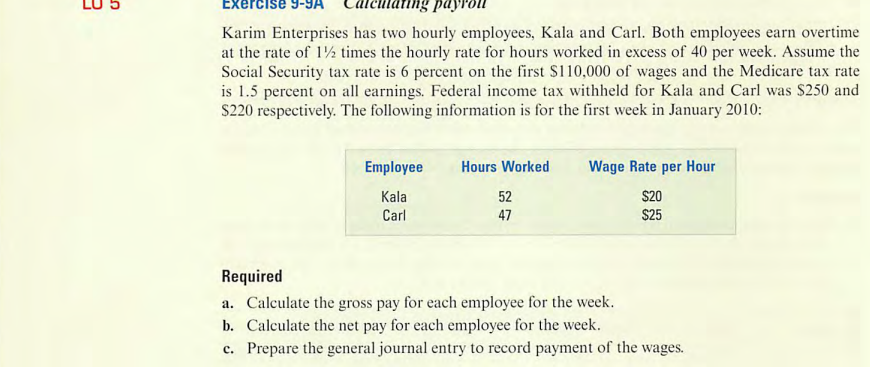

Karim Enterprises has two hourly employees, Kala and Carl. Both employees earn overtime at the rate of 1½ times the hourly rate for hours worked in excess of 40 per week. Assume the Social Security tax rate is 6 percent on the first $110,000 of wages and the Medicare tax rate is 1.5 percent on all earnings. Federal income tax withheld for Kala and Carl was $250 and $220 respectively. The following information is for the first week in January 2010: Employee Kala Carl Hours Worked 52 47 Wage Rate per Hour $20 $25 Required a. Calculate the gross pay for each employee for the week. b. Calculate the net pay for each employee for the week. c. Prepare the general journal entry to record payment of the wages.

Karim Enterprises has two hourly employees, Kala and Carl. Both employees earn overtime at the rate of 1½ times the hourly rate for hours worked in excess of 40 per week. Assume the Social Security tax rate is 6 percent on the first $110,000 of wages and the Medicare tax rate is 1.5 percent on all earnings. Federal income tax withheld for Kala and Carl was $250 and $220 respectively. The following information is for the first week in January 2010: Employee Kala Carl Hours Worked 52 47 Wage Rate per Hour $20 $25 Required a. Calculate the gross pay for each employee for the week. b. Calculate the net pay for each employee for the week. c. Prepare the general journal entry to record payment of the wages.

College Accounting (Book Only): A Career Approach

12th Edition

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cathy J. Scott

Chapter8: Employer Taxes, Payments, And Reports

Section: Chapter Questions

Problem 4E

Related questions

Question

Transcribed Image Text:3

S

Exercise 9-

Karim Enterprises has two hourly employees, Kala and Carl. Both employees earn overtime

at the rate of 1½ times the hourly rate for hours worked in excess of 40 per week. Assume the

Social Security tax rate is 6 percent on the first $110,000 of wages and the Medicare tax rate

is 1.5 percent on all earnings. Federal income tax withheld for Kala and Carl was $250 and

$220 respectively. The following information is for the first week in January 2010:

Employee

Kala

Carl

Hours Worked

52

47

Wage Rate per Hour

$20

$25

Required

a. Calculate the gross pay for each employee for the week.

b. Calculate the net pay for each employee for the week.

c. Prepare the general journal entry to record payment of the wages.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,