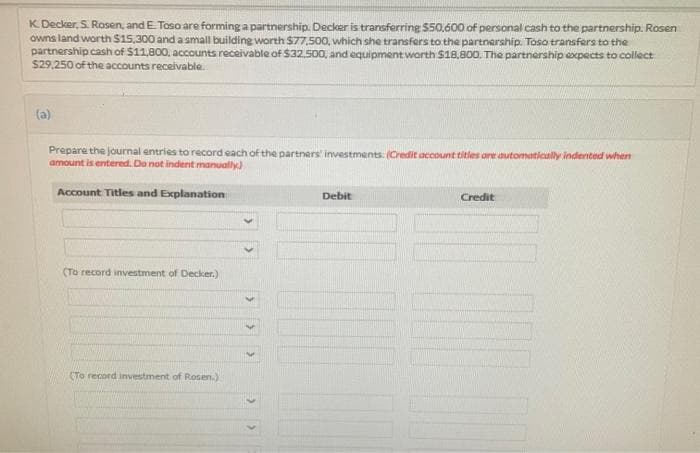

K. Decker, S. Rosen, and E. Toso are forming a partnership. Decker is transferring $50.600 of personal cash to the partnership. Rosen owns land worth $15,300 and a small building worth $77,500, which she transfers to the partnership. Toso transfers to the partnership cash of $11,800, accounts receivable of $32,500, and equipment worth $18,800. The partnership expects to collect $29,250 of the accounts receivable. (a) Prepare the journal entries to record each of the partners investments. (Credit account titles are automatically indented when amount is entered. Do not indent manually)

K. Decker, S. Rosen, and E. Toso are forming a partnership. Decker is transferring $50.600 of personal cash to the partnership. Rosen owns land worth $15,300 and a small building worth $77,500, which she transfers to the partnership. Toso transfers to the partnership cash of $11,800, accounts receivable of $32,500, and equipment worth $18,800. The partnership expects to collect $29,250 of the accounts receivable. (a) Prepare the journal entries to record each of the partners investments. (Credit account titles are automatically indented when amount is entered. Do not indent manually)

Chapter21: Partnerships

Section: Chapter Questions

Problem 2BCRQ

Related questions

Question

Transcribed Image Text:K. Decker, S. Rosen, and E. Toso are forming a partnership. Decker is transferring $50.600 of personal cash to the partnership. Rosen

owns land worth $15,300 and a small building worth $77,500, which she transfers to the partnership. Toso transfers to the

partnership cash of $11,800, accounts receivable of $32.500, and equipment worth $18,800. The partnership expects to collect

$29,250 of the accounts receivable..

(a)

Prepare the journal entries to record each of the partners' investments. (Credit account titles are automatically indented when

amount is entered. Do not indent manually)

Account Titles and Explanation

(To record investment of Decker.)

(To record investment of Rosen.)

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you