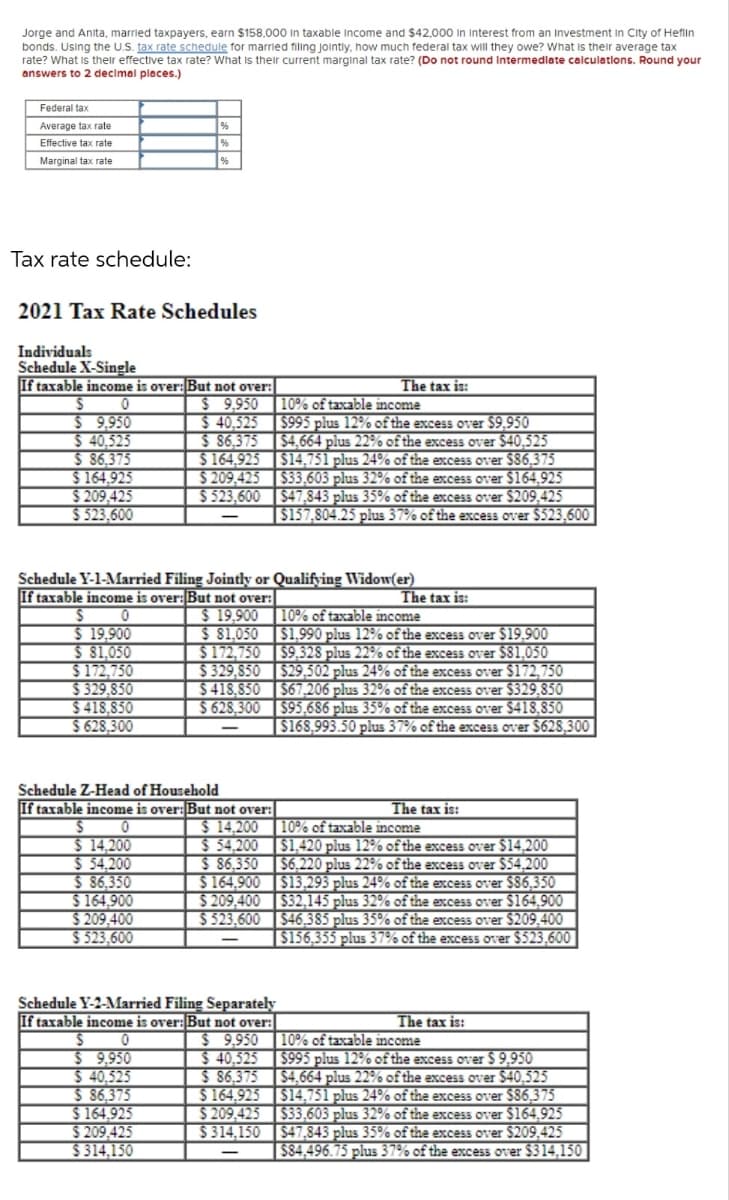

Jorge and Anita, married taxpayers, earn $158,000 in taxable income and $42,000 in Interest from an Investment in City of Heflin bonds. Using the U.S. tax rate schedule for married filing jointly, how much federal tax will they owe? What is their average tax rate? What is their effective tax rate? What is their current marginal tax rate? (Do not round Intermediate calculations. Round your answers to 2 decimal places.) Federal tax Average tax rate Effective tax rate Marginal tax rate % %

Jorge and Anita, married taxpayers, earn $158,000 in taxable income and $42,000 in Interest from an Investment in City of Heflin bonds. Using the U.S. tax rate schedule for married filing jointly, how much federal tax will they owe? What is their average tax rate? What is their effective tax rate? What is their current marginal tax rate? (Do not round Intermediate calculations. Round your answers to 2 decimal places.) Federal tax Average tax rate Effective tax rate Marginal tax rate % %

Chapter25: Taxation Of International Transact Ions

Section: Chapter Questions

Problem 38P

Related questions

Question

Transcribed Image Text:Jorge and Anita, married taxpayers, earn $158,000 in taxable income and $42,000 in Interest from an Investment in City of Heflin

bonds. Using the U.S. tax rate schedule for married filling jointly, how much federal tax will they owe? What is their average tax

rate? What is their effective tax rate? What is their current marginal tax rate? (Do not round Intermediate calculations. Round your

answers to 2 decimal places.)

Federal tax

Average tax rate

Effective tax rate

Marginal tax rate

Tax rate schedule:

2021 Tax Rate Schedules

Individuals

Schedule X-Single

If taxable income is over: But not over:

0

$9,950

$9.950

$ 40,525

$ 86,375

$164,925

$209,425

$ 523,600

The tax is:

10% of taxable income

$995 plus 12% of the excess over $9,950

$4,664 plus 22% of the excess over $40,525

$164,925 |$14,751 plus 24% of the excess over $86,375

$33,603 plus 32% of the excess over $164,925

$47,843 plus 35% of the excess over $209,425

$209,425

$523,600

| $157,804.25 plus 37% of the excess over $523,600

Schedule Y-1-Married Filing Jointly or Qualifying Widow(er)

If taxable income is over: But not over:

0

$ 19,900

10% of taxable income

$ 19,900

$81,050 $1,990 plus 12% of the excess over $19,900

$172,750 |$9,328 plus 22% of the excess over $81,050

$ 81,050

$172,750

$329,850

$329,850

$418,850

$418,850

$ 628,300

$ 628.300

$164,900

$209,400

$ 523,600

$ 40,525

$ 86,375

Schedule Z-Head of Household

If taxable income is over: But not over:

0

$ 14,200

$ 14,200

$ 54,200

$ 54,200

$ 86,350

$ 86,350

$164,900

$209,400

$523,600

0

S

$ 9,950

$ 40,525

$ 86,375

$164.925

$ 209,425

$314,150

The tax is:

$29,502 plus 24% of the excess over $172,750

$67,206 plus 32% of the excess over $329,850

$95,686 plus 35% of the excess over $418,850

| $168,993.50 plus 37% of the excess over $628,300

Schedule Y-2-Married Filing Separately

If taxable income is over: But not over:

$9.950

The tax is:

10% of taxable income

$1,420 plus 12% of the excess over $14,200

$6,220 plus 22% of the excess over $54,200

$13,293 plus 24% of the excess over $86,350

$32,145 plus 32% of the excess over $164,900

$46,385 plus 35% of the excess over $209,400

| $156,355 plus 37% of the excess over $523,600

The tax is:

10% of taxable income

$ 40,525

$995 plus 12% of the excess over $ 9,950

$ 86,375 $4,664 plus 22% of the excess over $40,525

$164,925 |$14,751 plus 24% of the excess over $86,375

$209,425 $33,603 plus 32% of the excess over $164,925

$314,150 ||$47,843 plus 35% of the excess over $209,425

|| $84,496.75 plus 37% of the excess over $314,150

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT