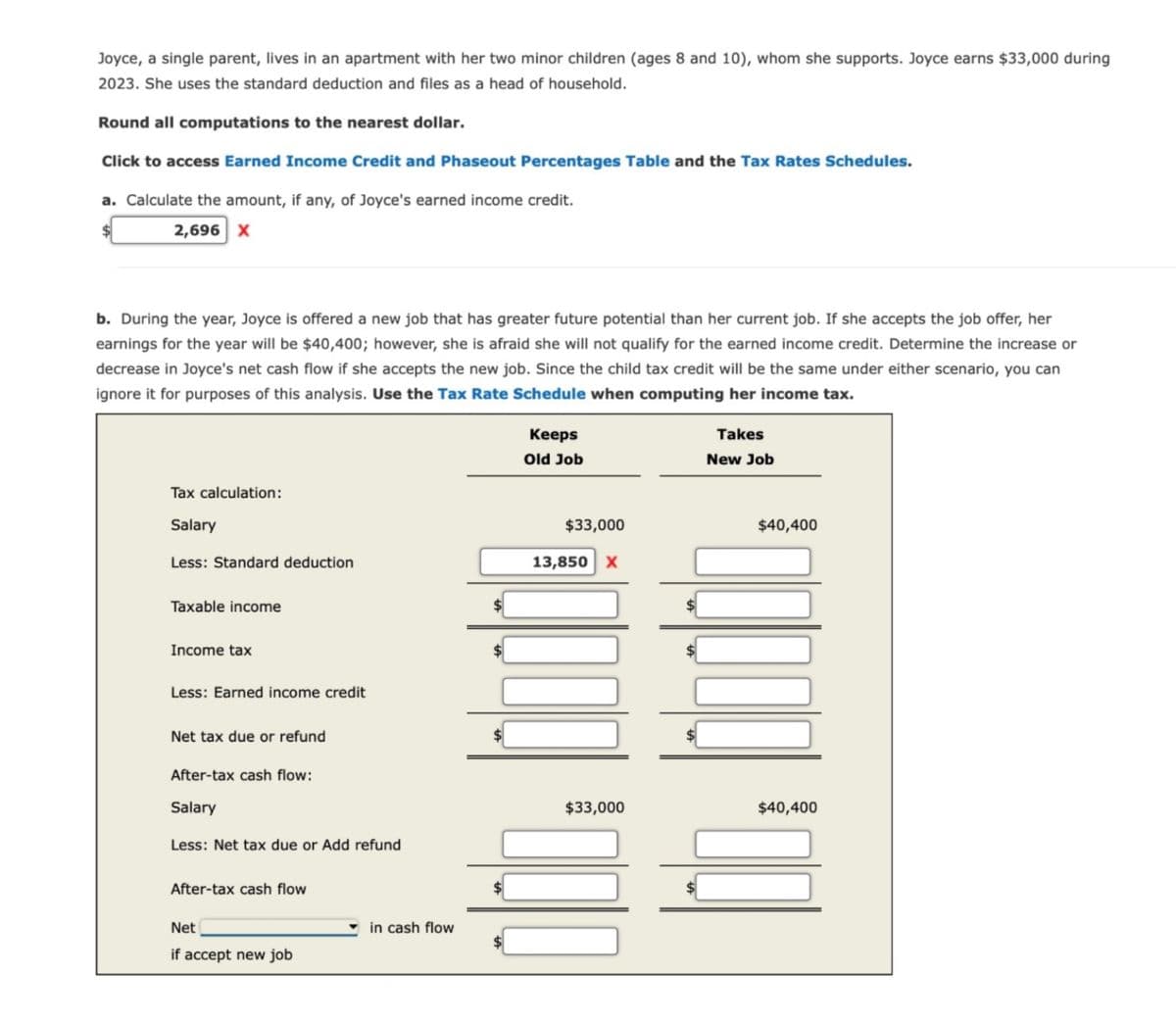

Joyce, a single parent, lives in an apartment with her two minor children (ages 8 and 10), whom she supports. Joyce earns $33,000 during 2023. She uses the standard deduction and files as a head of household. Round all computations to the nearest dollar. Click to access Earned Income Credit and Phaseout Percentages Table and the Tax Rates Schedules. a. Calculate the amount, if any, of Joyce's earned income credit. 2,696 X b. During the year, Joyce is offered a new job that has greater future potential than her current job. If she accepts the job offer, her earnings for the year will be $40,400; however, she is afraid she will not qualify for the earned income credit. Determine the increase or decrease in Joyce's net cash flow if she accepts the new job. Since the child tax credit will be the same under either scenario, you can ignore it for purposes of this analysis. Use the Tax Rate Schedule when computing her income tax. Tax calculation: Salary Less: Standard deduction Taxable income Income tax Less: Earned income credit Net tax due or refund After-tax cash flow: Salary Less: Net tax due or Add refund After-tax cash flow Net in cash flow if accept new job ta Keeps Old Job $33,000 13,850 X Takes New Job $40,400 $33,000 $40,400

Joyce, a single parent, lives in an apartment with her two minor children (ages 8 and 10), whom she supports. Joyce earns $33,000 during 2023. She uses the standard deduction and files as a head of household. Round all computations to the nearest dollar. Click to access Earned Income Credit and Phaseout Percentages Table and the Tax Rates Schedules. a. Calculate the amount, if any, of Joyce's earned income credit. 2,696 X b. During the year, Joyce is offered a new job that has greater future potential than her current job. If she accepts the job offer, her earnings for the year will be $40,400; however, she is afraid she will not qualify for the earned income credit. Determine the increase or decrease in Joyce's net cash flow if she accepts the new job. Since the child tax credit will be the same under either scenario, you can ignore it for purposes of this analysis. Use the Tax Rate Schedule when computing her income tax. Tax calculation: Salary Less: Standard deduction Taxable income Income tax Less: Earned income credit Net tax due or refund After-tax cash flow: Salary Less: Net tax due or Add refund After-tax cash flow Net in cash flow if accept new job ta Keeps Old Job $33,000 13,850 X Takes New Job $40,400 $33,000 $40,400

Chapter12: Tax Credits And Payments

Section: Chapter Questions

Problem 28P

Related questions

Question

Transcribed Image Text:Joyce, a single parent, lives in an apartment with her two minor children (ages 8 and 10), whom she supports. Joyce earns $33,000 during

2023. She uses the standard deduction and files as a head of household.

Round all computations to the nearest dollar.

Click to access Earned Income Credit and Phaseout Percentages Table and the Tax Rates Schedules.

a. Calculate the amount, if any, of Joyce's earned income credit.

2,696 X

b. During the year, Joyce is offered a new job that has greater future potential than her current job. If she accepts the job offer, her

earnings for the year will be $40,400; however, she is afraid she will not qualify for the earned income credit. Determine the increase or

decrease in Joyce's net cash flow if she accepts the new job. Since the child tax credit will be the same under either scenario, you can

ignore it for purposes of this analysis. Use the Tax Rate Schedule when computing her income tax.

Tax calculation:

Salary

Less: Standard deduction

Taxable income

Income tax

Less: Earned income credit

Net tax due or refund

After-tax cash flow:

Salary

Less: Net tax due or Add refund

After-tax cash flow

Net

in cash flow

if accept new job

ta

Keeps

Old Job

$33,000

13,850 X

Takes

New Job

$40,400

$33,000

$40,400

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you