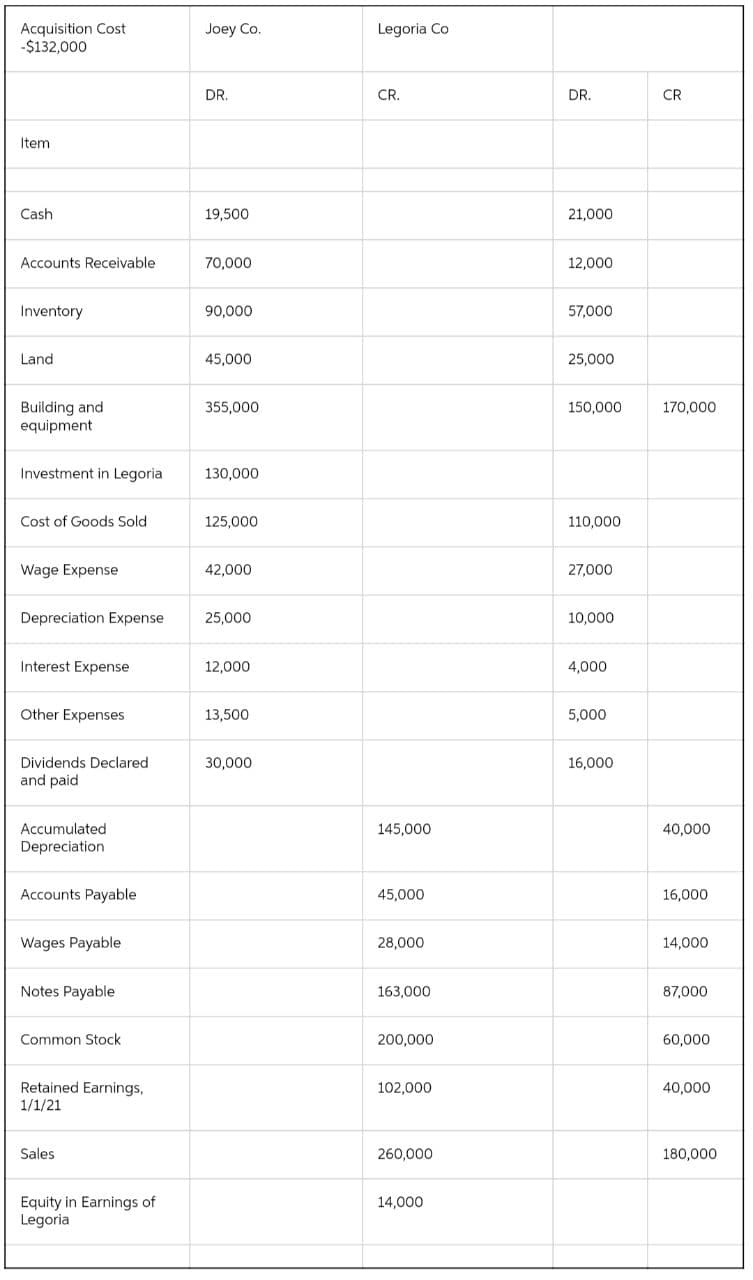

Joey Corporation acquired 100 percent of Legoria Company’s common stock on January 1, 2021 for cash paying $132,000. At that date, the fair value of Legoria’s Buildings and Equipment was $20,000 more than book value. Buildings and equipment are depreciated on a 10-year basis. Although goodwill is not amortized, the management of Joey CO. concluded on December 31, 2021, that the goodwill involved in the acquisition of Legoria Co. shares has been impaired and the correct carrying value was $4,000. Trial balance data for Joey Co and Legoria Co. are presented above.

Joey Corporation acquired 100 percent of Legoria Company’s common stock on January 1, 2021 for cash paying $132,000. At that date, the fair value of Legoria’s Buildings and Equipment was $20,000 more than book value. Buildings and equipment are depreciated on a 10-year basis. Although

NOTE that this Trial balance uses Accumulated

Required:

1). Give all of the

2). Give all of the Consolidation [Elimination entries] needed to prepare Consolidated Financial Statements for the year ended December 31, 2021 and show the Consolidated Income Statement,

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 3 images