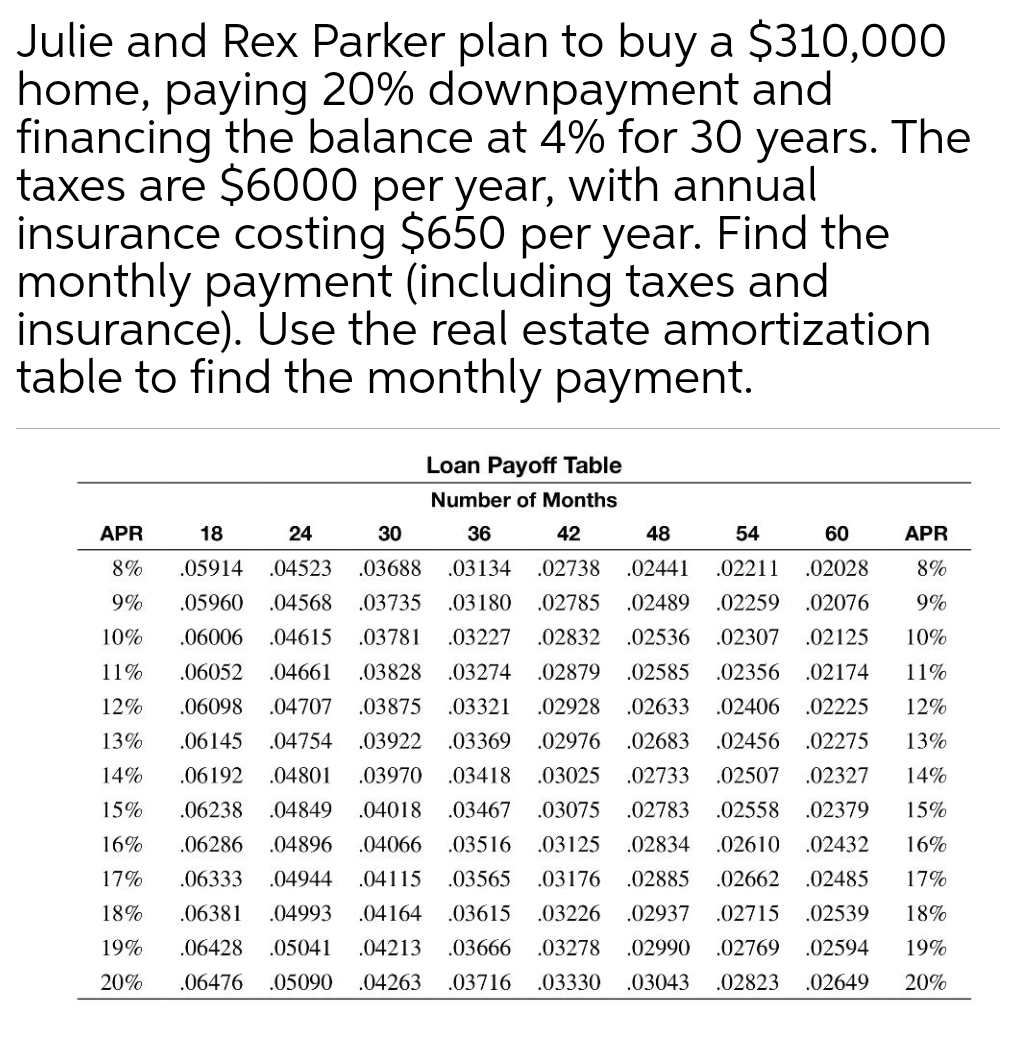

Julie and Rex Parker plan to buy a $310,000 home, paying 20% downpayment and financing the balance at 4% for 30 years. The taxes are $6000 per year, with annual insurance costing $650 per year. Find the monthly payment (including taxes and insurance). Use the real estate amortization table to find the monthly payment. Loan Payoff Table Number of Months APR 18 24 30 36 42 48 54 60 APR 8% .05914 .04523 .03688 .03134 .02738 .02441 .02211 .02028 8% 9% .05960 .04568 .03735 .03180 .02785 .02489 .02259 .02076 9% 10% .06006 .04615 .03781 .03227 .02832 .02536 .02307 .02125 10% 11% .06052 .04661 .03828 .03274 .02879 .02585 .02356 .02174 11% 12% .06098 .04707 .03875 .03321 .02928 .02633 .02406 .02225 12% 13% .06145 .04754 .03922 .03369 .02976 .02683 .02456 .02275 13% 14% .06192 .04801 .03970 .03418 .03025 .02733 .02507 .02327 14% 15% .06238 .04849 .04018 .03467 .03075 .02783 .02558 .02379 15% 16% .06286 .04896 .04066 .03516 .03125 .02834 .02610 .02432 16% 17% .06333 .04944 .04115 .03565 .03176 .02885 .02662 .02485 17% 18% .06381 .04993 .04164 .03615 .03226 .02937 .02715 .02539 18% 19% .06428 .05041 .04213 .03666 .03278 .02990 .02769 .02594 19% 20% .06476 .05090 .04263 .03716 .03330 .03043 .02823 .02649 20%

Julie and Rex Parker plan to buy a $310,000 home, paying 20% downpayment and financing the balance at 4% for 30 years. The taxes are $6000 per year, with annual insurance costing $650 per year. Find the monthly payment (including taxes and insurance). Use the real estate amortization table to find the monthly payment. Loan Payoff Table Number of Months APR 18 24 30 36 42 48 54 60 APR 8% .05914 .04523 .03688 .03134 .02738 .02441 .02211 .02028 8% 9% .05960 .04568 .03735 .03180 .02785 .02489 .02259 .02076 9% 10% .06006 .04615 .03781 .03227 .02832 .02536 .02307 .02125 10% 11% .06052 .04661 .03828 .03274 .02879 .02585 .02356 .02174 11% 12% .06098 .04707 .03875 .03321 .02928 .02633 .02406 .02225 12% 13% .06145 .04754 .03922 .03369 .02976 .02683 .02456 .02275 13% 14% .06192 .04801 .03970 .03418 .03025 .02733 .02507 .02327 14% 15% .06238 .04849 .04018 .03467 .03075 .02783 .02558 .02379 15% 16% .06286 .04896 .04066 .03516 .03125 .02834 .02610 .02432 16% 17% .06333 .04944 .04115 .03565 .03176 .02885 .02662 .02485 17% 18% .06381 .04993 .04164 .03615 .03226 .02937 .02715 .02539 18% 19% .06428 .05041 .04213 .03666 .03278 .02990 .02769 .02594 19% 20% .06476 .05090 .04263 .03716 .03330 .03043 .02823 .02649 20%

Chapter5: The Time Value Of Money

Section: Chapter Questions

Problem 41P

Related questions

Question

Transcribed Image Text:Julie and Rex Parker plan to buy a $310,000

home, paying 20% downpayment and

financing the balance at 4% for 30 years. The

taxes are $6000 per year, with annual

insurance costing $650 per year. Find the

monthly payment (including taxes and

insurance). Use the real estate amortization

table to find the monthly payment.

Loan Payoff Table

Number of Months

APR

18

24

30

36

42

48

54

60

APR

8%

.05914

.04523

.03688

.03134

.02738

.02441

.02211

.02028

8%

9%

.05960

.04568

.03735

.03180

.02785

.02489

.02259

.02076

9%

10%

.06006

.04615

.03781

.03227

.02832

.02536

.02307

.02125

10%

11%

.06052

.04661

.03828

.03274

.02879

.02585

.02356

.02174

11%

12%

.06098

.04707

.03875

.03321

.02928

.02633

.02406 .02225

12%

13%

.06145

.04754

.03922

.03369

.02976

.02683

.02456

.02275

13%

14%

.06192

.04801

.03970

.03418

.03025

.02733

.02507

.02327

14%

15%

.06238

.04849

.04018

.03467

.03075

.02783

.02558

.02379

15%

16%

.06286

.04896

.04066

.03516

.03125

.02834

.02610

.02432

16%

17%

.06333

.04944

.04115

.03565

.03176

.02885

.02662

.02485

17%

18%

.06381

.04993

.04164

.03615

.03226

.02937

.02715

.02539

18%

19%

.06428

.05041

.04213

.03666

.03278

.02990

.02769

.02594

19%

20%

.06476

.05090

.04263

.03716

.03330

.03043

.02823

.02649

20%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning