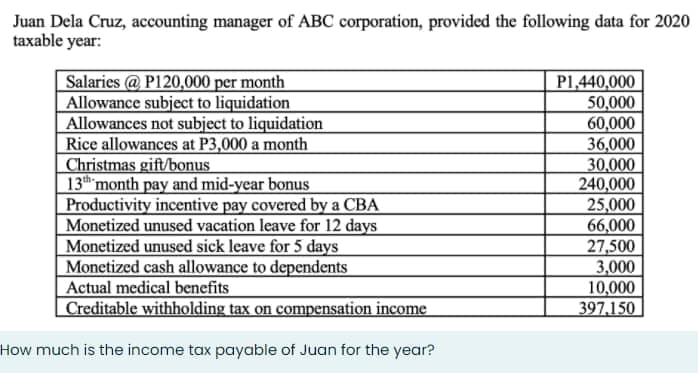

Juan Dela Cruz, accounting manager of ABC corporation, provided the following data for 2020 taxable year: Salaries @ P120,000 per month Allowance subject to liquidation Allowances not subject to liquidation Rice allowances at P3,000 a month Christmas gift/bonus 13th month pay and mid-year bonus Productivity incentive pay covered by a CBA Monetized unused vacation leave for 12 days Monetized unused sick leave for 5 days Monetized cash allowance to dependents Actual medical benefits Creditable withholding tax on compensation income P1,440,000 50,000 60,000 36,000 30,000 240,000 25,000 66,000 27,500 3,000 10,000 397,150 How much is the inconme tay p gvable of Jugn for the vear?

Juan Dela Cruz, accounting manager of ABC corporation, provided the following data for 2020 taxable year: Salaries @ P120,000 per month Allowance subject to liquidation Allowances not subject to liquidation Rice allowances at P3,000 a month Christmas gift/bonus 13th month pay and mid-year bonus Productivity incentive pay covered by a CBA Monetized unused vacation leave for 12 days Monetized unused sick leave for 5 days Monetized cash allowance to dependents Actual medical benefits Creditable withholding tax on compensation income P1,440,000 50,000 60,000 36,000 30,000 240,000 25,000 66,000 27,500 3,000 10,000 397,150 How much is the inconme tay p gvable of Jugn for the vear?

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter9: Working Capital

Section: Chapter Questions

Problem 9Q

Related questions

Question

Transcribed Image Text:Juan Dela Cruz, accounting manager of ABC corporation, provided the following data for 2020

taxable year:

Salaries @ P120,000 per month

Allowance subject to liquidation

Allowances not subject to liquidation

Rice allowances at P3,000 a month_

Christmas gift/bonus

13th month pay and mid-year bonus

Productivity incentive pay covered by a CBA

Monetized unused vacation leave for 12 days

Monetized unused sick leave for 5 days

Monetized cash allowance to dependents

Actual medical benefits

Creditable withholding tax on compensation income

P1,440,000

50,000

60,000

36,000

30,000

240,000

25,000

66,000

27,500

3,000

10,000

397,150

How much is the income tax payable of Juan for the year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning