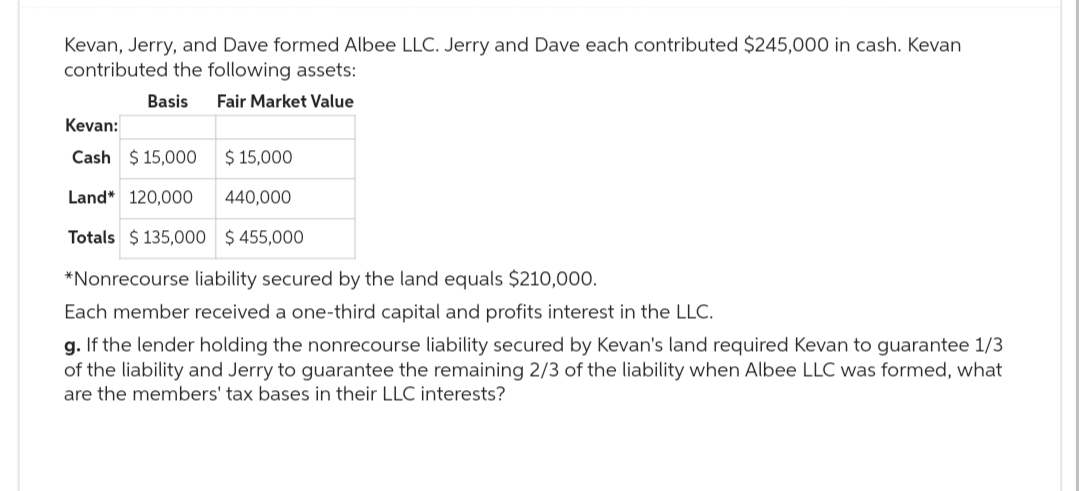

Kevan, Jerry, and Dave formed Albee LLC. Jerry and Dave each contributed $245,000 in cash. Kevan contributed the following assets: Basis Fair Market Value Kevan: Cash $15,000 $15,000 Land* 120,000 440,000 Totals $135,000 $455,000 *Nonrecourse liability secured by the land equals $210,000. Each member received a one-third capital and profits interest in the LLC. g. If the lender holding the nonrecourse liability secured by Kevan's land required Kevan to guarantee of the liability and Jerry to guarantee the remaining 2/3 of the liability when Albee LLC was formed, wh are the members' tax bases in their LLC interests?

Kevan, Jerry, and Dave formed Albee LLC. Jerry and Dave each contributed $245,000 in cash. Kevan contributed the following assets: Basis Fair Market Value Kevan: Cash $15,000 $15,000 Land* 120,000 440,000 Totals $135,000 $455,000 *Nonrecourse liability secured by the land equals $210,000. Each member received a one-third capital and profits interest in the LLC. g. If the lender holding the nonrecourse liability secured by Kevan's land required Kevan to guarantee of the liability and Jerry to guarantee the remaining 2/3 of the liability when Albee LLC was formed, wh are the members' tax bases in their LLC interests?

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter15: S Corporations

Section: Chapter Questions

Problem 5CE

Related questions

Question

Please Do not Give Image format

Transcribed Image Text:Kevan, Jerry, and Dave formed Albee LLC. Jerry and Dave each contributed $245,000 in cash. Kevan

contributed the following assets:

Basis Fair Market Value

Kevan:

Cash $15,000

$ 15,000

Land* 120,000 440,000

Totals $135,000 $455,000

*Nonrecourse liability secured by the land equals $210,000.

Each member received a one-third capital and profits interest in the LLC.

g. If the lender holding the nonrecourse liability secured by Kevan's land required Kevan to guarantee 1/3

of the liability and Jerry to guarantee the remaining 2/3 of the liability when Albee LLC was formed, what

are the members' tax bases in their LLC interests?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT