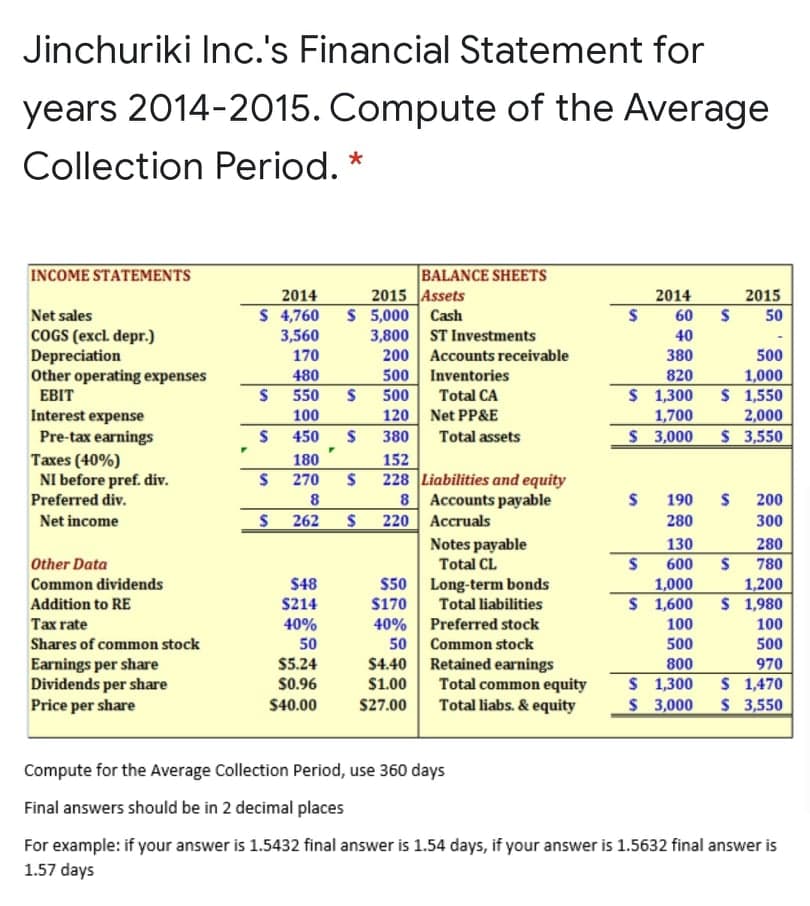

Jinchuriki Inc.'s Financial Statement for years 2014-2015. Compute of the Average Collection Period. * INCOME STATEMENTS BALANCE SHEETS 2015 JAssets $ 5,000 Cash 3,800 ST Investments 200 Accounts receivable 500 Inventories 2014 2014 2015 60 $ 4,760 3,560 170 Net sales 50 COGS (excl. depr.) Depreciation Other operating expenses EBIT 40 380 500 480 1,000 $ 1,550 2,000 S 3,550 820 $ 550 $ 1,300 1,700 S 3,000 500 Total CA Interest expense Pre-tax earnings 100 120 Net PP&E 450 380 Total assets Taxes (40%) NI before pref. div. 180 152 228 Liabilities and equity 8 Accounts payable S 220 Accruals 270 200 300 Preferred div. 190 Net income $ 262 280 Notes payable Total CL $50 Long-term bonds Total liabilities 40% Preferred stock Common stock $4.40 Retained earnings Total common equity Total liabs. & equity 130 600 1,000 $ 1,600 280 Other Data 780 Common dividends $48 1,200 $ 1,980 Addition to RE $214 $170 Tax rate 40% 100 100 Shares of common stock 50 50 500 500 Earnings per share Dividends per share Price per share $5.24 S0.96 800 $ 1,300 $ 3,000 970 $ 1,470 $ 3,550 $1.00 $40.00 S27.00 Compute for the Average Collection Period, use 360 days Final answers should be in 2 decimal places For example: if your answer is 1.5432 final answer is 1.54 days, if your answer is 1.5632 final answer is 1.57 days %24 %24 %24

Jinchuriki Inc.'s Financial Statement for years 2014-2015. Compute of the Average Collection Period. * INCOME STATEMENTS BALANCE SHEETS 2015 JAssets $ 5,000 Cash 3,800 ST Investments 200 Accounts receivable 500 Inventories 2014 2014 2015 60 $ 4,760 3,560 170 Net sales 50 COGS (excl. depr.) Depreciation Other operating expenses EBIT 40 380 500 480 1,000 $ 1,550 2,000 S 3,550 820 $ 550 $ 1,300 1,700 S 3,000 500 Total CA Interest expense Pre-tax earnings 100 120 Net PP&E 450 380 Total assets Taxes (40%) NI before pref. div. 180 152 228 Liabilities and equity 8 Accounts payable S 220 Accruals 270 200 300 Preferred div. 190 Net income $ 262 280 Notes payable Total CL $50 Long-term bonds Total liabilities 40% Preferred stock Common stock $4.40 Retained earnings Total common equity Total liabs. & equity 130 600 1,000 $ 1,600 280 Other Data 780 Common dividends $48 1,200 $ 1,980 Addition to RE $214 $170 Tax rate 40% 100 100 Shares of common stock 50 50 500 500 Earnings per share Dividends per share Price per share $5.24 S0.96 800 $ 1,300 $ 3,000 970 $ 1,470 $ 3,550 $1.00 $40.00 S27.00 Compute for the Average Collection Period, use 360 days Final answers should be in 2 decimal places For example: if your answer is 1.5432 final answer is 1.54 days, if your answer is 1.5632 final answer is 1.57 days %24 %24 %24

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter17: Financial Statement Analysis

Section: Chapter Questions

Problem 1FSA: Financial statement analysis The financial statements for Nike, Inc., are presented in Appendix D at...

Related questions

Question

Transcribed Image Text:Jinchuriki Inc.'s Financial Statement for

years 2014-2015. Compute of the Average

Collection Period. *

INCOME STATEMENTS

BALANCE SHEETS

2015 Assets

$ 5,000 Cash

3,800 ST Investments

200 Accounts receivable

500 Inventories

500

2014

60

2015

50

2014

$ 4,760

3,560

170

Net sales

COGS (excl. depr.)

Depreciation

Other operating expenses

EBIT

Interest expense

Pre-tax earnings

40

380

500

820

480

550

$ 1,300

1,700

$ 3,000

1,000

$ 1,550

2,000

$ 3,550

Total CA

100

120

Net PP&E

450

380

Total assets

152

Taxes (40%)

NI before pref. div.

180

228 Liabilities and equity

8 Accounts payable

220 Accruals

270

Preferred div.

8

190

200

Net income

262

280

300

130

280

780

Notes payable

Other Data

Total CL

600

$50 Long-term bonds

$170

Common dividends

$48

1,000

$ 1,600

1,200

$ 1,980

Addition to RE

$214

Total liabilities

Tax rate

40%

40%

50

Preferred stock

100

100

Shares of common stock

50

Common stock

500

500

$5.24

S0.96

Retained earnings

Total common equity

Total liabs. & equity

800

Earnings per share

Dividends per share

Price per share

$4.40

970

$ 1,300

S 3,000

$ 1,470

$ 3,550

$1.00

$40.00

$27.00

Compute for the Average Collection Period, use 360 days

Final answers should be in 2 decimal places

For example: if your answer is 1.5432 final answer is 1.54 days, if your answer is 1.5632 final answer is

1.57 days

%24

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning