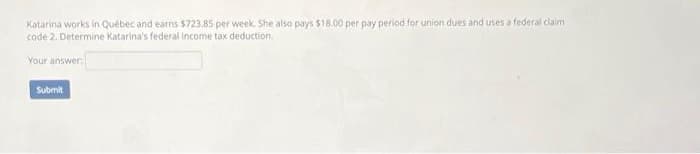

Katarina works in Québec and earns $723.85 per week. She also pays $18.00 per pay period for union dues and uses a federal claim code 2. Determine Katarina's federal income tax deduction. Your answer: Submit

Katarina works in Québec and earns $723.85 per week. She also pays $18.00 per pay period for union dues and uses a federal claim code 2. Determine Katarina's federal income tax deduction. Your answer: Submit

Chapter1: Federal Income Taxation—an Overview

Section: Chapter Questions

Problem 74TA

Related questions

Question

L 24

Transcribed Image Text:Katarina works in Québec and earns $723.85 per week. She also pays $18.00 per pay period for union dues and uses a federal claim

code 2. Determine Katarina's federal income tax deduction.

Your answer:

Submit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub