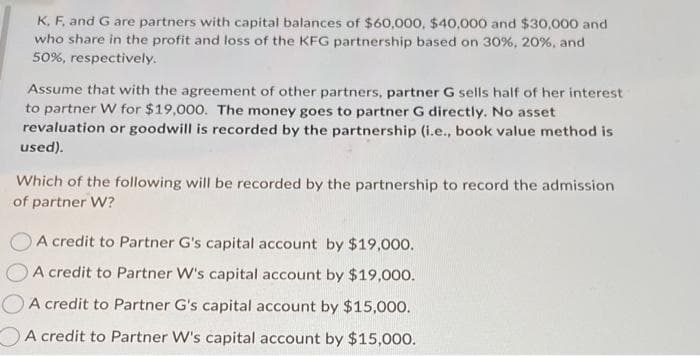

K, F, and G are partners with capital balances of $60,000, $40,000 and $30,000 and who share in the profit and loss of the KFG partnership based on 30 %, 20%, and 50%, respectively. Assume that with the agreement of other partners, partner G sells half of her interest o partner W for $19,000. The money goes to partner G directly. No asset evaluation or goodwill is recorded by the partnership (i.e., book value method is sed). hich of the following will be recorded by the partnership to record the admission partner W? A credit to Partner G's capital account by $19,000. A credit to Partner W's capital account by $19,000. A credit to Partner G's capital account by $15,000.

K, F, and G are partners with capital balances of $60,000, $40,000 and $30,000 and who share in the profit and loss of the KFG partnership based on 30 %, 20%, and 50%, respectively. Assume that with the agreement of other partners, partner G sells half of her interest o partner W for $19,000. The money goes to partner G directly. No asset evaluation or goodwill is recorded by the partnership (i.e., book value method is sed). hich of the following will be recorded by the partnership to record the admission partner W? A credit to Partner G's capital account by $19,000. A credit to Partner W's capital account by $19,000. A credit to Partner G's capital account by $15,000.

Chapter11: Partnerships: Distributions, Transfer Of Interests, And Terminations

Section: Chapter Questions

Problem 42P

Related questions

Question

Transcribed Image Text:K, F, and G are partners with capital balances of $60,000, $40,000 and $30,000 and

who share in the profit and loss of the KFG partnership based on 30%, 20%, and

50%, respectively.

Assume that with the agreement of other partners, partner G sells half of her interest

to partner W for $19,000. The money goes to partner G directly. No asset

revaluation or goodwill is recorded by the partnership (i.e., book value method is

used).

Which of the following will be recorded by the partnership to record the admission

of partner W?

A credit to Partner G's capital account by $19,000.

A credit to Partner W's capital account by $19,000.

A credit to Partner G's capital account by $15,000.

A credit to Partner W's capital account by $15,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you