Just yesterday, you expected that XYZ Inc. will generate a nice 8% annual return (measured as the total return on shares traded on the stock exchange) to its shareholders forever. However, today you woke up to the news that XYZ made an important cost-reducing discovery that gives it a competitive advantage over its competitors and doubles its annual profits and dividends for the next 5 years. Unfortunately, after five years, XYZ's competitors will catch up, and XYZ's profit will return to its normal level (the one it would have had without this discovery). Nothing else has changed. What can you say about the expected annual return R that XYZ will generate to its shareholders 3 years from now (i.e., between year 3 and 4). A) R>16% B) R=16% C) R=14.4% D) R=9.6% E) 8%

Just yesterday, you expected that XYZ Inc. will generate a nice 8% annual return (measured as the total return on shares traded on the stock exchange) to its shareholders forever. However, today you woke up to the news that XYZ made an important cost-reducing discovery that gives it a competitive advantage over its competitors and doubles its annual profits and dividends for the next 5 years. Unfortunately, after five years, XYZ's competitors will catch up, and XYZ's profit will return to its normal level (the one it would have had without this discovery). Nothing else has changed. What can you say about the expected annual return R that XYZ will generate to its shareholders 3 years from now (i.e., between year 3 and 4). A) R>16% B) R=16% C) R=14.4% D) R=9.6% E) 8%

Chapter7: Common Stock: Characteristics, Valuation, And Issuance

Section: Chapter Questions

Problem 25P

Related questions

Question

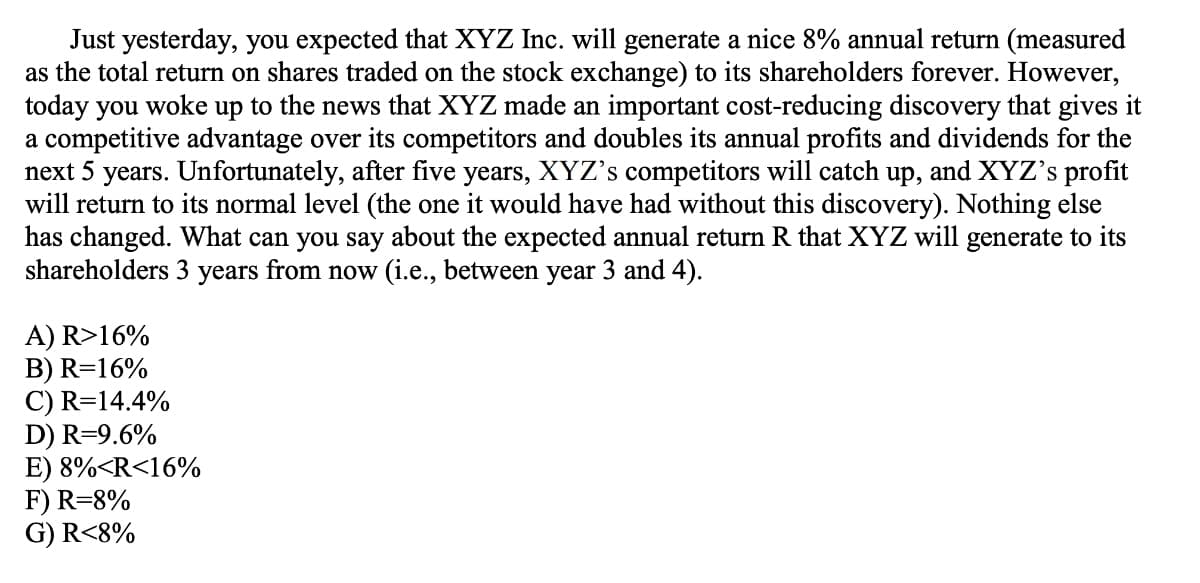

Transcribed Image Text:Just yesterday, you expected that XYZ Inc. will generate a nice 8% annual return (measured

as the total return on shares traded on the stock exchange) to its shareholders forever. However,

today you woke up to the news that XYZ made an important cost-reducing discovery that gives it

a competitive advantage over its competitors and doubles its annual profits and dividends for the

next 5 years. Unfortunately, after five years, XYZ's competitors will catch up, and XYZ's profit

will return to its normal level (the one it would have had without this discovery). Nothing else

has changed. What can you say about the expected annual return R that XYZ will generate to its

shareholders 3 years from now (i.e., between year 3 and 4).

A) R>16%

B) R=16%

C) R=14.4%

D) R=9.6%

E) 8%<R<16%

F) R=8%

G) R<8%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning