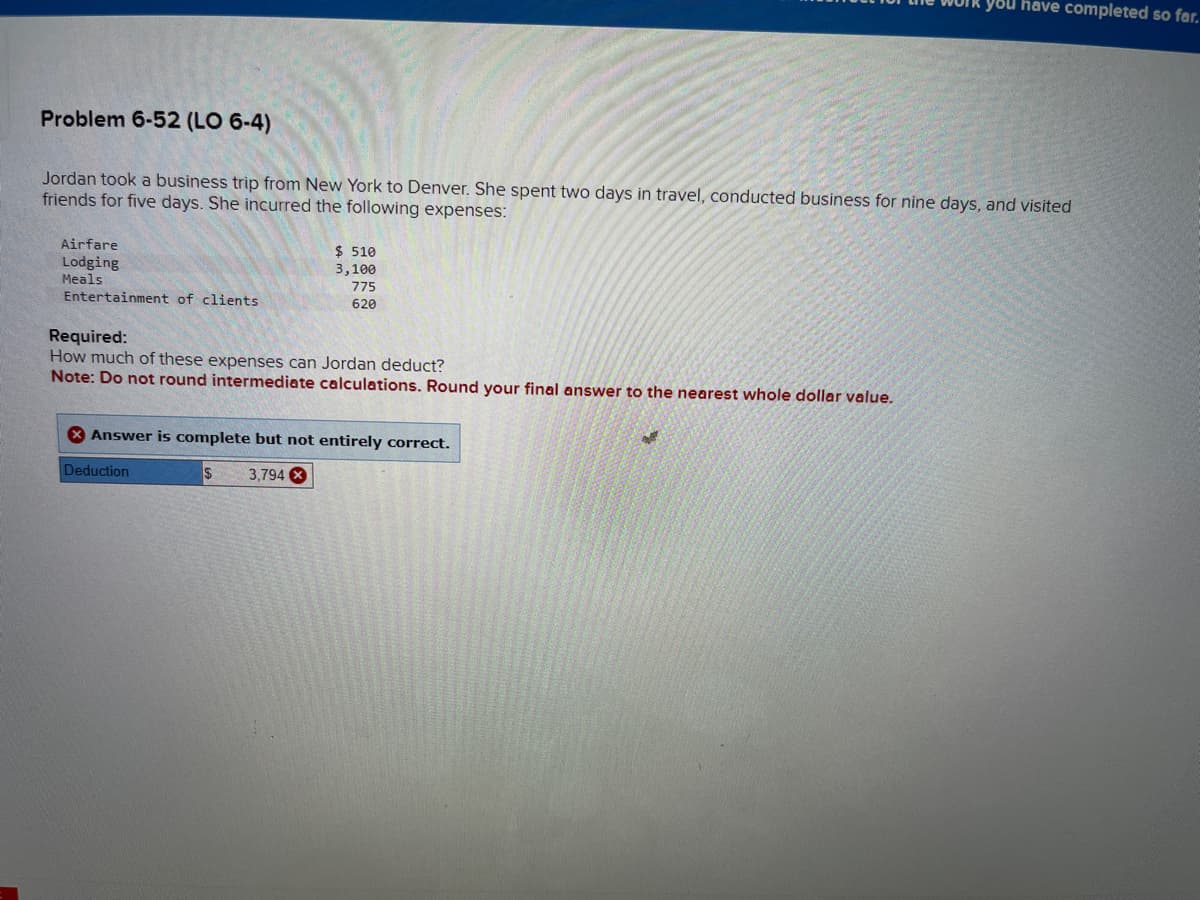

Jordan took a business trip from New York to Denver. She spent two days in travel, conducted business for nine days, and visited friends for five days. She incurred the following expenses: Airfare Lodging Meals Entertainment of clients $ 510 3,100 775 620 Required: How much of these expenses can Jordan deduct? Note: Do not round intermediate calculations. Round your final answer to the nearest whole dollar value. Answer is complete but not entirely correct. $ 3,794 X Deduction

Jordan took a business trip from New York to Denver. She spent two days in travel, conducted business for nine days, and visited friends for five days. She incurred the following expenses: Airfare Lodging Meals Entertainment of clients $ 510 3,100 775 620 Required: How much of these expenses can Jordan deduct? Note: Do not round intermediate calculations. Round your final answer to the nearest whole dollar value. Answer is complete but not entirely correct. $ 3,794 X Deduction

Chapter8: Depreciation, Cost Recovery, Amortization, And Depletion

Section: Chapter Questions

Problem 55P

Related questions

Question

Transcribed Image Text:Problem 6-52 (LO 6-4)

Jordan took a business trip from New York to Denver. She spent two days in travel, conducted business for nine days, and visited

friends for five days. She incurred the following expenses:

Airfare

Lodging

Meals

Entertainment of clients

$ 510

3,100

775

620

Required:

How much of these expenses can Jordan deduct?

Note: Do not round intermediate calculations. Round your final answer to the nearest whole dollar value.

Answer is complete but not entirely correct.

$ 3,794 X

Deduction

you have completed so far.

28

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT