Justin's einployer uses the percentage method to calculate his federal withholding. Justin earns $50,960 annually, and takes 3 exemptions. What is his weekly taxable income? PERCENTAGE METHOD FOR FIT WITHHOLDING SINGLE PERSON WEEKLY PAYROLL PERIOD Allowance Rate = $63.46 Weekly Taxable Wage The amount of FIT withholding is -- Over But not over... $1 $0.00 0.10(gross pay - $51) $14.40 0.15(gross pay - 195) $81.90 0.20(gross pay $645) $195 195 645 645 1,482 +]

Justin's einployer uses the percentage method to calculate his federal withholding. Justin earns $50,960 annually, and takes 3 exemptions. What is his weekly taxable income? PERCENTAGE METHOD FOR FIT WITHHOLDING SINGLE PERSON WEEKLY PAYROLL PERIOD Allowance Rate = $63.46 Weekly Taxable Wage The amount of FIT withholding is -- Over But not over... $1 $0.00 0.10(gross pay - $51) $14.40 0.15(gross pay - 195) $81.90 0.20(gross pay $645) $195 195 645 645 1,482 +]

Chapter1: Equations, Inequalities, And Mathematical Modeling

Section1.3: Modeling With Linear Equations

Problem 3ECP: Your family has annual loan payments equal to 28 of its annual income. During theyear, the loan...

Related questions

Question

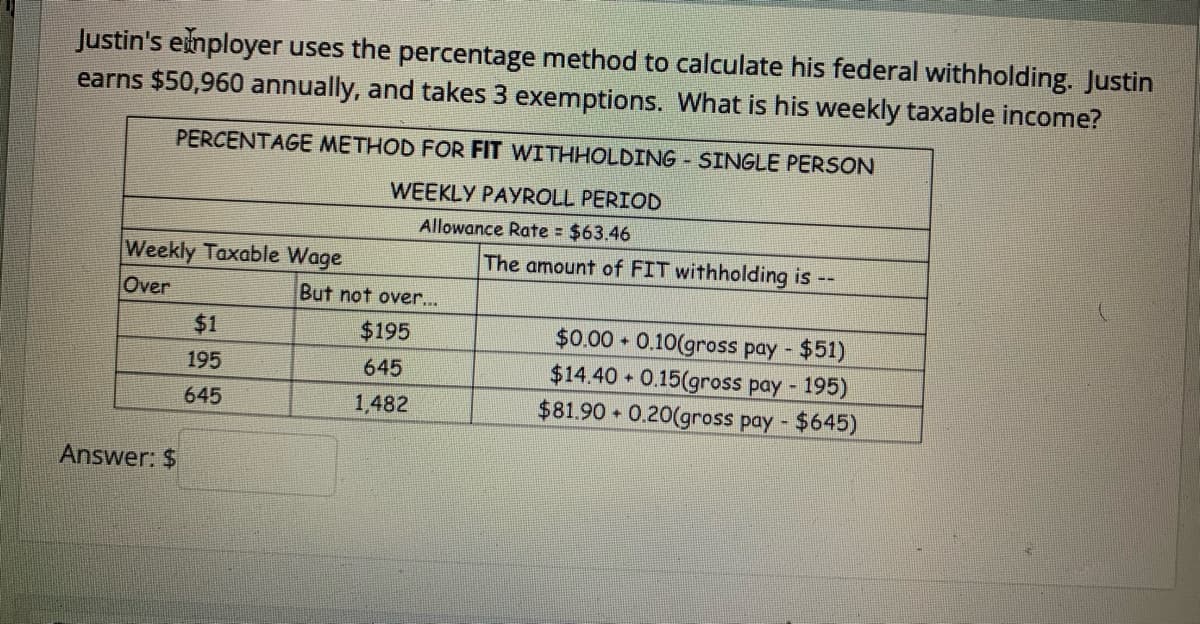

Transcribed Image Text:Justin's eimployer uses the percentage method to calculate his federal withholding. Justin

earns $50,960 annually, and takes 3 exemptions. What is his weekly taxable income?

PERCENTAGE METHOD FOR FIT WITHHOLDING SINGLE PERSON

WEEKLY PAYROLL PERIOD

Allowance Rate = $63.46

Weekly Taxable Wage

The amount of FIT withholding is

Over

But not over...

$0.00 0.10(gross pay - $51)

$14.40 0.15(gross pay - 195)

$81.90 0.20(gross pay - $645)

$1

$195

195

645

645

1,482

Answer: $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you