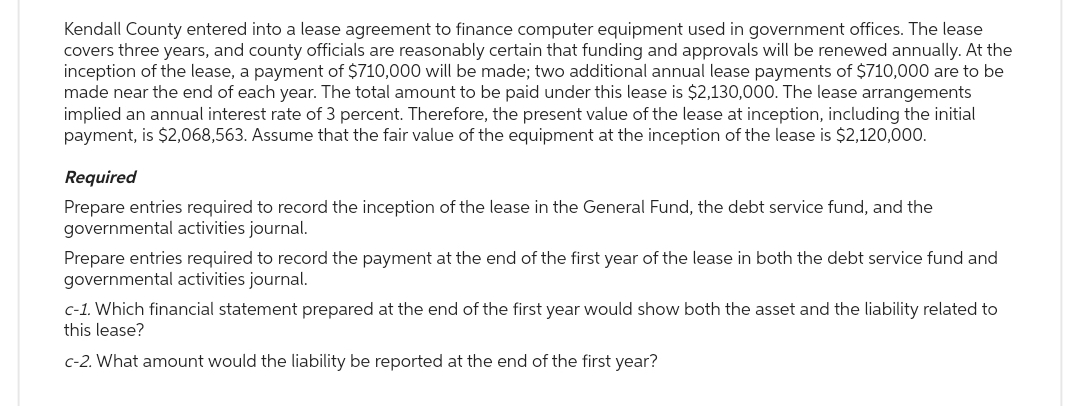

Kendall County entered into a lease agreement to finance computer equipment used in government offices. The lease covers three years, and county officials are reasonably certain that funding and approvals will be renewed annually. At the inception of the lease, a payment of $710,000 will be made; two additional annual lease payments of $710,000 are to be made near the end of each year. The total amount to be paid under this lease is $2,130,000. The lease arrangements implied an annual interest rate of 3 percent. Therefore, the present value of the lease at inception, including the initial payment, is $2,068,563. Assume that the fair value of the equipment at the inception of the lease is $2,120,000. Required Prepare entries required to record the inception of the lease in the General Fund, the debt service fund, and the governmental activities journal. Prepare entries required to record the payment at the end of the first year of the lease in both the debt service fund and governmental activities journal. c-1. Which financial statement prepared at the end of the first year would show both the asset and the liability related to this lease? c-2. What amount would the liability be reported at the end of the first year?

Kendall County entered into a lease agreement to finance computer equipment used in government offices. The lease covers three years, and county officials are reasonably certain that funding and approvals will be renewed annually. At the inception of the lease, a payment of $710,000 will be made; two additional annual lease payments of $710,000 are to be made near the end of each year. The total amount to be paid under this lease is $2,130,000. The lease arrangements implied an annual interest rate of 3 percent. Therefore, the present value of the lease at inception, including the initial payment, is $2,068,563. Assume that the fair value of the equipment at the inception of the lease is $2,120,000. Required Prepare entries required to record the inception of the lease in the General Fund, the debt service fund, and the governmental activities journal. Prepare entries required to record the payment at the end of the first year of the lease in both the debt service fund and governmental activities journal. c-1. Which financial statement prepared at the end of the first year would show both the asset and the liability related to this lease? c-2. What amount would the liability be reported at the end of the first year?

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 7MC: Using the information provided, what transaction represents the best application of the present...

Related questions

Question

Hh.15.

Transcribed Image Text:Kendall County entered into a lease agreement to finance computer equipment used in government offices. The lease

covers three years, and county officials are reasonably certain that funding and approvals will be renewed annually. At the

inception of the lease, a payment of $710,000 will be made; two additional annual lease payments of $710,000 are to be

made near the end of each year. The total amount to be paid under this lease is $2,130,000. The lease arrangements

implied an annual interest rate of 3 percent. Therefore, the present value of the lease at inception, including the initial

payment, is $2,068,563. Assume that the fair value of the equipment at the inception of the lease is $2,120,000.

Required

Prepare entries required to record the inception of the lease in the General Fund, the debt service fund, and the

governmental activities journal.

Prepare entries required to record the payment at the end of the first year of the lease in both the debt service fund and

governmental activities journal.

c-1. Which financial statement prepared at the end of the first year would show both the asset and the liability related to

this lease?

c-2. What amount would the liability be reported at the end of the first year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning