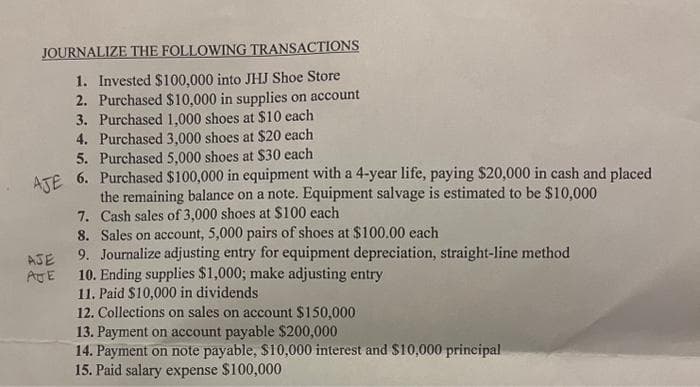

JOURNALIZE THE FOLLOWING TRANSACTIONS 1. Invested $100,000 into JHJ Shoe Store 2. Purchased $10,000 in supplies on account 3. Purchased 1,000 shoes at $10 each 4. Purchased 3,000 shoes at $20 each 5. Purchased 5,000 shoes at $30 each AJE 6. Purchased $100,000 in equipment with a 4-year life, paying $20,000 in cash and placed the remaining balance on a note. Equipment salvage is estimated to be $10,000 Cash sales of 3,000 shoes at $100 each 7. 8. Sales on account, 5,000 pairs of shoes at $100.00 each AJE 9. Journalize adjusting entry for equipment depreciation, straight-line method AE 10. Ending supplies $1,000; make adjusting entry 11. Paid $10,000 in dividends 12. Collections on sales on account $150,000 13. Payment on account payable $200,000 14. Payment on note payable, $10,000 interest and $10,000 principal 15. Paid salary expense $100,000

Q: Tamarisk Company lost most of its inventory in a fire in December just before the year-end physical…

A: Inventory loss due to fire refers to the reduction in the recorded value of merchandise destroyed by…

Q: Samtech Manufacturing purchased land and a building for $4 million. In addition to the purchase…

A: Land is the non-current asset that is usually held by the entity for using the same to run its…

Q: Suppose LovetoRead sells 2,000 hardcover books per day at an average price of $70. Assume that…

A: Budgeted sales revenue is the sales revenue estimated to be earned during the budgeted period.

Q: Bob Sample opened the Campus Laundromat on September 1, 2022. During the first month of operations,…

A: The objective of the question is to prepare the Statement of Financial Position (Balance Sheet) for…

Q: For the year 2007, the company board of directors declared that they will pay RM50,000 bonuses for…

A: Journal entries in accounting are a documentation of the financial dealings that a company has…

Q: Legacy issues $620,000 of 9.5%, four-year bonds dated January 1, 2021, that pay interest…

A: Unamortized discount at period end = Previous balance - Discount amortizedCarrying value = Previous…

Q: Presented below are the comparative income and retained earnings statements for Bridgeport Inc. for…

A: The amount of profit a business has left over after covering all of its direct and indirect…

Q: A contractor enters into a revenue contract to construct customized equipment for a customer. The…

A: If the likely % is less than 50% then, bonus amount is not considered for computing transaction…

Q: The delivery cycle time was: Multiple Choice

A: Delivery cycle time is the span between the acceptance of an order to the delivery of the item to…

Q: Recording the Sale of Common and Preferred Stock At the end of its first year of operations,…

A: Journal Entry :— It is an act of recording transactions in books of account when transaction…

Q: am. 117.

A: COGS represents the direct costs associated with the production or acquisition of goods that are…

Q: The structural consequences of redlining and residential segregation have declined, if not…

A: The Act promotes equal housing opportunities for all citizens and makes it illegal to discriminate…

Q: A partnership has liquidated all assets but still reports the following account balances: Beck, loan…

A: Partnership: Arrangement between two or more people whereby they agree to manage business operations…

Q: Employee Total Hours Hourly Rate Total Health Care M. Swift $14.00 S. Current $22.00 B. Wavey $18.00…

A: Payroll is the method used to compensate employees for the work they have completed. This involves…

Q: Wingate Corporation had the following income and expenses for 2023: Income from operations $70,000…

A: A net operating loss (NOL) occurs when a company's allowable tax deductions exceed its taxable…

Q: Flight promotion Depreciation of aircraft Fuel for aircraft Liability insurance Salaries, flight…

A: Financial advantage (disadvantage) of discontinuing flight 482 = Saving in flight costs - Loss of…

Q: Gomez Company uses a sales journal, purchases journal, cash receipts journal, cash payments journal,…

A: Purchase Journal is a table where all the purchases on account are recorded. It is also known as a…

Q: Adelphia Manufacturing issued $70,000 of direct materials and $9,000 of indirect materials for…

A: In a cost accounting system, direct materials used is debited to work in process and indirect…

Q: 12. The Thomas Company has two service departments and two operating departments. The following data…

A: Overhead Overhead refers to those expenses which occur during the operating of a business. Overhead…

Q: Delicious Desserts makes cupcakes and cookies. The company gathered the following information for…

A: Variance analysis is difference between actual data and standard data. This helps in analysis of…

Q: At the beginning of 2024, Terra Lumber Company purchased a timber tract from Boise Cantor for…

A: DepreciationDepreciation is defined as an accounting method wherein the cost of tangible assets is…

Q: For the current year, a company reported the following: Sales of $2,354.0 million Gross property,…

A: The "capital expenditure" (CapEx) means the money spent by a business or institution on long-term…

Q: b. Oscar filed his tax return and paid his $2,700 tax liability seven months late. Late filing and…

A: Late filing means filing of returns after the due date of the Application year.Late payment…

Q: A retail product has the following standard costs established: • Direct Material per unit - 2 pounds…

A: Variance analysis is the difference between the standard performance and the actual performance,…

Q: On December 31, 2023, Berclair Incorporated had 400 million shares of common stock and 7 million…

A: According to the question given, we need to compute the earnings per share.Earnings per share:EPS is…

Q: On August 1, 2020, Peterson Corp. acquired 10, $ 1,000, 8% bonds at 95 plus accrued interest. The…

A: Investment can be defined as allocation of excess fund for generating returns in future. The…

Q: Required information [The following information applies to the questions displayed below.) Income…

A: Financial Ratios: These are defined as the numbers that represent the state or health of the…

Q: Best Finance Corporation has an Italian subsidiary (Keith Solutions). In the remeasurement of the…

A: The cost of goods sold is cost incurred on the goods that are sold. It is deducted from the sales…

Q: During the month of March, Sandhill Co's employees earned wages of $68,000. Withholdings related to…

A: Payroll tax expense = State unemployment-tax payable + FICA taxes payable. Salaries and wages…

Q: A)What is the book value at the end of year eight? A)The book value at the end of year eight is…

A: 200% declining balance or double declining balance is a method of depreciation under which…

Q: Kingbird Company is constructing a building. Construction began on February 1 and was completed on…

A: Notes payable financial instrument that facilitates the company to borrow the loan or the purchase…

Q: An auditor established a $60,000 tolerable misstatement for an account balance of $1,000,000. The…

A: Tolerable misstatement is a concept used during the planning and execution of an audit. The auditor…

Q: On October 1, 2024 Oriole Corporation issued 6%, 10 year bonds with a face value of $8060000 at 104.…

A: Cas received from issuance of bonds= Face value of bonds x issue price/100 = $8060000*104/100=…

Q: Prepare a Translation worksheet.

A:

Q: Garcia Company sells snowboards. Each snowboard requires direct materials of $114, direct labor of…

A: The markup cost is the added price to the cost price of the product. The selling price is calculated…

Q: Simply Sweets has provided the following relating to the most recent month (August 31, 2016) of…

A: Segment reporting is the reporting of the operating segments of a company in the disclosures…

Q: Problem 11-5A (Algo) Calculate and analyze ratios (LO11-6) Cyberdyne Systems and Virtucon are…

A: Ratio Analysis -The ratio is the technique used by the prospective investor or an individual or…

Q: P6-5 (Algo) Preparing a Bank Reconciliation and Related Journal Entries LO6-4 Skip to question…

A: Ideally cash balance as per cashbook and bank statemenr balance must reconcile with each other. In…

Q: ds are paid to shareholders. split occurs

A: The stockholders section in the balance sheet consist of contributed capital and retained earning

Q: Nov. 1 Beginning inventory Purchase 9 (a) 15 22 29 30 Sale Purchase Sale Purchase 65 Cost of goods…

A: Under this method, a company totals all the inventory units and their costs and calculates the…

Q: Janine is 50 and has a good job at a biotechnology company. Janine estimates that she will need…

A: You can make tax-advantaged retirement savings using an individual retirement account (IRA). An…

Q: A retail product has the following standard costs established: Direct Material per unit - 2…

A: Variance analysis is the difference between the standard performance and the actual performance,…

Q: Symphony Electronics produces wireless speakers for outdoor use on patios, decks, etc. Their most…

A: Budgeting is the process of estimating expenses to be incurred in near future over estimated income…

Q: Revenue and expense data for Tribal Technologies Co. are as follows: 2018 2017 $665,000 $579,000…

A: Income statement lists revenue, expenses, tax etc. and shows net profit earned during the…

Q: The Wildhorse Store had a beginning inventory on January 1 of 320 full-size strollers at a cost of…

A: INVENTORY VALUATIONInventory Valuation is a Method of Calculation of Value of Inventory at the End…

Q: Required information [The following information applies to the questions displayed below.] Select…

A: By taking into account both the quantity and the cost of each unit, the Weighted Average Method…

Q: The following production and cost per EUP data are available for Vendome Corp for February: Units…

A: Weighted average method is one of the method used for process costing. Under this, equivalent units…

Q: Skysong Corporation had the following 2025 Income statement. Revenues $103,000 Expenses Net income…

A: Statement of Cash Flow is a financial statement that shows the inflow and outflow of cash during the…

Q: The following stockholders' equity accounts, arranged alphabetically.are in the ledger of Swifty…

A: STATEMENT OF SHAREHOLDERS EQUITYStatement of Shareholders Equity is also Known as Changes in…

Q: Alfa Co. uses a process costing system. The following data are available for one department for…

A: The equivalent units are calculated on the basis of the percentage of the work completed during the…

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

- A business has the following transactions: A. The business is started by receiving cash from an investor in exchange for common stock $10,000. B. Rent of $1,250 is paid for the first month. C. Office supplies are purchased for $375. D. Services worth $3,450 are performed. Cash is received for half. E. Customers pay $1,250 for services to be performed next month. F. $6,000 is paid for a one year insurance policy. G. We receive 25% of the money owed by customers in D. H. A customer has placed an order for $475 of services to be done this coming week. How much total revenue does the company have?During December of this year, G. Elden established Ginnys Gym. The following asset, liability, and owners equity accounts are included in the chart of accounts: During December, the following transactions occurred: a. Elden deposited 35,000 in a bank account in the name of the business. b. Bought exercise equipment for cash, 8,150, Ck. No. 1001. c. Bought advertising on account from Hazel Company, 105. d. Bought a display rack on account from Cyber Core, 790. e. Bought office equipment on account from Office Aids, 185. f. Elden invested her exercise equipment with a fair market value of 1,200 in the business. g. Made a payment to Cyber Core, 200, Ck. No. 1002. h. Sold services for the month of December for cash, 800. Required 1. Write the account classifications (Assets, Liabilities, Capital, Drawing, Revenue, Expense) in the fundamental accounting equation, as well as the plus and minus signs and Debit and Credit. 2. Write the account names on the T accounts under the classifications, place the plus and minus signs for each T account, and label the debit and credit sides of the T accounts 3. Record the amounts in the proper positions in the T accounts. Write the letter next to each entry to identify the transaction. 4. Foot and balance the accounts.In March, T. Carter established Carter Delivery Service. The account headings are presented below. Transactions completed during the month of March follow. a. Carter deposited 25,000 in a bank account in the name of the business. b. Bought a used truck from Degroot Motors for 15,140, paying 5,140 in cash and placing the remainder on account. c. Bought equipment on account from Flemming Company, 3,450. d. Paid the rent for the month, 1,000, Ck. No. 3001 (Rent Expense). e. Sold services for cash for the first half of the month, 6,927 (Service Income). f. Bought supplies for cash, 301, Ck. No. 3002. g. Bought insurance for the truck for the year, 1,200, Ck. No. 3003. h. Received and paid the bill for utilities, 349, Ck. No. 3004 (Utilities Expense). i. Received a bill for gas and oil for the truck, 218 (Gas and Oil Expense). j. Sold services on account, 3,603 (Service Income). k. Sold services for cash for the remainder of the month, 4,612 (Service Income). l. Paid wages to the employees, 3,958, Ck. Nos. 30053007 (Wages Expense). m. Carter withdrew cash for personal use, 1,250, Ck. No. 3008. Required 1. In the equation, write the owners name above the terms Capital and Drawing. 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses. 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.

- In March, T. Carter established Carter Delivery Service. The account headings are presented below. Transactions completed during the month of March follow. a. Carter deposited 25,000 in a bank account in the name of the business. b. Bought a used truck from Degroot Motors for 15,140, paying 5,140 in cash and placing the remainder on account. c. Bought equipment on account from Flemming Company, 3,450. d. Paid the rent for the month, 1,000, Ck. No. 3001. e. Sold services for cash for the first half of the month, 6,927. f. Bought supplies for cash, 301, Ck. No. 3002. g. Bought insurance for the truck for the year, 1,200, Ck. No. 3003. h. Received and paid the bill for utilities, 349, Ck. No. 3004. i. Received a bill for gas and oil for the truck, 218. j. Sold services on account, 3,603. k. Sold services for cash for the remainder of the month, 4,612. l. Paid wages to the employees, 3,958, Ck. Nos. 30053007. m. Carter withdrew cash for personal use, 1,250, Ck. No. 3008. Required 1. Record the transactions and the balance after each transaction 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.George Hoskin started his own business, Hoskin Hauling. The following transactions occurred in the first two weeks: A. George Hoskin contributed cash of $12,000 and a truck worth $10,000 to start the business. He received Common Stock in return. B. Paid two months rent in advance, $800. C. Agreed to do a hauling job for a price of $1,200. D. Performed the hauling job discussed in C. We will get paid later. E. Received payment of $600 on the hauling job done in D. F. Purchased gasoline on credit, $50. G. Performed another hauling job. Earned $750, was paid cash. Record the following transactions in T-accounts. Label each entry with the appropriate letter. Total the T-accounts when you are done.Hajun Company started its business on May 1, 2019. The following transactions occurred during the month of May. Prepare the journal entries in the journal on Page 1. A. The owners invested $5,000 from their personal account to the business account. B. Paid rent $400 with check #101. C. Initiated a petty cash fund $200 check #102. D. Received $400 cash for services rendered E. Purchased office supplies for $90 with check #103. F. Purchased computer equipment $1,000, paid $350 with check #104 and will pay the remainder in 30 days. G. Received $500 cash for services rendered. H. Paid wages $250, check #105. I. Petty cash reimbursement office supplies $25, Maintenance Expense $125, Miscellaneous Expense $35. Cash on hand $18. Check #106. J. Increased Petty Cash by $50, check #107.

- Domingo Company started its business on January 1, 2019. The following transactions occurred during the month of May. Prepare the journal entries in the journal on Page 1. A. The owners invested $10,000 from their personal account to the business account. B. Paid rent $500 with check #101. C. Initiated a petty cash fund $500 with check #102. D. Received $1,000 cash for services rendered. E. Purchased office supplies for $158 with check #103. F. Purchased computer equipment $2,500, paid $1,350 with check #104, and will pay the remainder in 30 days. G. Received $800 cash for services rendered. H. Paid wages $600, check #105. I. Petty cash reimbursement: office supplies $256, maintenance expense $108, postage expense $77, miscellaneous expense $55. Cash on hand $11. Check #106. J. Increased petty cash by $30, check #107.On October 1, 2019, Jay Pryor established an interior decorating business, Pioneer Designs. During the month, Jay completed the following transactions related to the business: Oct. 1. Jay transferred cash from a personal bank account to an account to be used for the business, 18,000. 4.Paid rent for period of October 4 to end of month, 3,000. 10.Purchased a used truck for 23,750, paying 3,750 cash and giving a note payable for the remainder. 13.Purchased equipment on account, 10,500. 14.Purchased supplies for cash, 2,100. 15.Paid annual premiums on property and casualty insurance, 3,600. 15.Received cash for job completed, 8,950. Enter the following transactions on Page 2 of the two-column journal: 21.Paid creditor a portion of the amount owed for equipment purchased on October 13, 2,000. 24.Recorded jobs completed on account and sent invoices to customers, 14,150. 26.Received an invoice for truck expenses, to be paid in November, 700. 27.Paid utilities expense, 2,240. 27.Paid miscellaneous expenses, 1,100. Oct. 29. Received cash from customers on account, 7,600. 30.Paid wages of employees, 4,800. 31.Withdrew cash for personal use, 3,500. Instructions 1. Journalize each transaction in a two-column journal beginning on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) Journal entry explanations may be omitted. 2. Post the journal to a ledger of four-column accounts, inserting appropriate posting references as each item is posted. Extend the balances to the appropriate balance columns after each transaction is posted. 3. Prepare an unadjusted trial balance for Pioneer Designs as of October 31, 2019. 4. Determine the excess of revenues over expenses for October. 5. Can you think of any reason why the amount determined in (4) might not be the net income for October?On March 1 of this year, B. Gervais established Gervais Catering Service. The account headings are presented below. Transactions completed during the month follow. a. Gervais deposited 25,000 in a bank account in the name of the business. b. Bought a truck from Kelly Motors for 26,329, paying 8,000 in cash and placing the balance on account, Ck. No. 500. c. Bought catering equipment on account from Luigis Equipment, 3,795. d. Paid the rent for the month, 1,255, Ck. No. 501. e. Bought insurance for the truck for one year, 400, Ck. No. 502. f. Sold catering services for cash for the first half of the month, 3,012. g. Bought supplies for cash, 185, Ck. No. 503. h. Sold catering services on account, 4,307. i. Received and paid the heating bill, 248, Ck. No. 504. j. Received a bill from GC Gas and Lube for gas and oil for the truck, 128. k. Sold catering services for cash for the remainder of the month, 2,649. l. Gervais withdrew cash for personal use, 1,550, Ck. No. 505. m. Paid the salary of the assistant, 1,150, Ck. No. 506. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.

- On March 1 of this year, B. Gervais established Gervais Catering Service. The account headings are presented below. Transactions completed during the month follow. a. Gervais deposited 25,000 in a bank account in the name of the business. b. Bought a truck from Kelly Motors for 26,329, paying 8,000 in cash and placing the balance on account, Ck. No. 500. c. Bought catering equipment on account from Luigis Equipment, 3,795. d. Paid the rent for the month, 1,255, Ck. No. 501 (Rent Expense). e. Bought insurance for the truck for one year, 400, Ck. No. 502. f. Sold catering services for cash for the first half of the month, 3,012 (Catering Income). g. Bought supplies for cash, 185, Ck. No. 503. h. Sold catering services on account, 4,307 (Catering Income). i. Received and paid the heating bill, 248, Ck. No. 504 (Utilities Expense). j. Received a bill from GC Gas and Lube for gas and oil for the truck, 128 (Gas and Oil Expense). k. Sold catering services for cash for the remainder of the month, 2,649 (Catering Income). l. Gervais withdrew cash for personal use, 1,550, Ck. No. 505. m. Paid the salary of the assistant, 1,150, Ck. No. 506 (Salary Expense). Required 1. In the equation, write the owners name above the terms Capital and Drawing. 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses. 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.The transactions completed by PS Music during June 2019 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the businesss operations: July 1.Peyton Smith made an additional investment in PS Music by depositing 5,000 in PS Musics checking account. 1.Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music store. Paid rent for July, 1,750. 1.Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2.Received 1,000 cash from customers on account. 3.On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for 80 hours per month for a monthly fee of 3,600. Any additional hours beyond 80 will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3.Paid 250 to creditors on account. 4.Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5.Purchased office equipment on account from Office Mart, 7,500. 8.Paid for a newspaper advertisement, 200. 11.Received 1,000 for serving as a disc jockey for a party. 13.Paid 700 to a local audio electronics store for rental of digital recording equipment. 14.Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: 16.Received 2,000 for serving as a disc jockey for a wedding reception. 18.Purchased supplies on account, 850. July 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22.Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23.Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2019. 27.Paid electric bill, 915. 28.Paid wages of 1,200 to receptionist and part-time assistant. 29.Paid miscellaneous expenses, 540. 30.Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2019. 31.Received 3,000 for serving as a disc jockey for a party. 31.Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists music during July. 31.Withdrew 1,250 cash from PS Music for personal use. PS Musics chart of accounts and the balance of accounts as of July 1, 2019 (all normal balances), are as follows: Instructions 1. Enter the July 1, 2019, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2. Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3. Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance as of July 31, 2019.The transactions completed by PS Music during June 2019 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the business's operations: July 1. Peyton Smith made an additional investment in PS Music by depositing 5,000 in PS Music's checking account. 1. Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music: store. Paid rent for July, 1,750. 1. Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2. Received 1,000 cash from customers on account. 3. On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for SO hours per month for a monthly fee of 3,600. Any additional hours beyond SO will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3. Paid 250 to creditors on account. 4. Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5. Purchased office equipment on account from Office Mart, 7,500. 8. Paid for a newspaper advertisement, 200. 11. Received 1,000 for serving as a disc jockey for a party. 13. Paid 700 to a local audio electronics store for rental of digital recording equipment. 11. Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: 16. Received 2,000 for serving as a disc jockey for a wedding reception. 18. Purchased supplies on account, 850. July 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22. Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23. Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2019. 27. Paid electric bill, 915. 28. Paid wages of 1,200 to receptionist and part-time assistant. 29. Paid miscellaneous expenses, 540. 30. Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2019. 31. Received 3,000 for serving as a disc jockey for a party. 31. Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists' music during July. 31. Withdrew l,250 cash from PS Music for personal use. PS Music's chart of accounts and the balance of accounts as of July 1, 2019 (all normal balances), are as follows: 11 Cash 3,920 12 Accounts receivable 1,000 14 Supplies 170 15 Prepaid insurance 17 Office Equipment 21 Accounts payable 250 23 Unearned Revenue 31 Peyton smith, Drawing 4,000 32 Fees Earned 500 41 Wages Expense 6,200 50 Office Rent Expense 400 51 Equipment Rent Expense 800 52 Utilities Expense 675 53 Supplies Expense 300 54 music Expense 1,590 55 Advertising Expense 500 56 Supplies Expense 180 59 Miscellaneous Expense 415 Instructions 1.Enter the July 1, 2019, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2.Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3.Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4.Prepare an unadjusted trial balance as of July 31, 2019.