Joanne Plummer is self-employed in 2019. Her Schedule C net income is $36,600 for the year, and Joanne also had a part-time job and earned $4,400 that was subject to FICA tax. Joanne received taxable dividends of $1,110 during the year, and she had a capital gain on the sale of stock of $9,100. Calculate Joanne's self-employment tax using page 1 of Schedule SE of Form 1040.

Joanne Plummer is self-employed in 2019. Her Schedule C net income is $36,600 for the year, and Joanne also had a part-time job and earned $4,400 that was subject to FICA tax. Joanne received taxable dividends of $1,110 during the year, and she had a capital gain on the sale of stock of $9,100. Calculate Joanne's self-employment tax using page 1 of Schedule SE of Form 1040.

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 9DQ: LO.2 Osprey Corporation, an accrual basis taxpayer, had taxable income for 2019 and paid 40,000 on...

Related questions

Question

Joanne Plummer is self-employed in 2019. Her Schedule C net income is $36,600 for the year, and Joanne also had a part-time job and earned $4,400 that was subject to FICA tax. Joanne received taxable dividends of $1,110 during the year, and she had a

Calculate Joanne's self-employment tax using page 1 of Schedule SE of Form 1040.

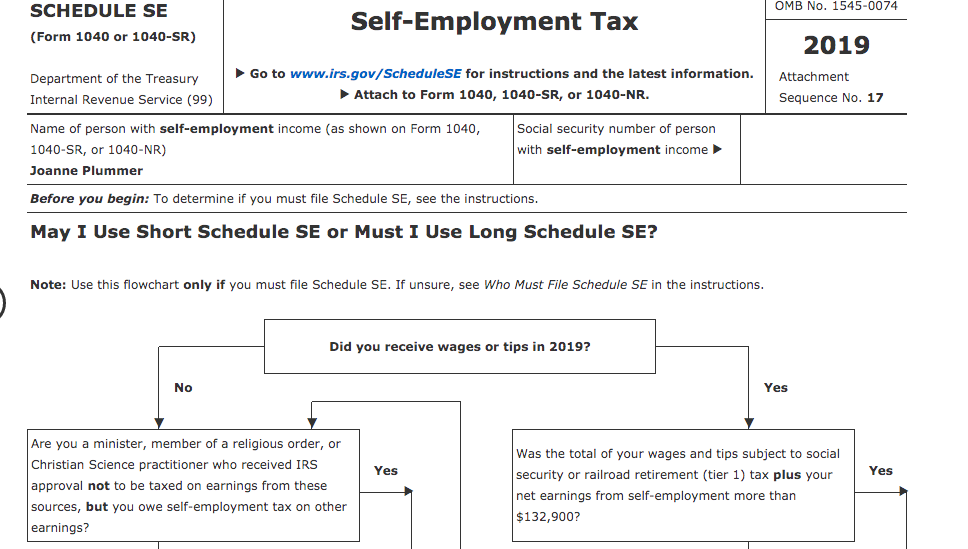

Transcribed Image Text:OMB No. 1545-0074

SCHEDULE SE

Self-Employment Tax

(Form 1040 or 1040-SR)

2019

• Go to www.irs.gov/ScheduleSE for instructions and the latest information.

Attachment

Department of the Treasury

Internal Revenue Service (99)

Attach to Form 1040, 1040-SR, or 1040-NR.

Sequence No. 17

Name of person with self-employment income (as shown on Form 1040,

Social security number of person

1040-SR, or 1040-NR)

with self-employment income

Joanne Plummer

Before you begin: To determine if you must file Schedule SE, see the instructions.

May I Use Short Schedule SE or Must I Use Long Schedule SE?

Note: Use this flowchart only if you must file Schedule SE. If unsure, see Who Must File Schedule SE in the instructions.

Did you receive wages or tips in 2019?

No

Yes

Are you a minister, member of a religious order, or

Was the total of your wages and tips subject to social

Christian Science practitioner who received IRS

Yes

security or railroad retirement (tier 1) tax plus your

Yes

approval not to be taxed on earnings from these

net earnings from self-employment more than

sources, but you owe self-employment tax on other

$132,900?

earnings?

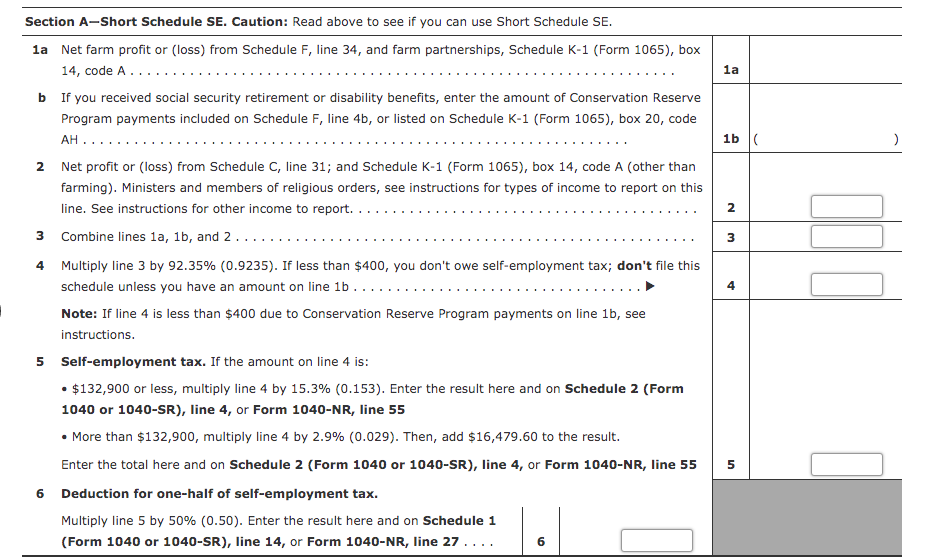

Transcribed Image Text:Section A-Short Schedule SE. Caution: Read above to see if you can use Short Schedule SE.

la Net farm profit or (loss) from Schedule F, line 34, and farm partnerships, Schedule K-1 (Form 1065), box

14, code A.....

1a

b If you received social security retirement or disability benefits, enter the amount of Conservation Reserve

Program payments included on Schedule F, line 4b, or listed on Schedule K-1 (Form 1065), box 20, code

1b (

АН ....

2 Net profit or (loss) from Schedule C, line 31; and Schedule K-1 (Form 1065), box 14, code A (other than

farming). Ministers and members of religious orders, see instructions for types of income to report on this

line. See instructions for other income to report.

2.

3

Combine lines la, 1b, and 2...

4 Multiply line 3 by 92.35% (0.9235). If less than $400, you don't owe self-employment tax; don't file this

schedule unless you have an amount on line 1b

4

Note: If line 4 is less than $400 due to Conservation Reserve Program payments on line 1b, see

instructions.

5 Self-employment tax. If the amount on line 4 is:

• $132,900 or less, multiply line 4 by 15.3% (0.153). Enter the result here and on Schedule 2 (Form

1040 or 1040-SR), line 4, or Form 1040-NR, line 55

• More than $132,900, multiply line 4 by 2.9% (0.029). Then, add $16,479.60 to the result.

Enter the total here and on Schedule 2 (Form 1040 or 1040-SR), line 4, or Form 1040-NR, line 55

5

6 Deduction for one-half of self-employment tax.

Multiply line 5 by 50% (0.50). Enter the result here and on Schedule 1

(Form 1040 or 1040-SR), line 14, or Form 1040-NR, line 27....

6

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT