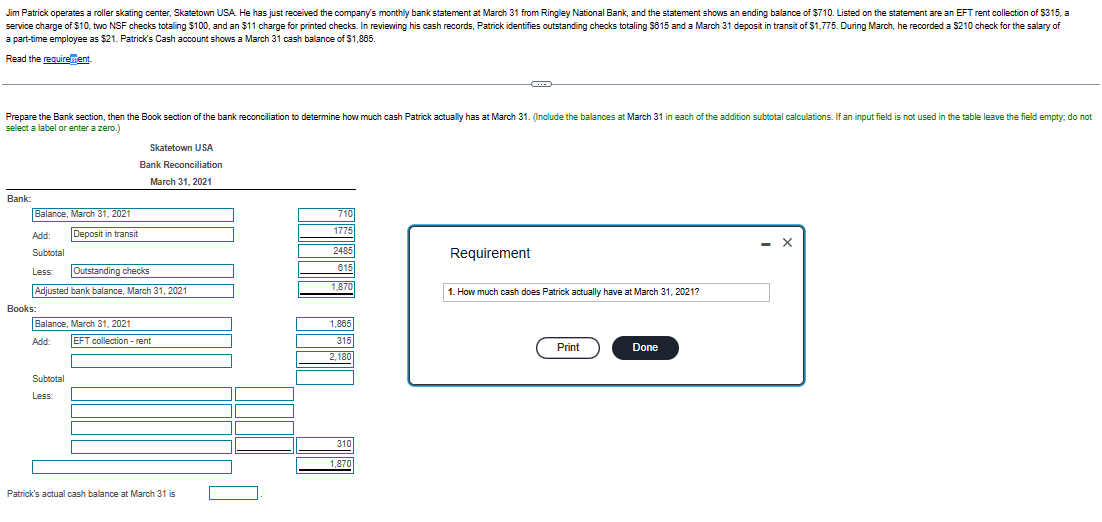

Jim Patrick operates a roller skating center, Skatetown USA. He has just received the company's monthly bank statement at March 31 from Ringley National Bank, and the statement shows an ending balance of $710. Listed on the statement are an EFT rent collection of $315, a service charge of $10, two NSF checks totaling $100, and an $11 charge for printed checks. In reviewing his cash records, Patrick identifies outstanding checks totaling $815 and a March 31 deposit in transit of $1,775. During March, he recorded a $210 check for the salary of a part-time employee as $21. Patrick's Cash account shows a March 31 cash balance of $1,885. Read the requirement. Prepare the Bank section, then the Book section of the bank reconciliation to determine how much cash Patrick actually has at March 31. (Include the balances at March 31 in each of the addition subtotal calculations. If an input field is not used in the table leave the field empty; do n select a label or enter a zero.) Bank: Balance, March 31, 2021 Add: Deposit in transit Subtotal Less: Outstanding checks Adjusted bank balance, March 31, 2021 Books: Balance, March 31, 2021 Add: Skatetown USA Bank Reconciliation March 31, 2021 Subtotal EFT collection-rent 710 1775 2485 615 1,870 1,865 315 2.180 Requirement 1. How much cash does Patrick actually have at March 31, 2021? Print Done - X X

Jim Patrick operates a roller skating center, Skatetown USA. He has just received the company's monthly bank statement at March 31 from Ringley National Bank, and the statement shows an ending balance of $710. Listed on the statement are an EFT rent collection of $315, a service charge of $10, two NSF checks totaling $100, and an $11 charge for printed checks. In reviewing his cash records, Patrick identifies outstanding checks totaling $815 and a March 31 deposit in transit of $1,775. During March, he recorded a $210 check for the salary of a part-time employee as $21. Patrick's Cash account shows a March 31 cash balance of $1,885. Read the requirement. Prepare the Bank section, then the Book section of the bank reconciliation to determine how much cash Patrick actually has at March 31. (Include the balances at March 31 in each of the addition subtotal calculations. If an input field is not used in the table leave the field empty; do n select a label or enter a zero.) Bank: Balance, March 31, 2021 Add: Deposit in transit Subtotal Less: Outstanding checks Adjusted bank balance, March 31, 2021 Books: Balance, March 31, 2021 Add: Skatetown USA Bank Reconciliation March 31, 2021 Subtotal EFT collection-rent 710 1775 2485 615 1,870 1,865 315 2.180 Requirement 1. How much cash does Patrick actually have at March 31, 2021? Print Done - X X

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter6: Bank Accounts, Cash Funds, And Internal Controls

Section: Chapter Questions

Problem 4PA

Related questions

Question

Question attached in SS

thanks for the help

l32ply2p3lyp23

pfefefefefpefp

lelele

ep33

Transcribed Image Text:Jim Patrick operates a roller skating center, Skatetown USA. He has just received the company's monthly bank statement at March 31 from Ringley National Bank, and the statement shows an ending balance of $710. Listed on the statement are an EFT rent collection of $315, a

service charge of $10, two NSF checks totaling $100, and an $11 charge for printed checks. In reviewing his cash records, Patrick identifies outstanding checks totaling $815 and a March 31 deposit in transit of $1,775. During March, he recorded a $210 check for the salary of

a part-time employee as $21. Patrick's Cash account shows a March 31 cash balance of $1,865.

Read the requirement.

Prepare the Bank section, then the Book section of the bank reconciliation to determine how much cash Patrick actually has at March 31. (Include the balances at March 31 in each of the addition subtotal calculations. If an input field is not used in the table leave the field empty; do not

select a label or enter a zero.)

Bank:

Balance, March 31, 2021

Add: Deposit in transit

Subtotal

Less:

Outstanding checks

Adjusted bank balance, March 31, 2021

Books:

Balance, March 31, 2021

Add:

Skatetown USA

Bank Reconciliation

March 31, 2021

Subtotal

Less:

EFT collection - rent

Patrick's actual cash balance at March 31 is

710

1775

2485

615

1,870

1.885

315

2,180

310

1,870

Requirement

1. How much cash does Patrick actually have at March 31, 2021?

Print

Done

-

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning