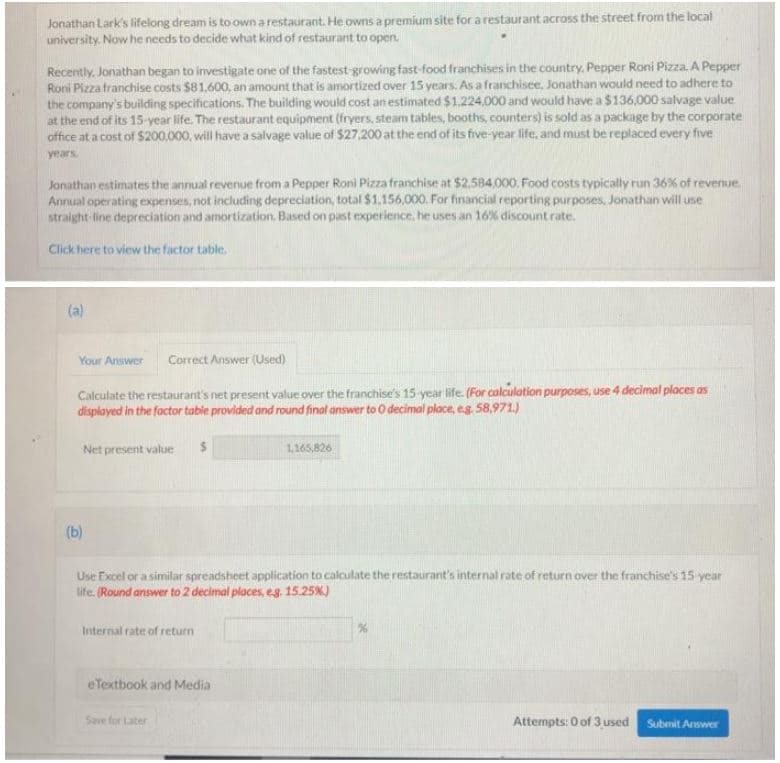

Jonathan Lark's lifelong dream is to own a restaurant. He owns a premium site for a restaurant across the street from the local university. Now he needs to decide what kind of restaurant to open. Recently, Jonathan began to investigate one of the fastest-growing fast-food franchises in the country, Pepper Roni Pizza. A Pepper Roni Pizza franchise costs $81.600, an amount that is amortized over 15 years. As a franchisee, Jonathan would need to adhere to the company's building specifications. The building would cost an estimated $1.224,000 and would have a $136,000 salvage value at the end of its 15-year life. The restaurant equipment (fryers, steam tables, booths, counters) is sold as a package by the corporate office at a cost of $200,000, will have a salvage value of $27.200 at the end of its five-year life, and must be replaced every five years Jonathan estimates the annual revenue from a Pepper Roni Pizza franchise at $2,584.000. Food costs typically run 36% of revenue. Annual operating expenses, not including depreciation, total $1.156.000. For financial reporting purposes, Jonathan will use straight-line depreciation and amortization. Based on past experience, he uses an 16% discount rate. Click here to view the factor table. (a) Your Answer Correct Answer (Used) Calculate the restaurant's net present value over the franchise's 15-year life. (For calculation purposes, use 4 decimal places as displayed in the factor table provided and round final answer to 0 decimal place, eg. 58,971.) Net present value 1,165,826 (b) Use Excel or a similar spreadsheet application to calculate the restaurant's internal rate of return over the franchise's 15 year life. (Round answer to 2 decimal places, eg. 15.25%) Internal rate of return eTextbook and Media Save for Later Attempts: 0 of 3 used Submit Arswer

Jonathan Lark's lifelong dream is to own a restaurant. He owns a premium site for a restaurant across the street from the local university. Now he needs to decide what kind of restaurant to open. Recently, Jonathan began to investigate one of the fastest-growing fast-food franchises in the country, Pepper Roni Pizza. A Pepper Roni Pizza franchise costs $81.600, an amount that is amortized over 15 years. As a franchisee, Jonathan would need to adhere to the company's building specifications. The building would cost an estimated $1.224,000 and would have a $136,000 salvage value at the end of its 15-year life. The restaurant equipment (fryers, steam tables, booths, counters) is sold as a package by the corporate office at a cost of $200,000, will have a salvage value of $27.200 at the end of its five-year life, and must be replaced every five years Jonathan estimates the annual revenue from a Pepper Roni Pizza franchise at $2,584.000. Food costs typically run 36% of revenue. Annual operating expenses, not including depreciation, total $1.156.000. For financial reporting purposes, Jonathan will use straight-line depreciation and amortization. Based on past experience, he uses an 16% discount rate. Click here to view the factor table. (a) Your Answer Correct Answer (Used) Calculate the restaurant's net present value over the franchise's 15-year life. (For calculation purposes, use 4 decimal places as displayed in the factor table provided and round final answer to 0 decimal place, eg. 58,971.) Net present value 1,165,826 (b) Use Excel or a similar spreadsheet application to calculate the restaurant's internal rate of return over the franchise's 15 year life. (Round answer to 2 decimal places, eg. 15.25%) Internal rate of return eTextbook and Media Save for Later Attempts: 0 of 3 used Submit Arswer

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section: Chapter Questions

Problem 13P

Related questions

Question

Transcribed Image Text:Jonathan Lark's lifelong dream is to own a restaurant. He owns a premium site for a restaurant across the street from the local

university. Now he needs to decide what kind of restaurant to open.

Recently, Jonathan began to investigate one of the fastest growing fast-food franchises in the country, Pepper Roni Pizza. A Pepper

Roni Pizza franchise costs $81.600, an amount that is amortized over 15 years. As a franchisce, Jonathan would need to adhere to

the company's building specifications. The building would cost an estimated $1.224,000 and would have a $136,000 salvage value

at the end of its 15-year life. The restaurant equipment (fryers, steam tables, booths, counters) is sold as a package by the corporate

office at a cost of $200.000, will have a salvage value of $27.200 at the end of its five-year life, and must be replaced every five

years

Jonathan estimates the annual revenue from a Pepper Roni Pizza tranchise at $2,584.000. Food costs typically run 36% of revenue.

Annual operating expenses, not including depreciation, total $1.156.000. For financial reporting purposes, Jonathan will use

straight line depreciation and amortization. Based on past experience, he uses an 16% discount rate.

Click here to view the factor table.

(a)

Your Answer

Correct Answer (Used)

Calculate the restaurant's net present value over the franchise's 15 year life. (For calculation purposes, use 4 decimal places as

displayed in the factor table provided and round final answer to 0 decimal place, eg. 58,971)

Net present value

1,165,826

(b)

Use Excel ora similar spreadsheet application to calculate the restaurant's internal rate of return over the franchise's 15 year

life. (Round answer to 2 decimal places, eg. 15.25%)

Internal rate of return

eTextbook and Media

Save for Later

Attermpts: O of 3 used

Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning