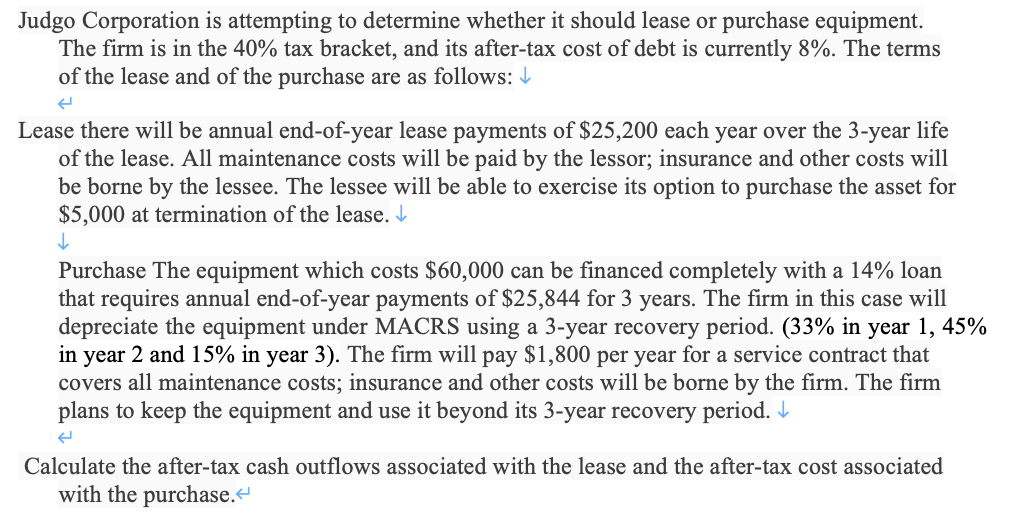

Judgo Corporation is attempting to determine whether it should lease or purchase equipment. The firm is in the 40% tax bracket, and its after-tax cost of debt is currently 8%. The terms of the lease and of the purchase are as follows: Lease there will be annual end-of-year lease payments of $25,200 each year over the 3-year life of the lease. All maintenance costs will be paid by the lessor; insurance and other costs will be borne by the lessee. The lessee will be able to exercise its option to purchase the asset for $5,000 at termination of the lease. I Purchase The equipment which costs $60,000 can be financed completely with a 14% loan that requires annual end-of-year payments of $25,844 for 3 years. The firm in this case will depreciate the equipment under MACRS using a 3-year recovery period. (33% in year 1, 45% in year 2 and 15% in year 3). The firm will pay $1,800 per year for a service contract that covers all maintenance costs; insurance and other costs will be borne by the firm. The firm plans to keep the equipment and use it beyond its 3-year recovery period. 4 Calculate the after-tax cash outflows associated with the lease and the after-tax cost associated with the purchase.

Judgo Corporation is attempting to determine whether it should lease or purchase equipment. The firm is in the 40% tax bracket, and its after-tax cost of debt is currently 8%. The terms of the lease and of the purchase are as follows: Lease there will be annual end-of-year lease payments of $25,200 each year over the 3-year life of the lease. All maintenance costs will be paid by the lessor; insurance and other costs will be borne by the lessee. The lessee will be able to exercise its option to purchase the asset for $5,000 at termination of the lease. I Purchase The equipment which costs $60,000 can be financed completely with a 14% loan that requires annual end-of-year payments of $25,844 for 3 years. The firm in this case will depreciate the equipment under MACRS using a 3-year recovery period. (33% in year 1, 45% in year 2 and 15% in year 3). The firm will pay $1,800 per year for a service contract that covers all maintenance costs; insurance and other costs will be borne by the firm. The firm plans to keep the equipment and use it beyond its 3-year recovery period. 4 Calculate the after-tax cash outflows associated with the lease and the after-tax cost associated with the purchase.

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter19: Lease Financing

Section: Chapter Questions

Problem 7MC: (1) Assume that the lease payments were actually 280,000 per year, that Consolidated Leasing is also...

Related questions

Question

Transcribed Image Text:Judgo Corporation is attempting to determine whether it should lease or purchase equipment.

The firm is in the 40% tax bracket, and its after-tax cost of debt is currently 8%. The terms

of the lease and of the purchase are as follows: I

Lease there will be annual end-of-year lease payments of $25,200 each year over the 3-year life

of the lease. All maintenance costs will be paid by the lessor; insurance and other costs will

be borne by the lessee. The lessee will be able to exercise its option to purchase the asset for

$5,000 at termination of the lease. I

Purchase The equipment which costs $60,000 can be financed completely with a 14% loan

that requires annual end-of-year payments of $25,844 for 3 years. The firm in this case will

depreciate the equipment under MACRS using a 3-year recovery period. (33% in year 1, 45%

in year 2 and 15% in year 3). The firm will pay $1,800 per year for a service contract that

covers all maintenance costs; insurance and other costs will be borne by the firm. The firm

plans to keep the equipment and use it beyond its 3-year recovery period. I

Calculate the after-tax cash outflows associated with the lease and the after-tax cost associated

with the purchase.“

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage