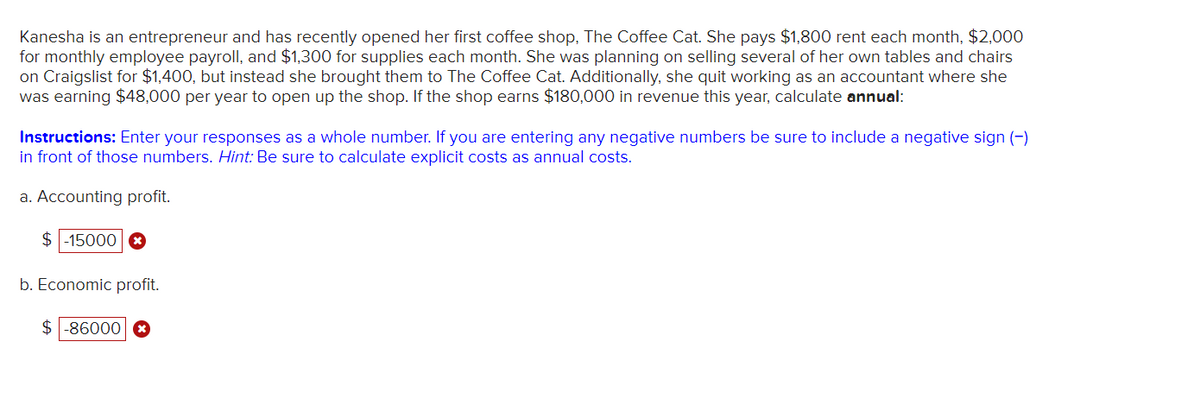

Kanesha is an entrepreneur and has recently opened her first coffee shop, The Coffee Cat. She pays $1,800 rent each month, $2,000 for monthly employee payroll, and $1,300 for supplies each month. She was planning on selling several of her own tables and chairs on Craigslist for $1,400, but instead she brought them to The Coffee Cat. Additionally, she quit working as an accountant where she was earning $48,000 per year to open up the shop. If the shop earns $180,000 in revenue this year, calculate annual: Instructions: Enter your responses as a whole number. If you are entering any negative numbers be sure to include a negative sign (-) in front of those numbers. Hint: Be sure to calculate explicit costs as annual costs. a. Accounting profit. $-15000 b. Economic profit. $-86000 x

Kanesha is an entrepreneur and has recently opened her first coffee shop, The Coffee Cat. She pays $1,800 rent each month, $2,000 for monthly employee payroll, and $1,300 for supplies each month. She was planning on selling several of her own tables and chairs on Craigslist for $1,400, but instead she brought them to The Coffee Cat. Additionally, she quit working as an accountant where she was earning $48,000 per year to open up the shop. If the shop earns $180,000 in revenue this year, calculate annual: Instructions: Enter your responses as a whole number. If you are entering any negative numbers be sure to include a negative sign (-) in front of those numbers. Hint: Be sure to calculate explicit costs as annual costs. a. Accounting profit. $-15000 b. Economic profit. $-86000 x

Chapter4: Gross Income: Concepts And Inclusions

Section: Chapter Questions

Problem 55P

Related questions

Question

Typed plz and Asap thanks

Transcribed Image Text:Kanesha is an entrepreneur and has recently opened her first coffee shop, The Coffee Cat. She pays $1,800 rent each month, $2,000

for monthly employee payroll, and $1,300 for supplies each month. She was planning on selling several of her own tables and chairs

on Craigslist for $1,400, but instead she brought them to The Coffee Cat. Additionally, she quit working as an accountant where she

was earning $48,000 per year to open up the shop. If the shop earns $180,000 in revenue this year, calculate annual:

Instructions: Enter your responses as a whole number. If you are entering any negative numbers be sure to include a negative sign (-)

in front of those numbers. Hint: Be sure to calculate explicit costs as annual costs.

a. Accounting profit.

$-15000

b. Economic profit.

$-86000 x

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 11 images

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT