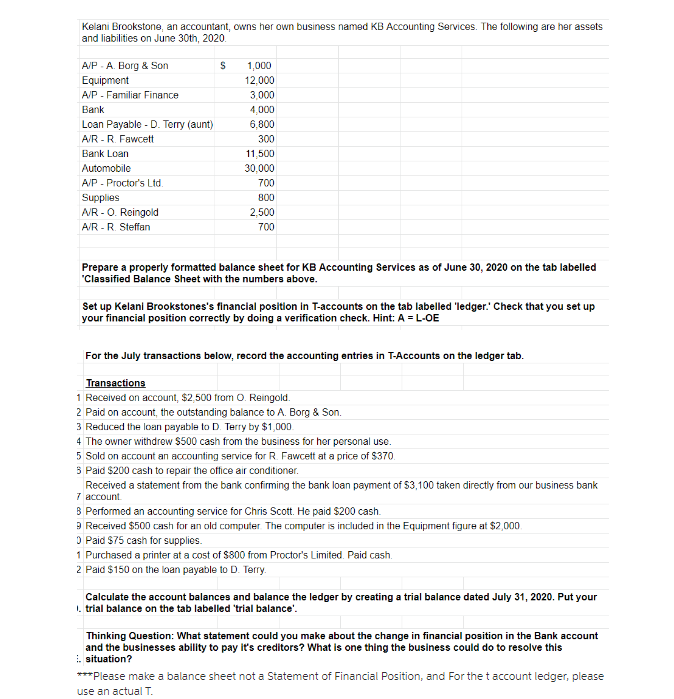

Kelani Brookstone, an accountant, owns her own business named KB Accounting Services. The following are her assets and liabilities on June 30th, 2020. A/P-A. Borg & Son S 1,000 Equipment 12,000 A/P - Familiar Finance 3,000 Bank 4,000 Loan Payable - D. Terry (aunt) 6.800 A/R - R. Fawcett 300 Bank Loan 11,500 Automobile 30,000 A/P - Proctor's Ltd. 700 Supplies 800 A/R-O. Reingold 2,500 A/R - R. Steffan 700 Prepare a properly formatted balance sheet for KB Accounting Services as of June 30, 2020 on the tab labelled 'Classified Balance Sheet with the numbers above.

Kelani Brookstone, an accountant, owns her own business named KB Accounting Services. The following are her assets and liabilities on June 30th, 2020. A/P-A. Borg & Son S 1,000 Equipment 12,000 A/P - Familiar Finance 3,000 Bank 4,000 Loan Payable - D. Terry (aunt) 6.800 A/R - R. Fawcett 300 Bank Loan 11,500 Automobile 30,000 A/P - Proctor's Ltd. 700 Supplies 800 A/R-O. Reingold 2,500 A/R - R. Steffan 700 Prepare a properly formatted balance sheet for KB Accounting Services as of June 30, 2020 on the tab labelled 'Classified Balance Sheet with the numbers above.

Chapter20: Corporations And Parterships

Section: Chapter Questions

Problem 40P

Related questions

Question

15.

Transcribed Image Text:Kelani Brookstone, an accountant, owns her own business named KB Accounting Services. The following are her assets

and liabilities on June 30th, 2020.

A/P-A. Borg & Son

S

1,000

Equipment

12,000

A/P - Familiar Finance

3,000

Bank

4,000

Loan Payable - D. Terry (aunt)

6,800

A/R - R. Fawcett

300

Bank Loan

11,500

Automobile

30,000

A/P - Proctor's Ltd.

700

Supplies

800

A/R-O. Reingold

2,500

A/R - R. Steffan

700

Prepare a properly formatted balance sheet for KB Accounting Services as of June 30, 2020 on the tab labelled

"Classified Balance Sheet with the numbers above.

Set up Kelani Brookstones's financial position in T-accounts on the tab labelled 'ledger. Check that you set up

your financial position correctly by doing a verification check. Hint: A = L-OE

For the July transactions below, record the accounting entries in T-Accounts on the ledger tab.

Transactions

1 Received on account, $2,500 from O. Reingold.

2 Paid on account, the outstanding balance to A. Borg & Son.

3 Reduced the loan payable to D. Terry by $1,000.

4 The owner withdrew $500 cash from the business for her personal use.

5 Sold on account an accounting service for R. Fawcett at a price of $370.

8 Paid $200 cash to repair the office air conditioner.

Received a statement from the bank confirming the bank loan payment of $3,100 taken directly from our business bank

7 account.

8 Performed an accounting service for Chris Scott. He paid $200 cash.

9 Received $500 cash for an old computer. The computer is included in the Equipment figure at $2,000.

Paid $75 cash for supplies.

1 Purchased a printer at a cost of $800 from Proctor's Limited. Paid cash.

2 Paid $150 on the loan payable to D. Terry.

Calculate the account balances and balance the ledger by creating a trial balance dated July 31, 2020. Put your

1. trial balance on the tab labelled trial balance'.

Thinking Question: What statement could you make about the change in financial position in the Bank account

and the businesses ability to pay it's creditors? What is one thing the business could do to resolve this

situation?

***Please make a balance sheet not a Statement of Financial Position, and For the t account ledger, please

use an actual T.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT