Kara, Incorporated, imposes a payback cutoff of three years for its international investment projects. Year Cash Flow (A) 0 123 + 4 -$ 65,000 25,500 33,000 23,500 10,500 Project A Project B Cash Flow (B) -$ 75,000 17,500 20,500 31,000 235,000 What is the payback period for both projects? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) years years Which project should the company accept?

Kara, Incorporated, imposes a payback cutoff of three years for its international investment projects. Year Cash Flow (A) 0 123 + 4 -$ 65,000 25,500 33,000 23,500 10,500 Project A Project B Cash Flow (B) -$ 75,000 17,500 20,500 31,000 235,000 What is the payback period for both projects? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) years years Which project should the company accept?

Fundamentals of Financial Management (MindTap Course List)

14th Edition

ISBN:9781285867977

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter12: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 17P: EQUIVALENT ANNUAL ANNUITY A firm has two mutually exclusive investment projects to evaluate; both...

Related questions

Question

Transcribed Image Text:2

ts

02:59:19

eBook

Hint

Print

ferences

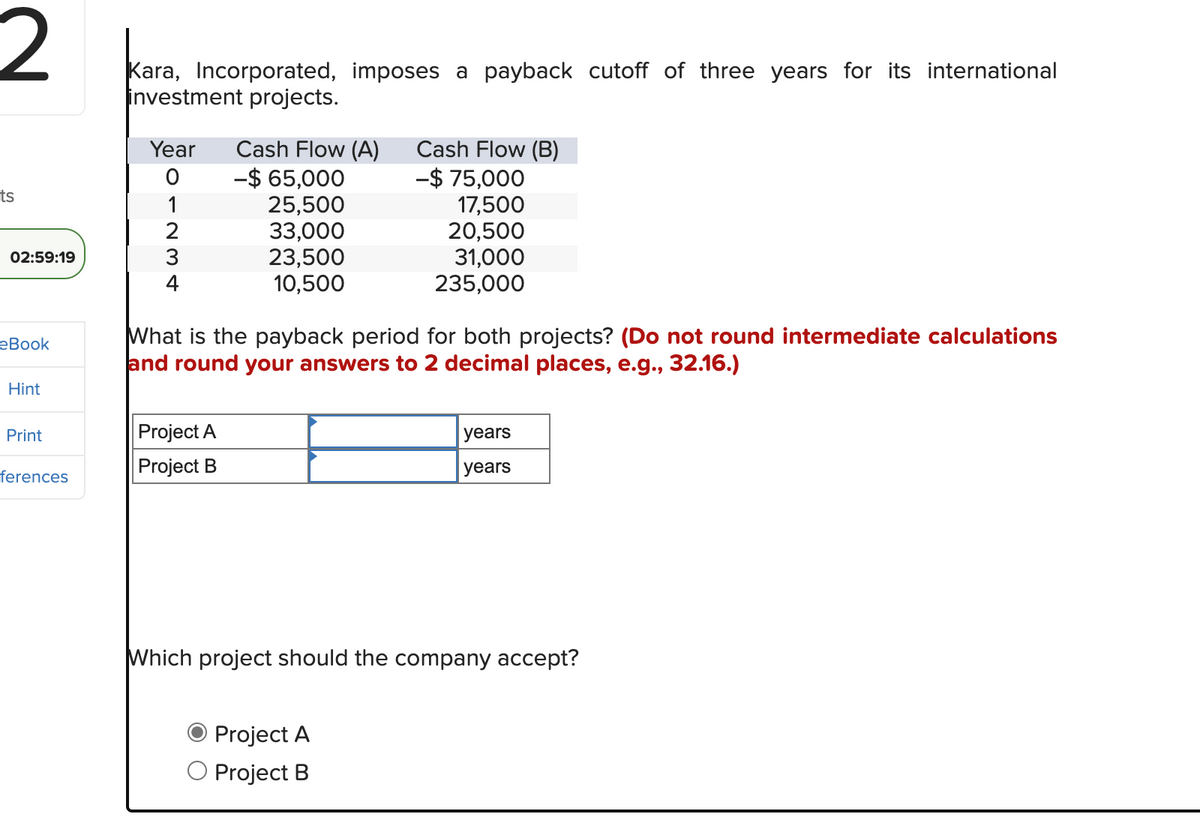

Kara, Incorporated, imposes a payback cutoff of three years for its international

investment projects.

Year

O

1

2

3

4

Cash Flow (A)

-$ 65,000

25,500

33,000

23,500

10,500

Project A

Project B

What is the payback period for both projects? (Do not round intermediate calculations

and round your answers to 2 decimal places, e.g., 32.16.)

Cash Flow (B)

-$ 75,000

17,500

20,500

31,000

235,000

Project A

O Project B

years

years

Which project should the company accept?

Transcribed Image Text:h. 9 Homework - Summer 2023 i

5

ints

02:56:05

eBook

Hint

Print

References

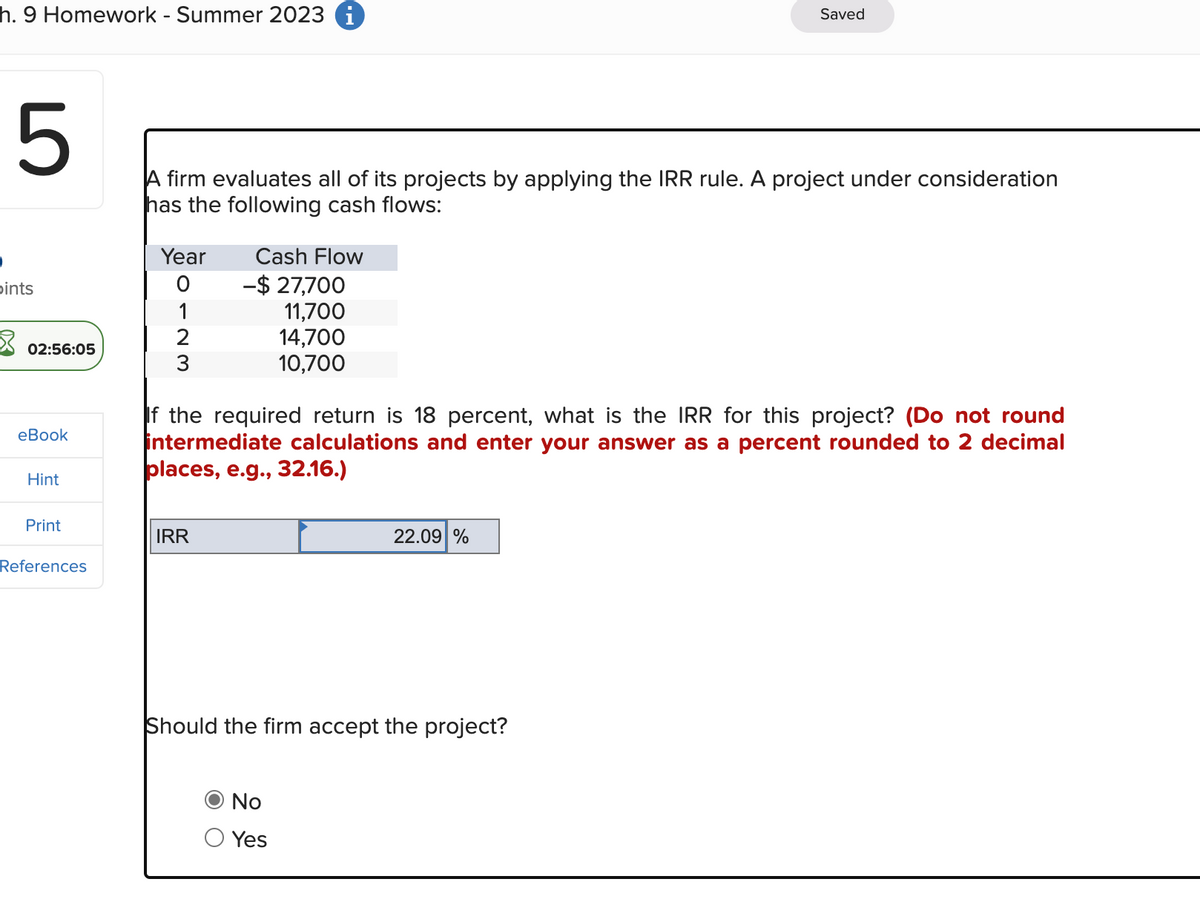

A firm evaluates all of its projects by applying the IRR rule. A project under consideration

has the following cash flows:

Year

O

1

2

3

Cash Flow

IRR

-$ 27,700

11,700

14,700

10,700

If the required return is 18 percent, what is the IRR for this project? (Do not round

intermediate calculations and enter your answer as a percent rounded to 2 decimal

places, e.g., 32.16.)

Saved

22.09 %

Should the firm accept the project?

No

Yes

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning