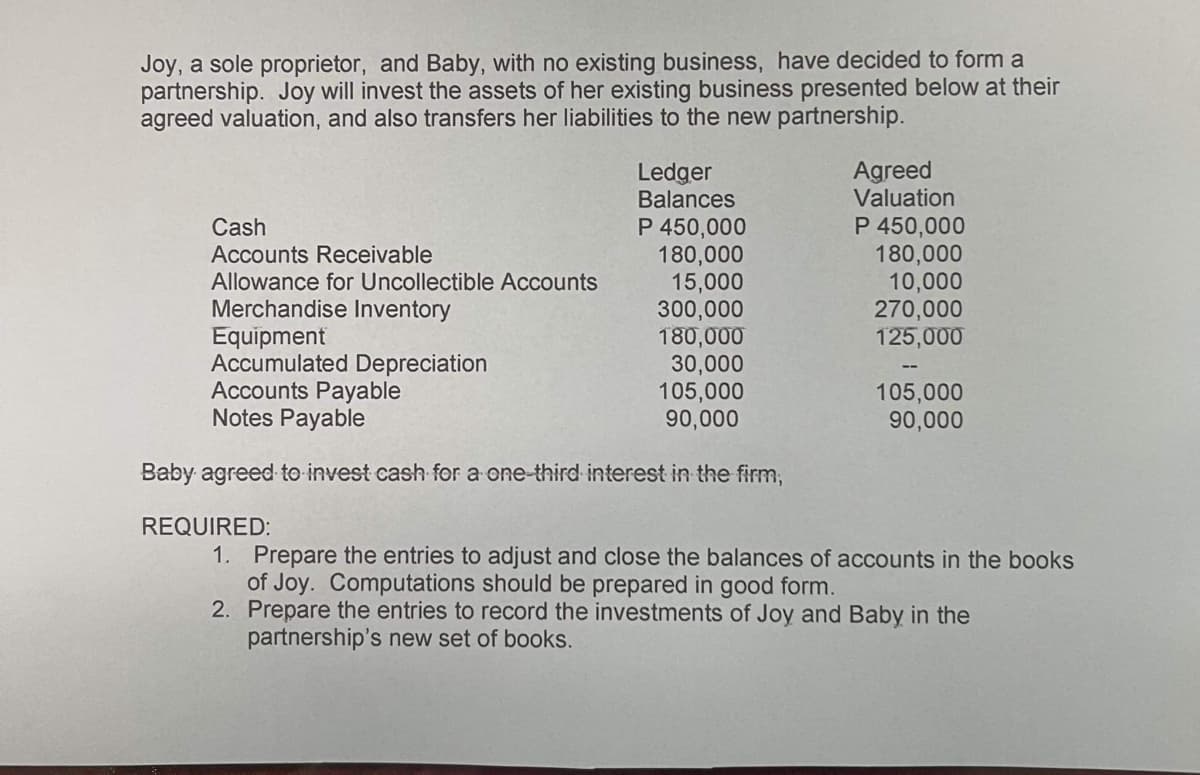

Joy, a sole proprietor, and Baby, with no existing business, have decided to form a partnership. Joy will invest the assets of her existing business presented below at their agreed valuation, and also transfers her liabilities to the new partnership. Ledger Balances Agreed Valuation P 450,000 180,000 15,000 300,000 180,000 30,000 105,000 90,000 P 450,000 180,000 10,000 270,000 125,000 Cash Accounts Receivable Allowance for Uncollectible Accounts Merchandise Inventory Equipment Accumulated Depreciation Accounts Payable Notes Payable 105,000 90,000 Baby agreed to invest cash for a one-third interest in the firm, REQUIRED: 1. Prepare the entries to adjust and close the balances of accounts in the books of Joy. Computations should be prepared in good form. 2. Prepare the entries to record the investments of Joy and Baby in the partnership's new set of books.

Joy, a sole proprietor, and Baby, with no existing business, have decided to form a partnership. Joy will invest the assets of her existing business presented below at their agreed valuation, and also transfers her liabilities to the new partnership. Ledger Balances Agreed Valuation P 450,000 180,000 15,000 300,000 180,000 30,000 105,000 90,000 P 450,000 180,000 10,000 270,000 125,000 Cash Accounts Receivable Allowance for Uncollectible Accounts Merchandise Inventory Equipment Accumulated Depreciation Accounts Payable Notes Payable 105,000 90,000 Baby agreed to invest cash for a one-third interest in the firm, REQUIRED: 1. Prepare the entries to adjust and close the balances of accounts in the books of Joy. Computations should be prepared in good form. 2. Prepare the entries to record the investments of Joy and Baby in the partnership's new set of books.

Chapter13: Comparative Forms Of Doing Business

Section: Chapter Questions

Problem 54P

Related questions

Question

Transcribed Image Text:Joy, a sole proprietor, and Baby, with no existing business, have decided to form a

partnership. Joy will invest the assets of her existing business presented below at their

agreed valuation, and also transfers her liabilities to the new partnership.

Ledger

Balances

Agreed

Valuation

P 450,000

180,000

15,000

300,000

180,000

30,000

105,000

90,000

P 450,000

180,000

10,000

270,000

125,000

Cash

Accounts Receivable

Allowance for Uncollectible Accounts

Merchandise Inventory

Equipment

Accumulated Depreciation

Accounts Payable

Notes Payable

105,000

90,000

Baby agreed to invest cash for a one-third interest in the firm,

REQUIRED:

1. Prepare the entries to adjust and close the balances of accounts in the books

of Joy. Computations should be prepared in good form.

2. Prepare the entries to record the investments of Joy and Baby in the

partnership's new set of books.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT