Keep or Drop AudioMart is a retailer of radios, stereos, and televisions. The store carries two portable sound systems that have radios, tape players, and speakers. System A, of slightly higher quality than System B, costs $21 more. With rare exceptions, the store also sells a headset when a system is sold. The headset can be used with either system. Variable-costing income statements for the three products follow: System A System B $45,300 Sales Less: Variable expenses Contribution margin Less: Fixed costs * 20,300 $25,000 Operating income (loss) 10,200 $32,100 $14,800 25,000 $7,100 18,000 Headset $8,400 Mark 3,700 $(10,900) *This includes common fixed costs totaling $18,000, allocated to each product in proportion to its revenues. The owner of the store is concerned about the profit performance of System B and is considering dropping it. If the product is dropped, sales of System A will increase by 32%, and sales of headsets will drop by 25%. Round all answers to the nearest whole number. Required: $4,700 2,400 $2,300 1. Prepare segmented income statements for the three products. Round your answers to the nearest dollar. Input expenses as positive numbers.

Keep or Drop AudioMart is a retailer of radios, stereos, and televisions. The store carries two portable sound systems that have radios, tape players, and speakers. System A, of slightly higher quality than System B, costs $21 more. With rare exceptions, the store also sells a headset when a system is sold. The headset can be used with either system. Variable-costing income statements for the three products follow: System A System B $45,300 Sales Less: Variable expenses Contribution margin Less: Fixed costs * 20,300 $25,000 Operating income (loss) 10,200 $32,100 $14,800 25,000 $7,100 18,000 Headset $8,400 Mark 3,700 $(10,900) *This includes common fixed costs totaling $18,000, allocated to each product in proportion to its revenues. The owner of the store is concerned about the profit performance of System B and is considering dropping it. If the product is dropped, sales of System A will increase by 32%, and sales of headsets will drop by 25%. Round all answers to the nearest whole number. Required: $4,700 2,400 $2,300 1. Prepare segmented income statements for the three products. Round your answers to the nearest dollar. Input expenses as positive numbers.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter4: Activity-based Costing

Section: Chapter Questions

Problem 2CMA: The Chocolate Baker specializes in chocolate baked goods. The firm has long assessed the...

Related questions

Question

100%

How do I calculate the remain boxes

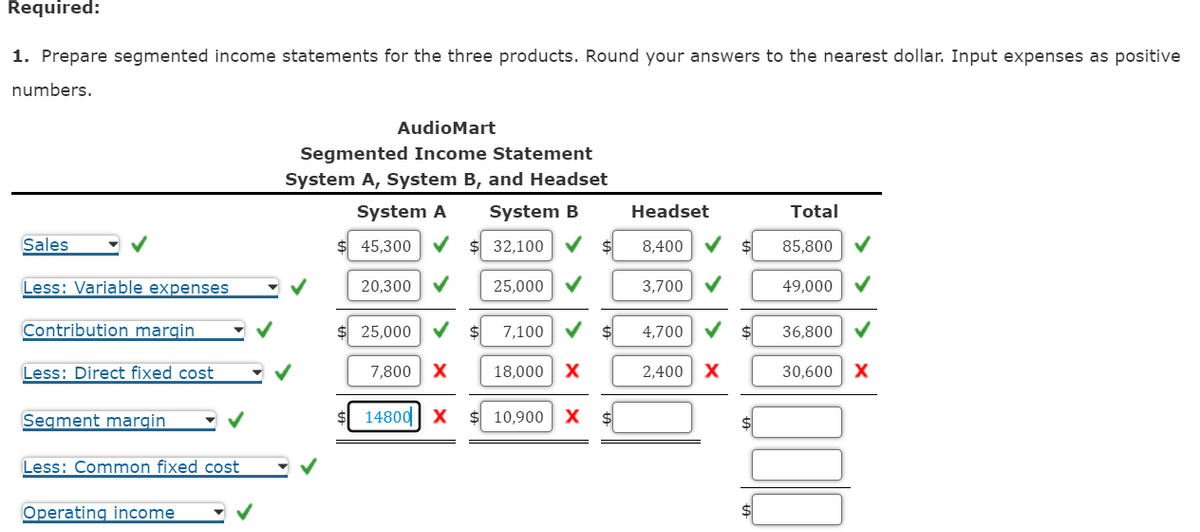

Transcribed Image Text:Required:

1. Prepare segmented income statements for the three products. Round your answers to the nearest dollar. Input expenses as positive

numbers.

Sales

Less: Variable expenses

Contribution margin

Less: Direct fixed cost

Segment margin

Less: Common fixed cost

Operating income

AudioMart

Segmented Income Statement

System A, System B, and Headset

System A

System B

45,300

20,300

25,000

7,800 X

14800 X

$ 32,100

25,000 ✔

7,100

18,000 X

10,900 X

$

$

Headset

8,400

3,700

4,700

2,400 X

$

$

Total

85,800

49,000

36,800

30,600 X

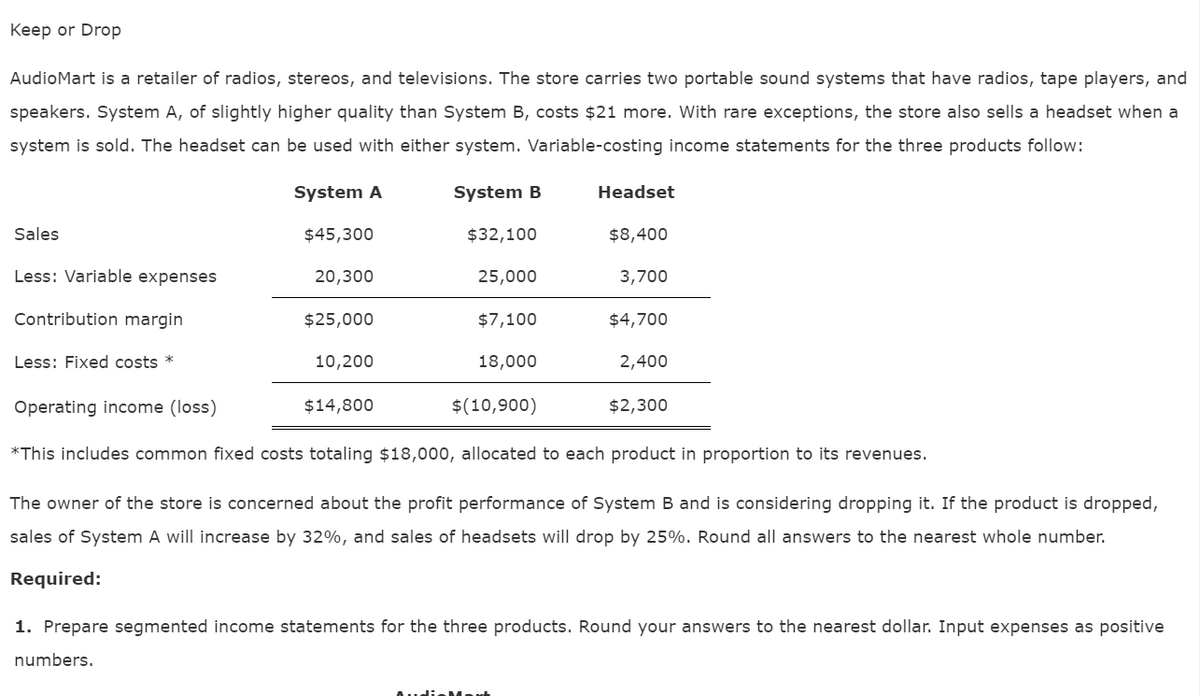

Transcribed Image Text:Keep or Drop

AudioMart is a retailer of radios, stereos, and televisions. The store carries two portable sound systems that have radios, tape players, and

speakers. System A, of slightly higher quality than System B, costs $21 more. With rare exceptions, the store also sells a headset when a

system is sold. The headset can be used with either system. Variable-costing income statements for the three products follow:

System A

System B

$45,300

Sales

Less: Variable expenses

Contribution margin

Less: Fixed costs *

Operating income (loss)

20,300

$25,000

10,200

$14,800

$32,100

25,000

$7,100

18,000

$(10,900)

Headset

$8,400

3,700

$4,700

2,400

$2,300

*This includes common fixed costs totaling $18,000, allocated to each product in proportion to its revenues.

The owner of the store is concerned about the profit performance of System B and is considering dropping it. If the product is dropped,

sales of System A will increase by 32%, and sales of headsets will drop by 25%. Round all answers to the nearest whole number.

Required:

1. Prepare segmented income statements for the three products. Round your answers to the nearest dollar. Input expenses as positive

numbers.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,