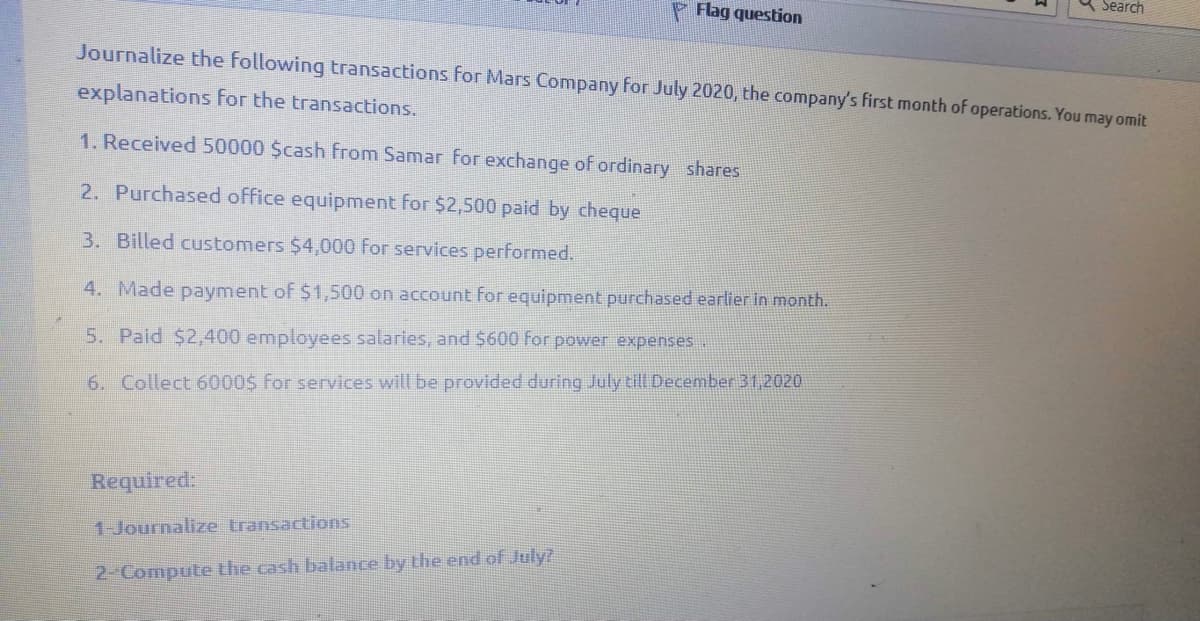

Journalize the following transactions for Mars Company for July 2020, the company's first month of operations. You may omit explanations for the transactions. 1. Received 50000 $cash from Samar for exchange of ordinary shares 2. Purchased office equipment for $2,500 paid by cheque 3. Billed customers $4,000 for services performed. 4. Made payment of $1,500 on account for equipment purchased earlier in month. 5. Paid $2,400 employees salaries, and $600 For power expenses 6. Collect 6000$ for services will be provided during July till December 31,2020

Q: 1. Ön January 1, 2019, issues 20,000 shares of common stock for cash. 2. On January 5, 2019,…

A: Journal entry: It is also called as book of original entry. All financial transactions occurred in a…

Q: uring 2018, the following events occurred for Parker Company Parker receives $36,000 cash in…

A: Accounting Equation: It is a statement where total assets are equal to the sum of total liabilities…

Q: Matrix Homes was organized on January 1, 2021 and had the account balances at January 31, listed in…

A: Accounting Equations:- These are equations where total assets are equal to the sum total of the…

Q: SIERRA CORPORATION On October 1, 2014, Sierra Corporation opened for business. The company has a…

A: Important Note : As per Bartleby Policy , in case of multiple sub parts we can do only first 3 sub…

Q: Toonie Tuesday Company began business on February 1, 2020 Record journal entries for each of the…

A: Golden rules of accounting works as base for preparing accounting entries for permanent accounts and…

Q: From the ledger balances given below, prepare a trial balance for the Bramble Company at June 30,…

A: Trail balances are used to prepare the financial statement of the organization. It includes both…

Q: Recording Transactions in a Financial Transaction Worksheet Hayley Williams is the owner of Good Dye…

A: Financial transaction worksheet provides the summary of all the transactions that took place in the…

Q: for the A. On first day of the month, issued common stock for cash, $24,000. B. On third day of…

A: The journal entries are prepared to keep the record of day to day transactions of the business on…

Q: Prepare journal entries for the transactions for Gordon Co for the month of July 2021. 7/2 Barry…

A: Journal entries recording is the first step in accounting cycle process, under which atleast one…

Q: Oriole Company was organized on April 1, 2019. The company prepares quarterly financial statements.…

A: PARTICULARS $ $ Revenues: Service Revenue 12,000 Rent Revenue 1,300 (A) Total…

Q: During June 2020, the business completed these transactions. a. Received cash of $9,400 and issued…

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in…

Q: Presented below is the adjusted trial balance of Brown Investment Advisers as at 30 June 2021.…

A: Here in this question, we are required to calculate income statement for year ended 30 June 2021.…

Q: The trial balance of Dunn Service Center, Inc., on March 1, 2018, lists the entity’s assets,…

A: Hello. Since your question has multiple sub-parts, we will solve first three sub-parts for you. If…

Q: Prepare a classified balance sheet for K and J Nursery, Inc. The equipment originally cost $140,000.

A: Given below is the balance sheet:

Q: Prepare general journal entries to record the following transactions for XYZ Group that occurred…

A: Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: Laker Incorporated’s fiscal year-end is December 31, 2021. The following is an adjusted trial…

A: Closing entries: The journal entries prepared to close the temporary accounts to Retained Earnings…

Q: From the ledger balances given below, prepare a trial balance for the Bramble Company at June 30,…

A: Trial balance in the business shows balances in all general ledger accounts in the business as on…

Q: The accounts of Salman Company follow with their normal balances at December 31, 2020. The accounts…

A: Introduction: Trial balance: After postings of ledger the final account balances are posted in Trial…

Q: Read: From the Ledger balances below, listed in alphabetical order, Prepare a Trial Balance for…

A: Trial balance is the summary of all general ledger account balances in the business.

Q: Martinez Corp. has the following transactions during August of the current year. Aug. 1 Issues…

A: Journal entry refer to the recording of all the non-economic & economic transactions made in the…

Q: The post-closing trial balance of Zuhoor Muscat Company shows the following balances at 31 March…

A: Post closing trial balance is the summary of all general ledger accounts balances after all the…

Q: Question ask you to jurnalize the january transaction, prepare trial balance and jurnalize the…

A: a.Journal entries

Q: The following selected accounts and their current balances appear in the ledger of Maroon Co. for…

A: Income Statement is prepared to show the net profit or loss earned by the company during a…

Q: Oriole Company was organized on April 1, 2020. The company prepares quarterly financial statements.…

A: Financial Statements are prepared by the management for reporting purposes. These are the essential…

Q: At the beginning of January, the balance in the Retained Earnings account is $250,000 for TR…

A:

Q: The adjusted trial balance for China Tea Company at December 31, 2021, is presented below: Accounts…

A: The balance sheet is prepared by the management to show the actual situation of the business entity…

Q: he adjusted trial balance for China Tea Company at December 31, 2021, is presented below: Accounts…

A:

Q: The trial balance of Dunn Service Center, Inc., on March 1, 2018, lists the entity's assets,…

A: Since you have asked a question with multiple subparts, we will solve the first three subparts for…

Q: The December 31, 2021, adjusted trial balance for Fightin' Blue Hens Corporation is presented…

A: The income statement is one of the essential parts of the financial statement used for reporting the…

Q: Given is the Trial Balance of ABC Corporation for the period ending December 31, 2020: ABC…

A: A 10-column worksheet is a columnar template that helps accountants and bookkeepers plan and…

Q: ance for Yondel Company at December 31, 2021 is presented below: Accounts Debit Credit $ 8,000…

A: 1) Closing entry for service revenue :-

Q: At the end of the 2021 year, the accounting staff at Prestige Design Flooring Inc. (PDF) have the…

A: A balance sheet is a representation of an individual's personal or corporation's financial balances…

Q: with this entries July 1 Began business by making a deposit in a company bank account of…

A: Adjusted Trial Balance: A adjusted trial balance is a statement of the final balance of all accounts…

Q: The following events occur for The Underwood Corporation during 2021 and 2022, its first two years…

A: Accounts receivables are current assets which shows that the amount that an entity has to collect…

Q: The general ledger of Red Storm Cleaners at January 1, 2021, includes the following account…

A: In preparation of closing journal entries all temporary accounts are transferred Permanent accounts.…

Q: The following transactions occurred during 2021 for the Beehive Honey Corporation: Feb. 1…

A: Interest expense (Feb 1)=$12,000×10%×1112=$1,100

Q: Can you help me with part B, #7-9 please! Roth Contractors Corporation was incorporated on December…

A: This is prepared after posting all the Journal entries in the respective ledger accounts. Trial…

Q: The general ledger of Green Stream Cleaners at January 1, 2024, includes the following account…

A: Journal Entries :— It is an act of recording transaction in books of account when it is occurred for…

Q: resented below is the adjusted trial balance of Metlock Corporation at December 31, 2020. Debit…

A: SOLUTION- CALCULATE CASH BALANCE TOTAL…

Q: The account balances of Sentinel Travel Service for the year ended August 31, 2019, are listed…

A: Given opening balance of capital = $380,000 Additional capital invested = $36,000 Withdrawals =…

Q: Using the business transactions below, complete T-accounts for the Smith Company. I have provided a…

A: The T-accounts are prepared to record the transactions to their specific accounts and final prepared…

Q: The general ledger of Jackrabbit Rentals at January 1, 2021, includes the following account…

A: Accounts payable are those people or suppliers which provide the goods or services on credit basis…

Q: with this entries July 1 Began business by making a deposit in a company bank account of…

A: SOLUTION- ADJUSTING ENTRIES ARE THE JOURNAL ENTRIES PASSED AT THE END OF THE FINANCIAL YEAR TO CLOSE…

Q: ACE Corporation prepares monthly financial statements. Below are listed some selected accounts and…

A: Adjusting Entry – Adjusting Entries are the entries that make the accrual principle work for the…

Q: The following transactions occurred for the Microchip Company. 1. On October 1, 2024, Microchip lent…

A: These are the accounting transactions that are having a monetary impact on the financial statement…

Q: Journalize for Harper and Co. each of the following transactions or state no entry required and…

A: The journal entries are prepared to keep the record of day to day transactions of the business.

Q: Given the following transactions of Entrepreneur Ark, what journal entries would you make, as its…

A: Journal entry is the process of recording the business transactions in the accounting books for the…

Q: On January 1, 2021, the general ledger of Dynamite Fireworks includes the following account…

A: Adjustments have to be made for the transactions that occurred during the month to reach the balance…

Q: The December 31, 2021, adjusted trial balance for Fightin’ Blue Hens Corporation is presented…

A: The financial statements of the business include balance sheet and income statement.

Q: Below are transactions for Wolverine Company during 2021.1. On December 1, 2021, Wolverine receives…

A: The adjusting entries are prepared at the end of the year to show the correct amount of expenses and…

Step by step

Solved in 2 steps with 1 images

- Income Statement and Balance Sheet Fort Worth Corporation began business in January 2016 as a commercial carpet-cleaning and drying service. Shares of stock were issued to the owners in exchange for cash. Equipment was purchased by making a down payment in cash and signing a note payable for the balance. Services are performed for local restaurants and office buildings on open account, and customers are given 15 days to pay their accounts. Rent for office and storage facilities is paid at the beginning of each month. Salaries and wages are paid at the end of the month. The following amounts are from the records of Fort Worth Corporation at the end of its first month of operations: Required Prepare an income statement for the month ended January 31, 2016. Prepare a balance sheet at January 31, 2016. What information would you need about Notes Payable to fully assess Fort Worths longterm viability? Explain your answer.The transactions completed by PS Music during June 2019 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the businesss operations: July 1.Peyton Smith made an additional investment in PS Music by depositing 5,000 in PS Musics checking account. 1.Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music store. Paid rent for July, 1,750. 1.Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2.Received 1,000 cash from customers on account. 3.On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for 80 hours per month for a monthly fee of 3,600. Any additional hours beyond 80 will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3.Paid 250 to creditors on account. 4.Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5.Purchased office equipment on account from Office Mart, 7,500. 8.Paid for a newspaper advertisement, 200. 11.Received 1,000 for serving as a disc jockey for a party. 13.Paid 700 to a local audio electronics store for rental of digital recording equipment. 14.Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: 16.Received 2,000 for serving as a disc jockey for a wedding reception. 18.Purchased supplies on account, 850. July 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22.Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23.Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2019. 27.Paid electric bill, 915. 28.Paid wages of 1,200 to receptionist and part-time assistant. 29.Paid miscellaneous expenses, 540. 30.Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2019. 31.Received 3,000 for serving as a disc jockey for a party. 31.Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists music during July. 31.Withdrew 1,250 cash from PS Music for personal use. PS Musics chart of accounts and the balance of accounts as of July 1, 2019 (all normal balances), are as follows: Instructions 1. Enter the July 1, 2019, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2. Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3. Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance as of July 31, 2019.The transactions completed by PS Music during June 2019 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the business's operations: July 1. Peyton Smith made an additional investment in PS Music by depositing 5,000 in PS Music's checking account. 1. Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music: store. Paid rent for July, 1,750. 1. Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2. Received 1,000 cash from customers on account. 3. On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for SO hours per month for a monthly fee of 3,600. Any additional hours beyond SO will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3. Paid 250 to creditors on account. 4. Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5. Purchased office equipment on account from Office Mart, 7,500. 8. Paid for a newspaper advertisement, 200. 11. Received 1,000 for serving as a disc jockey for a party. 13. Paid 700 to a local audio electronics store for rental of digital recording equipment. 11. Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: 16. Received 2,000 for serving as a disc jockey for a wedding reception. 18. Purchased supplies on account, 850. July 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22. Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23. Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2019. 27. Paid electric bill, 915. 28. Paid wages of 1,200 to receptionist and part-time assistant. 29. Paid miscellaneous expenses, 540. 30. Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2019. 31. Received 3,000 for serving as a disc jockey for a party. 31. Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists' music during July. 31. Withdrew l,250 cash from PS Music for personal use. PS Music's chart of accounts and the balance of accounts as of July 1, 2019 (all normal balances), are as follows: 11 Cash 3,920 12 Accounts receivable 1,000 14 Supplies 170 15 Prepaid insurance 17 Office Equipment 21 Accounts payable 250 23 Unearned Revenue 31 Peyton smith, Drawing 4,000 32 Fees Earned 500 41 Wages Expense 6,200 50 Office Rent Expense 400 51 Equipment Rent Expense 800 52 Utilities Expense 675 53 Supplies Expense 300 54 music Expense 1,590 55 Advertising Expense 500 56 Supplies Expense 180 59 Miscellaneous Expense 415 Instructions 1.Enter the July 1, 2019, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2.Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3.Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4.Prepare an unadjusted trial balance as of July 31, 2019.

- The transactions completed by PS Music during June 2018 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the businesss operations: July 1. Peyton Smith made an additional investment in PS Musk in exchange for common stock by depositing 5,000 in PS Music s checking account. 1. Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music store. Paid rent for July, 1,750. 1. Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2. Received 1,000 on account. 3. On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for 80 hours per month for a monthly fee of 3,600. Any additional hours beyond 80 will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3. Paid 250 on account. 4. Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5. Purchased office equipment on account from Office Mart, 7,500. 8. Paid for a newspaper advertisement, 200. 11. Received 1,000 for serving as a disc jockey for a party. 13. Paid 700 to a local audio electronics store for rental of digital recording equipment. 14. Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on lage 2 of the two-column journal: 16. Received 2,000 for serving as a disc jockey for a wedding reception. 18. Purchased supplies on account, 850. 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22. Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23. Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2018. 27. Paid electric bill, 915. 28. Paid wages of 1,200 to receptionist and part-time assistant. 29. Paid miscellaneous expenses, 540. 30. Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2018. 31. Received 3,000 for serving as a disc jockey for a party. July 31. Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists music during July. 31. Paid dividends, 1,250. PS Musics chart of accounts and the balance of accounts as of July 1, 2018 (all normal balances), are as follows: 11 Cash 3,920 41 Fees Earned 6,200 12 Accounts Receivable 1,000 50 Wages Expense 400 14 Supplies 170 51 Office Rent Expense 800 15 Prepaid Insurance 52 Equipment Rent Expense 675 17 Office Equipment 53 Utilities Expense 300 21 Accounts Payable 250 54 Music Expense 1,590 23 Unearned Revenue 55 Advertising Expense 500 31 Common Stock 4,000 56 Supplies Expense 180 33 Dividends 500 59 Miscellaneous Expense 415 Instructions 1. Enter the July 1, 2018, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column, and place a check mark () in the Posting Reference column. {Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2. Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3. Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance as of July 31, 2018.Entries Prepared from a Trial Balance and Proof of the Cash Balance Russell Company was incorporated on January 1 with the issuance of capital stock in return for $120,000 of cash contributed by the owners. The only other transaction entered into prior to beginning operations was the issuance of a $50,000 note payable in exchange for equipment and fixtures. The following trial balance was prepared at the end of the first month by the bookkeeper for Russell Company: Required Determine the balance in the Cash account. Identify all of the transactions that affected the Cash account during the month. Use a T account to prove what the balance in Cash will be after all transactions are recorded.Journalize for Harper and Co. each of the following transactions or state no entry required and explain why. Be sure to follow proper journal writing rules. A. A corporation is started with an investment of $50,000 in exchange for stock. B. Equipment worth $4,800 is ordered. C. Office supplies worth $750 are purchased on account. D. A part-time worker is hired. The employee will work 15–20 hours per week starting next Monday at a rate of $18 per hour. E. The equipment is received along with the invoice. Payment is due in three equal monthly installments, with the first payment due in sixty days.

- Prepare journal entries to record the following transactions. Create a T-account for Cash, post any entries that affect the account, and calculate the ending balance for the account. Assume a Cash beginning balance of $16,333. A. February 2, issued stock to shareholders, for cash, $25,000 B. March 10, paid cash to purchase equipment, $16,000Domingo Company started its business on January 1, 2019. The following transactions occurred during the month of May. Prepare the journal entries in the journal on Page 1. A. The owners invested $10,000 from their personal account to the business account. B. Paid rent $500 with check #101. C. Initiated a petty cash fund $500 with check #102. D. Received $1,000 cash for services rendered. E. Purchased office supplies for $158 with check #103. F. Purchased computer equipment $2,500, paid $1,350 with check #104, and will pay the remainder in 30 days. G. Received $800 cash for services rendered. H. Paid wages $600, check #105. I. Petty cash reimbursement: office supplies $256, maintenance expense $108, postage expense $77, miscellaneous expense $55. Cash on hand $11. Check #106. J. Increased petty cash by $30, check #107.Journal Entries Castle Consulting Agency began business in February. The transactions entered into by Castle during its first month of operations are as follows: Acquired articles of incorporation from the state and issued 10,000 shares of capital stock in exchange for $150,000 in cash. Paid monthly rent of $400. Signed a five-year promissory note for $100,000 at the bank. Purchased software to be used on future jobs. The software costs $950 and is expected to be used on five to eight jobs over the next two years. Billed customers $12,500 for work performed during the month. Paid office personnel $3,000 for the month of February. Received a utility bill of $100. The total amount is due in 30 days. Required Prepare in journal form, the entry to record each transaction.

- Prepare journal entries to record the following transactions: A. December 1, collected balance due from customer account, $5,500 B. December 12, paid creditors for supplies purchased last month, $4,200 C. December 31, paid cash dividend to stockholders, $1,000Journal entries and trial balance On August 1, 20Y7, Rafael Masey established Planet Realty, which completed the following transactions during the month: a. Rafael Masey transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, 17,500. b. Purchased supplies on account, 2,300. c. Earned sales commissions, receiving cash, 13,300. d. Paid rent on office and equipment for the month, 3,000. e. Paid creditor on account, 1,150. f. Paid dividends, 1,800. g. Paid automobile expenses (including rental charge) for month, 1,500, and miscellaneous expenses, 400. h. Paid office salaries, 2,800. i. Determined that the cost of supplies used was 1,050. Instructions 1. Journalize entries for transactions (a) through (i), using the following account titles: Cash, Supplies, Accounts Payable, Common Stock, Dividends, Sales Commissions, Rent Expense, Office Salaries Expense, Automobile Expense, Supplies Expense, Miscellaneous Expense. Journal entry explanations may be omitted. 2. Prepare T accounts, using the account titles in (1). Post the journal entries to these accounts, placing the appropriate letter to the left of each amount to identify the transactions. Determine the account balances, after all posting is complete. Accounts containing only a single entry do not need a balance. 3. Prepare an unadjusted trial balance as of August 31, 20Y7. 4. Determine the following: a. Amount of total revenue recorded in the ledger. b. Amount of total expenses recorded in the ledger. c. Amount of net income for August. 5. Determine the increase or decrease in retained earnings for August.The transactions completed by PS Music during June 20Y5 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the businesss operations: July 1. Peyton Smith made an additional investment in PS Music in exchange for common stock by depositing 5,000 in PS Musics checking account. 1. Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music store. Paid rent for July, 1,750. 1. Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2. Received 1,000 on account. 3. On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for 80 hours per month for a monthly fee of 3,600. Any additional hours beyond 80 will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3. Paid 250 on account. 4. Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5. Purchased office equipment on account from Office Mart, 7,500. 8. Paid for a newspaper advertisement, 200. 11. Received 1,000 for serving as a disc jockey for a party. 13. Paid 700 to a local audio electronics store for rental of digital recording equipment. 14. Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: 16. Received 2,000 for serving as a disc jockey for a wedding reception. 18. Purchased supplies on account, 850. 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22. Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23. Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 20Y5. 27. Paid electric bill, 915. 28. Paid wages of 1,200 to receptionist and part-time assistant. 29. Paid miscellaneous expenses, 540. 30. Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 20Y5. 31. Received 3,000 for serving as a disc jockey for a party. 31. Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists music during July. 31. Paid dividends, 1,250. PS Musics chart of accounts and the balance of accounts as of July 1, 20Y5 (all normal balances), are as follows: Instructions 1. Enter the July 1, 20Y5, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column, and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2. Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3. Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance as of July 31, 20Y5.