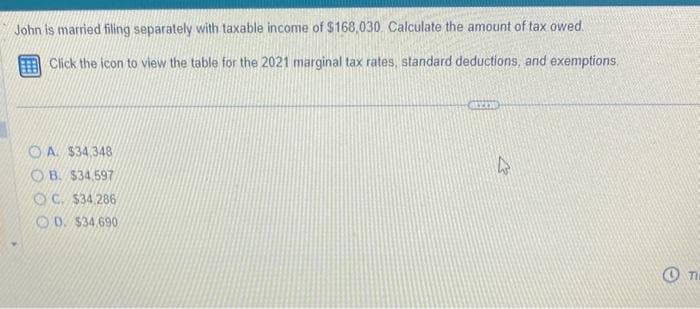

John is married filing separately with taxable income of $168,030. Calculate the amount of tax owed. Click the icon to view the table for the 2021 marginal tax rates, standard deductions, and exemptions. OA. $34.348 OB. $34.597 OC. $34.286 OD. $34,690 MEE 12 T

Q: In order to accumulate enough money for a down payment on a house, a couple deposits $374 per month…

A: A financial investment or physical asset's value on a particular date in the future is referred to…

Q: Frontier Rare Coins (FRC) was formed on January 1, 2024. Additional data for the year follow: i…

A: There are three statements of the organization which show different accounting financials. 1. Income…

Q: Sweet Acacia Industries expects credit sales for January, February, and March to be $200,400,…

A: Cash collection budget includes the estimated amount of cash received from the Accounts receivable.…

Q: A restaurant granted a 25% discount to senior citizens in excess of the 20% mandatory requirement.…

A: Given data is as follows: Discount granted = 25%Excess percentage = 20%Receipts report = P108,000

Q: You have been offered two different jobs for the upcoming summer. Since both are full-time…

A: Differential analysis is a decision-making method that contrasts the net results of two options…

Q: Exercise 1: Earnings per share (EPS-DEPS) The following information corresponds to the Rogue…

A: The earnings available to shareholders =Net income- Tax(30% of Net income) - Preference Dividend…

Q: PLEASE ANSWER ASAP. DO NOT USE EXCEL The HO ships merchandise to the branch at 50% above cost. On…

A: Given Information: Beginning Inventory = P15,000 Shipments from HO = P110,000 Ending Inventory =…

Q: ow did you calculate $43,100?

A: The second part of depreciation on buildings is calculated for the transactions during 2021.

Q: Periodic Payment Payment Interval Term Interest Rate Conversion Period $2500 1 month 6 years 10%…

A: Present value represents the current market price of the future value of the project. It estimates…

Q: 1. After determining the total product cost of P100.00 per unit, Mr. Abecee the owner, decided to…

A: The question is based on the concept of Cost Accounting. Retail price is calculated by adding the…

Q: What information is provided by the Vendor Balance Detail Report?

A: The Vendor Balance Detail Report provides a detailed summary of a vendor's balance, including…

Q: Garver Industries has budgeted the following unit sales: 2020 Units 8,000 10,000 January February…

A: Production budget: It implies to a financial estimate that is prepared based on the forecasted sales…

Q: Assuming a 360-day year, the interest charged by the bank, at the rate of 6%, on a 90-day,…

A: Interest charged = Loan amount × Interest rate × interest period

Q: EllaJane Corporation was organized several years ago and was authorized to issue 4,000,000 shares of…

A: A journal is a list of all of your spending in chronological order. A journal is often pictured as a…

Q: Find the current yield as a percent of a bond, whose coupon rate is listed as 8.875 and currently…

A: Current Yield = Annual Coupon Payment / Current Price of Bond Annual Coupon Payment = 8.875…

Q: Is a deduction allowed under the MACRS rules for depreciable real estate (used in a business or held…

A: The correct answer is: (D) Yes. depreciation for real estate is computed using tables that follow…

Q: Lopez Company is considering replacing one of its old manufacturing machines. The old machine has a…

A: Since you have posted a question with multiple sub-parts, we will do the first three sub-parts for…

Q: Exercise 8-16 (Static) Record warranties over two years (LO8-5) Lindy Appliance begins operations in…

A: The date, the amount to be credited and debited, a brief description of the transaction, the…

Q: Ute Company reported the following capital structure during the current year: 5% cumulative…

A: Answer:- Basic earning per share:- Investors can learn how much of a company's net income was…

Q: On August 1, 2024, Trico Technologies, an aeronautic electronics company, borrows $20.2 million cash…

A: Interest expense is the amount of expense which is incurred on the use of fund and is calculated by…

Q: Wales, Henry Windsor and Catherine Wales, William's wife, as a partnership. REQUIRED: a. What are…

A: There are many type of business that include partnership form of business, Company and sole…

Q: Which of the following best describes the how Investment Centers are evaluated. Investment Centers…

A: A funding middle is an enterprise unit in a corporation that could utilize capital to make…

Q: Shep Company combines its operating expenses for budget purposes in a selling and administrative…

A: Sales commission = Total sales ×6% = 20,000×$25×6% = $30,000 Delivery expense = 20,000×$25×2% =…

Q: Windsor Company has gathered the following information: Variable manufacturing overhead costs Fixed…

A: The question is based on the concept of Cost Accounting. Predetermined overhead rate can be…

Q: Bullitt Foods purchased a truck from a company going out of business for $42,000. An appraisal…

A: The depreciation expense is the expense that relates to the usage of the fixed asset during the…

Q: fixed asset with a cost of $25,104 and accumulated depreciation of $22,593.60 is sold for $4,267.68.…

A: The gain or loss on sale of fixed assets is calculated as difference between book value of asset and…

Q: BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $137,700 paid to its…

A: The question has asked to compute the employment taxes for three separate situations. Employment…

Q: Kohler Corporation reports the following components of stockholders' equity at December 31 of the…

A: The shareholders' equity tells about the capital and cash that belongs to the shareholders or owners…

Q: List the types of intercompany revenue and expenses that are eliminated in the preparation of a…

A: Intercompany eliminations display monetary consequences without transactions among subsidiaries.…

Q: A market that has three firms with the following market shares: Firm A = Firm B = Firm C = 35% 41%…

A: A merger is a business agreement in which it is decided that two companies will operate as one and…

Q: Required information [The following information applies to the questions displayed below.] On…

A: Lets understand the basics. When bond is issued for more than its face when then bond is known to be…

Q: Alma Corp. issues 1,040 shares of $9 par common stock at $15 per share. When the transaction is…

A: When Common stock is issued at premium the additional amount received in Excess of Par is credited…

Q: Question 1 The following costs were extracted from Red's company book at the end of December 2014…

A: Administrative cost indicates the expense being incurred by the business entity in the operation of…

Q: Explain the four factors where the premium tax credit (PTC) applies.

A: 1. Household Income: A household's Modified Adjusted Gross Income (MAGI) is used to determine the…

Q: Do audit teams normally need to refer the work of an expert in its audit report? Explain the…

A: Auditor's expert is an individual or organization which possess expertise in the field other than…

Q: A trial balance before adjustments included the following: Debit Credit Sales P 425,000…

A: Note: Under Direct write off method, bad debts expense are recorded when company is sure that amount…

Q: rouper Company began operations on January 1, 2018, and uses the average-cost method of pricing…

A: The question is based on the concept of Financial Accounting. Whenever any inventory valuation…

Q: Point, Inc. produces men's shirts. The following budgeted and actual amounts are for 2019: Cost…

A: Budget: It implies to a financial estimate that shows the expected numbers related to different…

Q: Emperor Pool Services provides pool cleaning and maintenance services to residential clients. It…

A: The official record for the business is a journal that includes every transaction in reverse…

Q: A retailer pays $120,000 rent each year for its two-story building. Space in this building is…

A: Allocation of overheads is based on the the type of overhead costs and need to determine suitable…

Q: The Hsu Manufacturing Company has two service departments: Maintenance and Accounting. The…

A: The service department costs can be allocated to the production departments using various methods.…

Q: Required: 1. Determine what the cost of labor, materials, and overhead for both Procedures 1 and 2…

A: Cost makeup of Procedure 1: Direct labor 480000 Direct materials 432000 Overhead 48000…

Q: Blue Dingo uses a standard costing system. The company's standard costs and variances for direct…

A: Total Direct Material Variance :— It is the difference between standard direct material cost and…

Q: h a minus sign.) ace Analysis e costs $ GA Keep 0 $ Replace Income Increase (Decrease) from…

A: To make a decision, the incremental income from each machine is compared with the existing machine

Q: 7. 8. Debt Ratio 9. Equity Ratio Working Capital ons

A: Ratio analysis means where different ratio of various years of years companies has been compared and…

Q: Prepare a journal entry for the purchase of a truck on April 4 for $63,730, paying $5,300 cash and…

A: Value of Asset = $63,730 Paid By Cash = $5300 Accounts Payable = $63,730 - $5,300…

Q: Other than 1040, what other forms need to be completed?

A: Schedule A: This is one of the schedules accompanying Form 1040. This schedule is used by filers to…

Q: Mack Precision Tool and Die has two production departments, Fabricating and Finishing, and two…

A: ANSWER Under step method of allocating service costs, the service cost of service department…

Q: Puleva S.A. of Madrid Spain, manufactures and sells 2 products of luxury finished cutlery – A and B.…

A: The question has asked to compute the break-even point, and, the total sales. Cost, volume, and…

Q: A and B (AB partnership) decide to form a partnership. A already has a business in operation and he…

A: The partnership comes into existence when two or more persons agree to do the business and further…

R2

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Arthur Wesson, an unmarried individual who is age 68, reports taxable income of 510,000 in 2019. He records positive AMT adjustments of 80,000 and preferences of 35,000. Arthur itemizes his deductions, and his regular tax liability in 2019 is 153,694. a. What is Arthurs AMT? b. What is the total amount of Arthurs tax liability? c. Draft a letter to Arthur explaining why he must pay more than the regular income tax liability. Arthurs address is 100 Colonels Way, Conway, SC 29526.Renee and Sanjeev Patel, who are married, reported taxable income of 1,008,000 for 2019. They incurred positive AMT adjustments of 75,000 and tax preference items of 67,500. The couple itemizes their deductions. a. Compute the Patels AMTI for 2019. b. Compute their tentative minimum tax for 2019.During the 2019 tax year, Brian, a single taxpayer, received $ 7,400 in Social Security benefits. His adjusted gross income for the year was $14,500 (not including the Social Security benefits) and he received $ 30,000 in tax-exempt interest income and has no for-AGI deductions, Calculate the amount of the Social Security benefits that Brian must include in his gross income for 2019. SIMPIFIED TAXABLE SOCIAL SECURITY WORKSHEET (FOR MOST PEOPLE) 1. Enter the total amount of Social Security income. 2. Enter one-half of line 1 3. Enter the total of taxable income items on Form 1040 except Social Security income. 4. Enter the amount of tax-exempt interest income. 5. Add lines 2,3, and 4 6. Enter all adjustments for AGl except for student loan interest, the domestic production activities deduction, and the tuition and fees deduction. 7. Subtract line 6 from line 5 . If zero or less, stop here, none of the Social Security benefits are taxable. 8. Enter $ 25,0001 $ 32,000 if married filing jointly; 0 if married filing separately and living with spouse at any time during the year) 9. Subtract line 8 from line 7 . If zero or less, enter -0 - Note: If line 9 is zero or less, stop here; none of your benefits are faxable. Otherwise, go on to line 10 10. Enter $ 9,0001 $12,000 if married filing jointly; 0 if married filing separately and living with spouse at any time during the year) 11. Subtract line 10 from line 9. If zero or less, enter -0 -. 12. Enter the smaller of line 9 or line 10 . 13. Enter one-half of line 12 14. Enter the smaller of line 2 or line 13 . 15. Multiply line 11 by 85 (. 85 ). If line 11 is zero, enter -0 -. 16. Add lines 14 and 15 17. Multiply line 1 by 85(.85) 18. Taxable benefits. Enter the smaller of line 16 or line 17 . 1.____________ 2.____________ 3.____________ 4.____________ 5.____________ 6.____________ 7.____________ 8.____________ 9.____________ 10.____________ 11.____________ 12.____________ 13.____________ 14.____________ 15.____________ 16.____________ 17.____________ 18.____________

- Melodie's taxable income is $39,000 and she pays income tax of $4,489. If Melodie's taxable income increases to $41,000, she would pay income taxes of $4,884. What is Melodie's marginal tax rate? 19.75 22.00 18.50 12.00 Some other amountWhich of the following would preclude a taxpayer from deducting student loan interest expense? a. The total amount paid is 1,000. b. The taxpayer is single with AGI of 55,000. c. The taxpayer is married filing jointly with AGI of 120,000. d. The taxpayer is taken as a dependent of another taxpayer.Lisa records nonrefundable Federal income tax credits of 65,000 for the year. Her regular income tax liability before credits is 190,000, and her TMT is 150,000. a. What is Lisas AMT? b. What is Lisas regular income tax liability after credits?