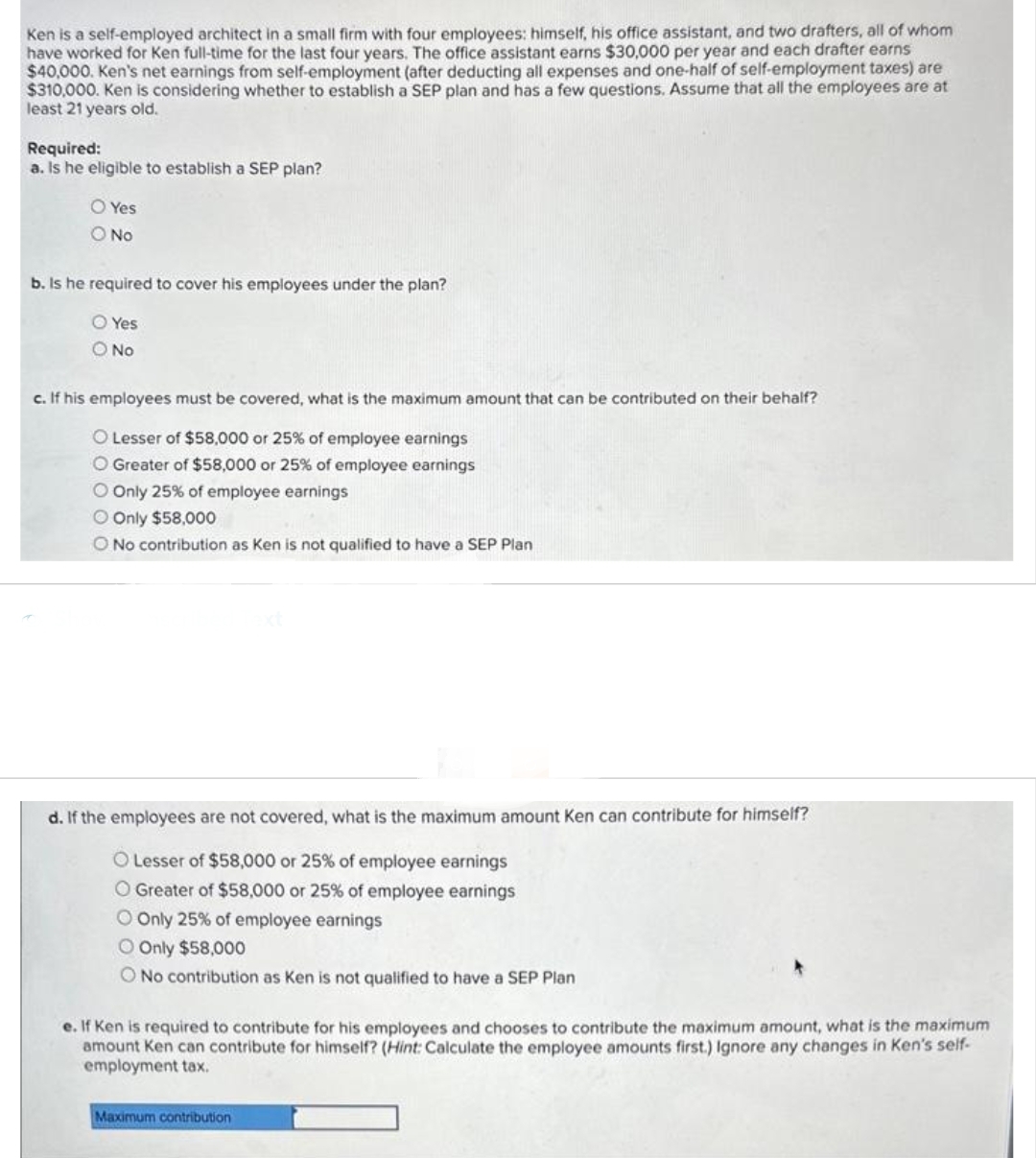

Ken is a self-employed architect in a small firm with four employees: himself, his office assistant, and two drafters, all of whom have worked for Ken full-time for the last four years. The office assistant earns $30,000 per year and each drafter earns $40,000. Ken's net earnings from self-employment (after deducting all expenses and one-half of self-employment taxes) are $310,000. Ken is considering whether to establish a SEP plan and has a few questions. Assume that all the employees are at least 21 years old. Required: a. Is he eligible to establish a SEP plan? O Yes O No b. Is he required to cover his employees under the plan? O Yes O No c. If his employees must be covered, what is the maximum amount that can be contributed on their behalf? O Lesser of $58,000 or 25% of employee earnings O Greater of $58,000 or 25% of employee O Only 25% of employee earnings O Only $58,000 O No contribution as Ken is not qualified to have a SEP Plan d. If the employees are not covered, what is the maximum amount Ken can contribute for himself? O Lesser of $58,000 or 25% of employee earnings O Greater of $58,000 or 25% of employee earnings O Only 25% of employee earnings O Only $58,000 O No contribution as Ken is not qualified to have a SEP Plan e. If Ken is required to contribute for his employees and chooses to contribute the maximum amount, what is the maximum amount Ken can contribute for himself? (Hint: Calculate the employee amounts first.) Ignore any changes in Ken's self- employment tax. Maximum contribution

Ken is a self-employed architect in a small firm with four employees: himself, his office assistant, and two drafters, all of whom have worked for Ken full-time for the last four years. The office assistant earns $30,000 per year and each drafter earns $40,000. Ken's net earnings from self-employment (after deducting all expenses and one-half of self-employment taxes) are $310,000. Ken is considering whether to establish a SEP plan and has a few questions. Assume that all the employees are at least 21 years old. Required: a. Is he eligible to establish a SEP plan? O Yes O No b. Is he required to cover his employees under the plan? O Yes O No c. If his employees must be covered, what is the maximum amount that can be contributed on their behalf? O Lesser of $58,000 or 25% of employee earnings O Greater of $58,000 or 25% of employee O Only 25% of employee earnings O Only $58,000 O No contribution as Ken is not qualified to have a SEP Plan d. If the employees are not covered, what is the maximum amount Ken can contribute for himself? O Lesser of $58,000 or 25% of employee earnings O Greater of $58,000 or 25% of employee earnings O Only 25% of employee earnings O Only $58,000 O No contribution as Ken is not qualified to have a SEP Plan e. If Ken is required to contribute for his employees and chooses to contribute the maximum amount, what is the maximum amount Ken can contribute for himself? (Hint: Calculate the employee amounts first.) Ignore any changes in Ken's self- employment tax. Maximum contribution

Chapter6: Business Expenses

Section: Chapter Questions

Problem 33P

Related questions

Question

K2.

Transcribed Image Text:Ken is a self-employed architect in a small firm with four employees: himself, his office assistant, and two drafters, all of whom

have worked for Ken full-time for the last four years. The office assistant earns $30,000 per year and each drafter earns

$40,000. Ken's net earnings from self-employment (after deducting all expenses and one-half of self-employment taxes) are

$310,000. Ken is considering whether to establish a SEP plan and has a few questions. Assume that all the employees are at

least 21 years old.

Required:

a. Is he eligible to establish a SEP plan?

O Yes

O No

b. Is he required to cover his employees under the plan?

O Yes

O No

c. If his employees must be covered, what is the maximum amount that can be contributed on their behalf?

O Lesser of $58,000 or 25% of employee earnings

O Greater of $58,000 or 25% of employee earnings

O Only 25% of employee earnings

O Only $58,000

O No contribution as Ken is not qualified to have a SEP Plan

d. If the employees are not covered, what is the maximum amount Ken can contribute for himself?

O Lesser of $58,000 or 25% of employee earnings

O Greater of $58,000 or 25% of employee earnings

O Only 25% of employee earnings

O Only $58,000

O No contribution as Ken is not qualified to have a SEP Plan

e. If Ken is required to contribute for his employees and chooses to contribute the maximum amount, what is the maximum

amount Ken can contribute for himself? (Hint: Calculate the employee amounts first.) Ignore any changes in Ken's self-

employment tax.

Maximum contribution

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT