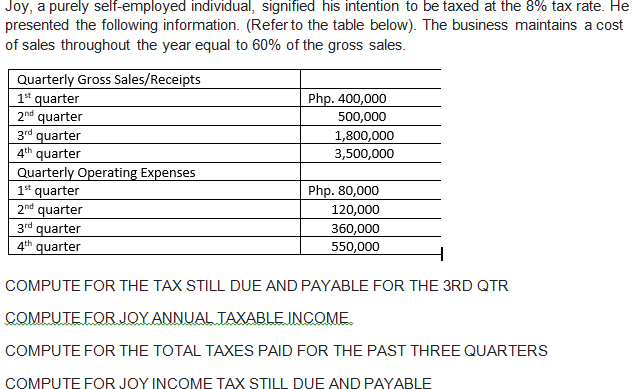

Joy, a purely self-employed individual, signified his intention to be taxed at the 8% tax rate. He presented the following information. (Refer to the table below). The business maintains a cost of sales throughout the year equal to 60% of the gross sales. Quarterly Gross Sales/Receipts 1st quarter 2nd quarter 3rd quarter 4th quarter Quarterly Operating Expenses 1st quarter 2nd quarter 3rd quarter 4th quarter Php. 400,000 500,000 1,800,000 3,500,000 Php. 80,000 120,000 360,000 550,000 COMPUTE FOR THE TAX STILL DUE AND PAYABLE FOR THE 3RD QTR COMPUTE FOR JOY ANNUAL TAXABLE INCOME. COMPUTE FOR THE TOTAL TAXES PAID FOR THE PAST THREE QUARTERS COMPUTE FOR JOY INCOME TAX STILL DUE AND PAYABLE

Joy, a purely self-employed individual, signified his intention to be taxed at the 8% tax rate. He presented the following information. (Refer to the table below). The business maintains a cost of sales throughout the year equal to 60% of the gross sales. Quarterly Gross Sales/Receipts 1st quarter 2nd quarter 3rd quarter 4th quarter Quarterly Operating Expenses 1st quarter 2nd quarter 3rd quarter 4th quarter Php. 400,000 500,000 1,800,000 3,500,000 Php. 80,000 120,000 360,000 550,000 COMPUTE FOR THE TAX STILL DUE AND PAYABLE FOR THE 3RD QTR COMPUTE FOR JOY ANNUAL TAXABLE INCOME. COMPUTE FOR THE TOTAL TAXES PAID FOR THE PAST THREE QUARTERS COMPUTE FOR JOY INCOME TAX STILL DUE AND PAYABLE

Chapter14: Taxes On The Financial Statements

Section: Chapter Questions

Problem 25P

Related questions

Question

Transcribed Image Text:Joy, a purely self-employed individual, signified his intention to be taxed at the 8% tax rate. He

presented the following information. (Refer to the table below). The business maintains a cost

of sales throughout the year equal to 60% of the gross sales.

Quarterly Gross Sales/Receipts

1t quarter

2nd quarter

3rd quarter

4th quarter

Quarterly Operating Expenses

1* quarter

2nd quarter

3rd quarter

4th quarter

Php. 400,000

500,000

1,800,000

3,500,000

Php. 80,000

120,000

360,000

550,000

COMPUTE FOR THE TAX STILL DUE AND PAYABLE FOR THE 3RD QTR

COMPUTE FOR JOY ANNUAL TAXABLE INCOME.

COMPUTE FOR THE TOTAL TAXES PAID FOR THE PAST THREE QUARTERS

COMPUTE FOR JOY INCOME TAX STILL DUE AND PAYABLE

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning