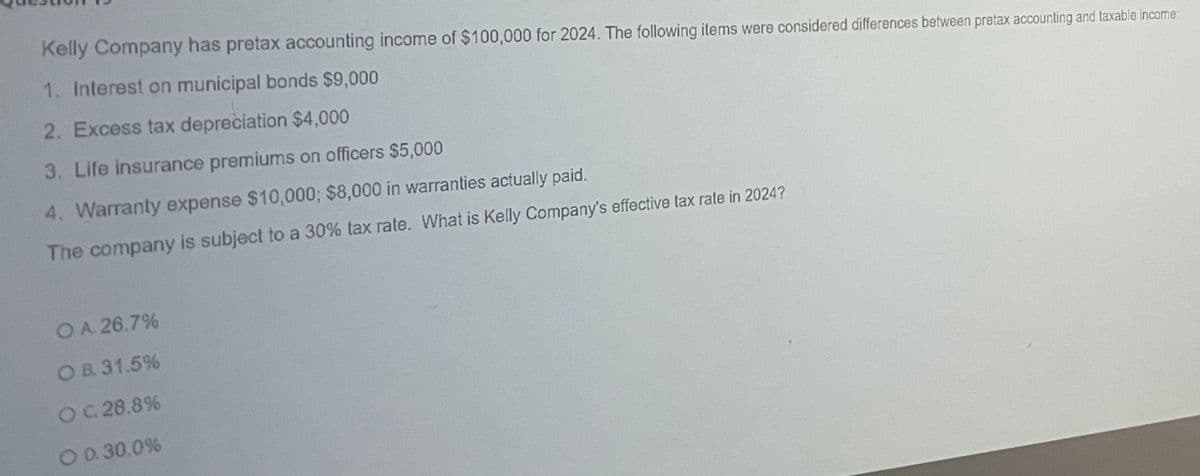

Kelly Company has pretax accounting income of $100,000 for 2024. The following items were considered differences between pretax accounting and taxable income: 1. Interest on municipal bonds $9,000 2. Excess tax depreciation $4,000 3. Life insurance premiums on officers $5,000 4. Warranty expense $10,000; $8,000 in warranties actually paid. The company is subject to a 30% tax rate. What is Kelly Company's effective tax rate in 2024? O A. 26.7% OB. 31.5% OC. 28.8% O D. 30.0%

Kelly Company has pretax accounting income of $100,000 for 2024. The following items were considered differences between pretax accounting and taxable income: 1. Interest on municipal bonds $9,000 2. Excess tax depreciation $4,000 3. Life insurance premiums on officers $5,000 4. Warranty expense $10,000; $8,000 in warranties actually paid. The company is subject to a 30% tax rate. What is Kelly Company's effective tax rate in 2024? O A. 26.7% OB. 31.5% OC. 28.8% O D. 30.0%

Chapter17: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 47P

Related questions

Question

None

Transcribed Image Text:Kelly Company has pretax accounting income of $100,000 for 2024. The following items were considered differences between pretax accounting and taxable income:

1. Interest on municipal bonds $9,000

2. Excess tax depreciation $4,000

3. Life insurance premiums on officers $5,000

4. Warranty expense $10,000; $8,000 in warranties actually paid.

The company is subject to a 30% tax rate. What is Kelly Company's effective tax rate in 2024?

O A. 26.7%

OB. 31.5%

OC. 28.8%

O D. 30.0%

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT