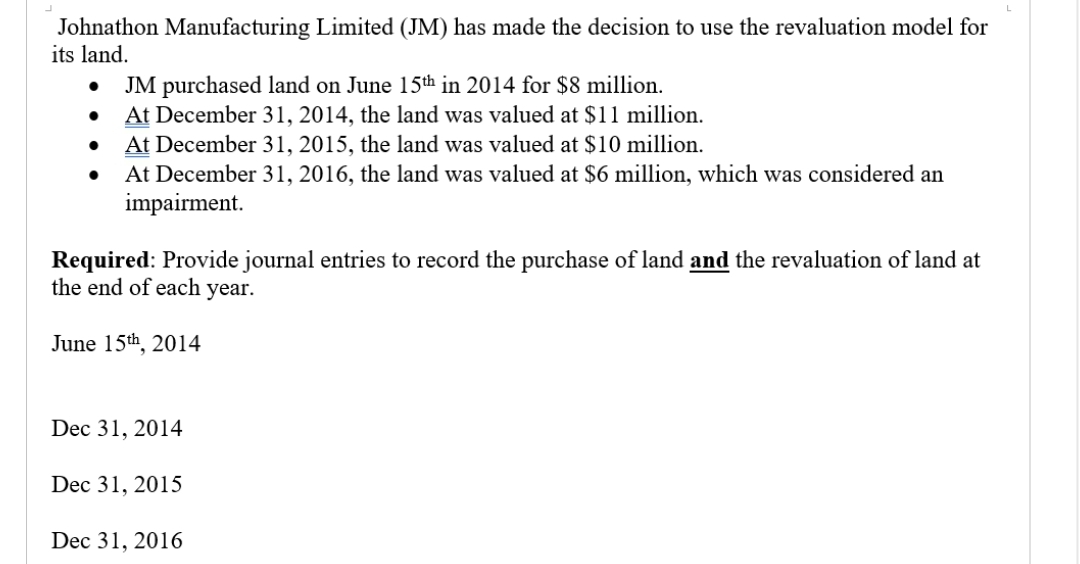

Johnathon Manufacturing Limited (JM) has made the decision to use the revaluation model for its land. ● ● JM purchased land on June 15th in 2014 for $8 million. At December 31, 2014, the land was valued at $11 million. At December 31, 2015, the land was valued at $10 million.

Johnathon Manufacturing Limited (JM) has made the decision to use the revaluation model for its land. ● ● JM purchased land on June 15th in 2014 for $8 million. At December 31, 2014, the land was valued at $11 million. At December 31, 2015, the land was valued at $10 million.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter2: Basic Accounting Systems: Cash Basis

Section: Chapter Questions

Problem 6CDQ: Capstone Consulting Services acquired land 5 years ago for $200,000. Capstone recently signed an...

Related questions

Question

Ll.1.

Transcribed Image Text:Johnathon Manufacturing Limited (JM) has made the decision to use the revaluation model for

its land.

● JM purchased land on June 15th in 2014 for $8 million.

At December 31, 2014, the land was valued at $11 million.

At December 31, 2015, the land was valued at $10 million.

At December 31, 2016, the land was valued at $6 million, which was considered an

impairment.

●

●

Required: Provide journal entries to record the purchase of land and the revaluation of land at

the end of each year.

June 15th, 2014

Dec 31, 2014

Dec 31, 2015

Dec 31, 2016

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning