Journalize this transactions for 2024, before starting the company for the journal entries uses the allowance method I added more imformation in the image for the background data and imformation. Transactions for 2024 1-Sales revenue on account, $113,600 (ignore Cost of Goods Sold). 2-Collections on account, $92,895 3-Write-offs of uncollectibles, $760. 4- The Company accepted a 90-day, 9%, $13,500 note receivable from a customer in exchange for 4 his account receivable. a Journalize the issuance of the note. b Journalize the collection of the principal and interest at maturity. (use 360 days) 5 Bad debts expense of $?? was recorded. (Refer to requirement 3)(about the write off) -attached is an image to the context the journal entries should be placed in

Journalize this transactions for 2024, before starting the company for the journal entries uses the allowance method I added more imformation in the image for the background data and imformation. Transactions for 2024 1-Sales revenue on account, $113,600 (ignore Cost of Goods Sold). 2-Collections on account, $92,895 3-Write-offs of uncollectibles, $760. 4- The Company accepted a 90-day, 9%, $13,500 note receivable from a customer in exchange for 4 his account receivable. a Journalize the issuance of the note. b Journalize the collection of the principal and interest at maturity. (use 360 days) 5 Bad debts expense of $?? was recorded. (Refer to requirement 3)(about the write off) -attached is an image to the context the journal entries should be placed in

Chapter5: Operating Activities: Purchases And Cash Payments

Section: Chapter Questions

Problem 2.1C

Related questions

Question

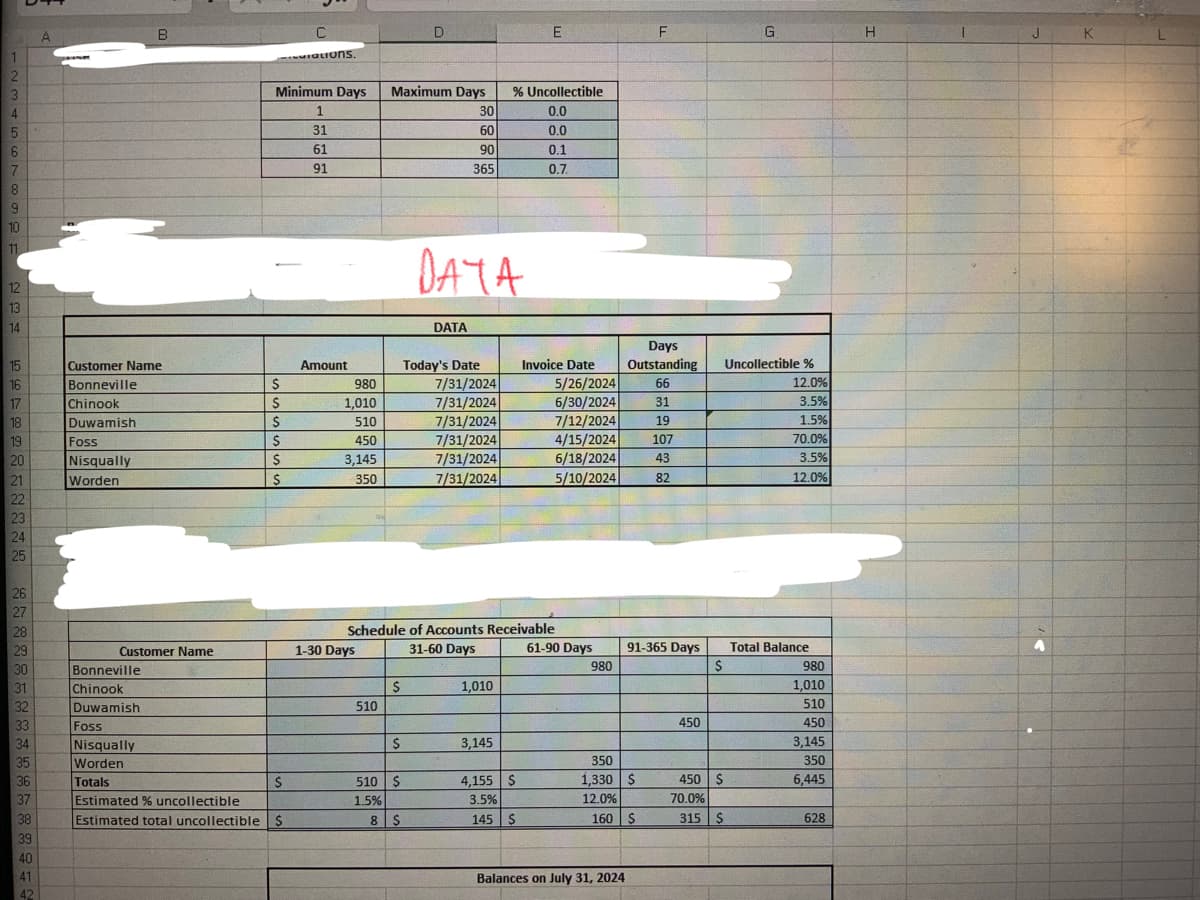

Journalize this transactions for 2024, before starting the company for the journal entries uses the allowance method

I added more imformation in the image for the background data and imformation.

Transactions for 2024

1-Sales revenue on account, $113,600 (ignore Cost of Goods Sold).

2-Collections on account, $92,895

3-Write-offs of uncollectibles, $760.

4- The Company accepted a 90-day, 9%, $13,500 note receivable from a customer in exchange for 4 his account receivable.

a Journalize the issuance of the note.

b Journalize the collection of the principal and interest at maturity. (use 360 days)

5 Bad debts expense of $?? was recorded. (Refer to requirement 3)(about the write off)

-attached is an image to the context the journal entries should be placed in

Transcribed Image Text:1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

A

Customer Name

Bonneville

Chinook

Duwamish

Foss

Nisqually

Worden

B

Customer Name

Bonneville

Chinook

Duwamish

Foss

Nisqually

Worden

Totals

C

mations.

Minimum Days Maximum Days

1

30

31

60

61

90

91

365

$

$

$

$

S

$

$

Estimated % uncollectible

Estimated total uncollectible $

Amount

980

1,010

510

450

3,145

350

1040

1-30 Days

510

$

D

$

510 $

1.5%

8 $

DATA

DATA

Today's Date

7/31/2024

7/31/2024

7/31/2024

7/31/2024

7/31/2024

7/31/2024

Schedule of Accounts Receivable

31-60 Days

1,010

% Uncollectible

0.0

0.0

0.1

0.7.

3,145

E

4,155 $

3.5%

145 $

Invoice Date

5/26/2024

6/30/2024

7/12/2024

4/15/2024

6/18/2024

5/10/2024

61-90 Days

980

Balances on July 31, 2024

F

Days

Outstanding

66

31

19

107

43

82

350

1,330 $

12.0%

160 $

91-365 Days

450

G

450 S

70.0%

315 $

Uncollectible %

12.0%

3.5%

1.5%

70.0%

3.5%

12.0%

Total Balance

$

980

1,010

510

450

3,145

350

6,445

628

H

J

K

Transcribed Image Text:1

2

3

4

5

6

7

$

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

A1

24

25

26

27

28

29

3:0

31

32

33

34

35

36

37

39

40

41

42

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

X AutoSave OnPv

70

71

File Home

63

64

65

66

67

68

69

A

Date

V

B

Insert Page Layout

X ✓ fx

Account and Explanation

C

✓ SAR.... Upload Pen... V

DR

D

CR

E

Formulas Data

I

G

H

K

Review View

L

M

N

0

F

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you