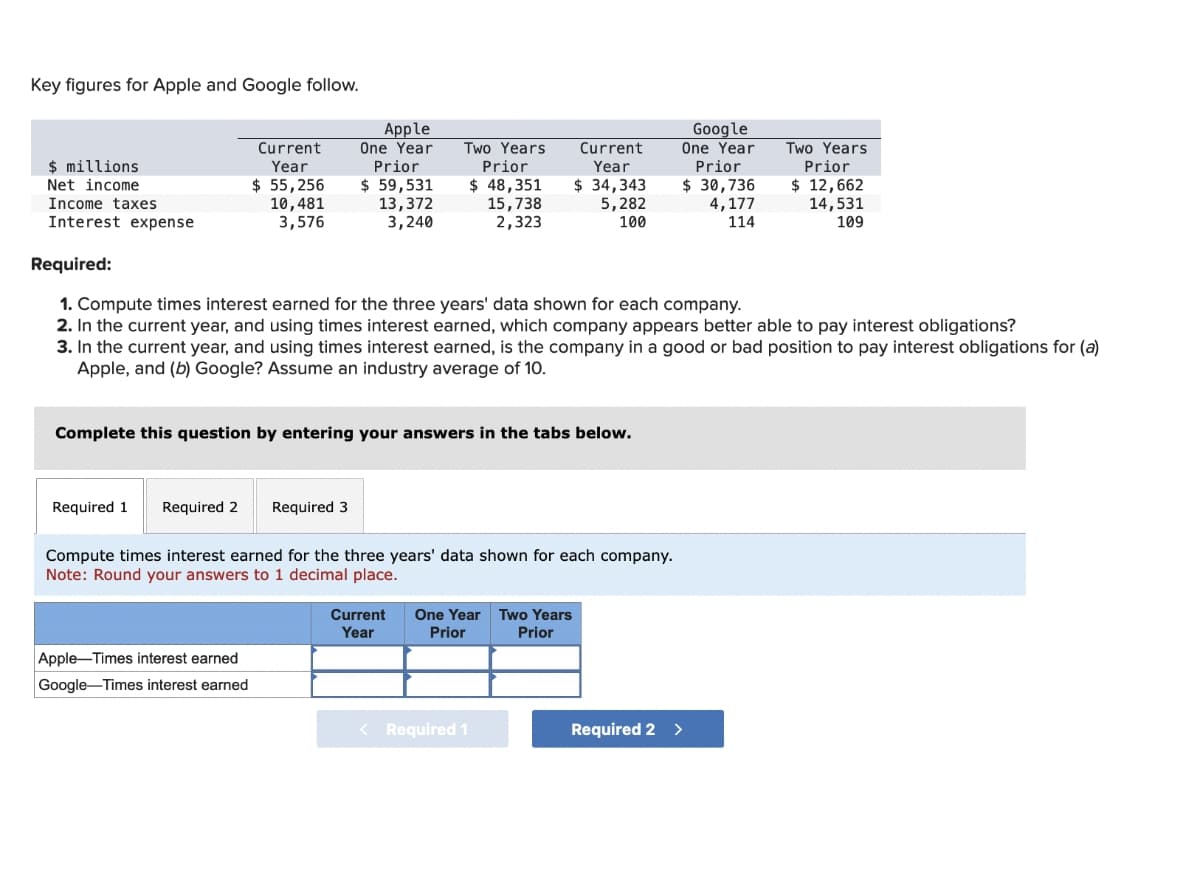

Key figures for Apple and Google follow. $ millions Net income Income taxes Interest expense Current Year $ 55,256 10,481 3,576 Required 1 Required 2 Apple One Year Prior $ 59,531 13,372 3,240 Apple-Times interest earned Google-Times interest earned Two Years Prior $ 48,351 15,738 2,323 Complete this question by entering your answers in the tabs below. Required 3. Required: 1. Compute times interest earned for the three years' data shown for each company. 2. In the current year, and using times interest earned, which company appears better able to pay interest obligations? 3. In the current year, and using times interest earned, is the company in a good or bad position to pay interest obligations for (a) Apple, and (b) Google? Assume an industry average of 10. Current Year $ 34,343 5,282 100 Compute times interest earned for the three years' data shown for each company. Note: Round your answers to 1 decimal place. Current One Year Two Years Year Prior Prior < Required 1 Google One Year Prior $ 30,736 4,177 114 Required 2 > Two Years Prior $ 12,662 14,531 109

Key figures for Apple and Google follow. $ millions Net income Income taxes Interest expense Current Year $ 55,256 10,481 3,576 Required 1 Required 2 Apple One Year Prior $ 59,531 13,372 3,240 Apple-Times interest earned Google-Times interest earned Two Years Prior $ 48,351 15,738 2,323 Complete this question by entering your answers in the tabs below. Required 3. Required: 1. Compute times interest earned for the three years' data shown for each company. 2. In the current year, and using times interest earned, which company appears better able to pay interest obligations? 3. In the current year, and using times interest earned, is the company in a good or bad position to pay interest obligations for (a) Apple, and (b) Google? Assume an industry average of 10. Current Year $ 34,343 5,282 100 Compute times interest earned for the three years' data shown for each company. Note: Round your answers to 1 decimal place. Current One Year Two Years Year Prior Prior < Required 1 Google One Year Prior $ 30,736 4,177 114 Required 2 > Two Years Prior $ 12,662 14,531 109

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter3: Taxes On The Financial Statements

Section: Chapter Questions

Problem 6RP

Related questions

Question

Please don't give image format

Transcribed Image Text:Key figures for Apple and Google follow.

$ millions

Net income

Income taxes

Interest expense

Current

Year

$ 55,256

10,481

3,576

Required 1 Required 2

Apple

One Year

Prior

$ 59,531

13,372

3,240

Apple-Times interest earned

Google-Times interest earned

Two Years

Prior

$ 48,351

15,738

2,323

Complete this question by entering your answers in the tabs below.

Required 3

Required:

1. Compute times interest earned for the three years' data shown for each company.

2. In the current year, and using times interest earned, which company appears better able to pay interest obligations?

3. In the current year, and using times interest earned, is the company in a good or bad position to pay interest obligations for (a)

Apple, and (b) Google? Assume an industry average of 10.

Current

Year

$34,343

5,282

100

Compute times interest earned for the three years' data shown for each company.

Note: Round your answers to 1 decimal place.

Current One Year Two Years

Year

Prior

Prior

< Required 1

Google

One Year

Prior

$ 30,736

4,177

114

Two Years

Prior

$ 12,662

14,531

109

Required 2 >

Transcribed Image Text:Key figures for Apple and Google follow.

$ millions

Net income

Income taxes

Interest expense

Current

Year

$ 55,256

10,481

3,576

Show Transcribed Text

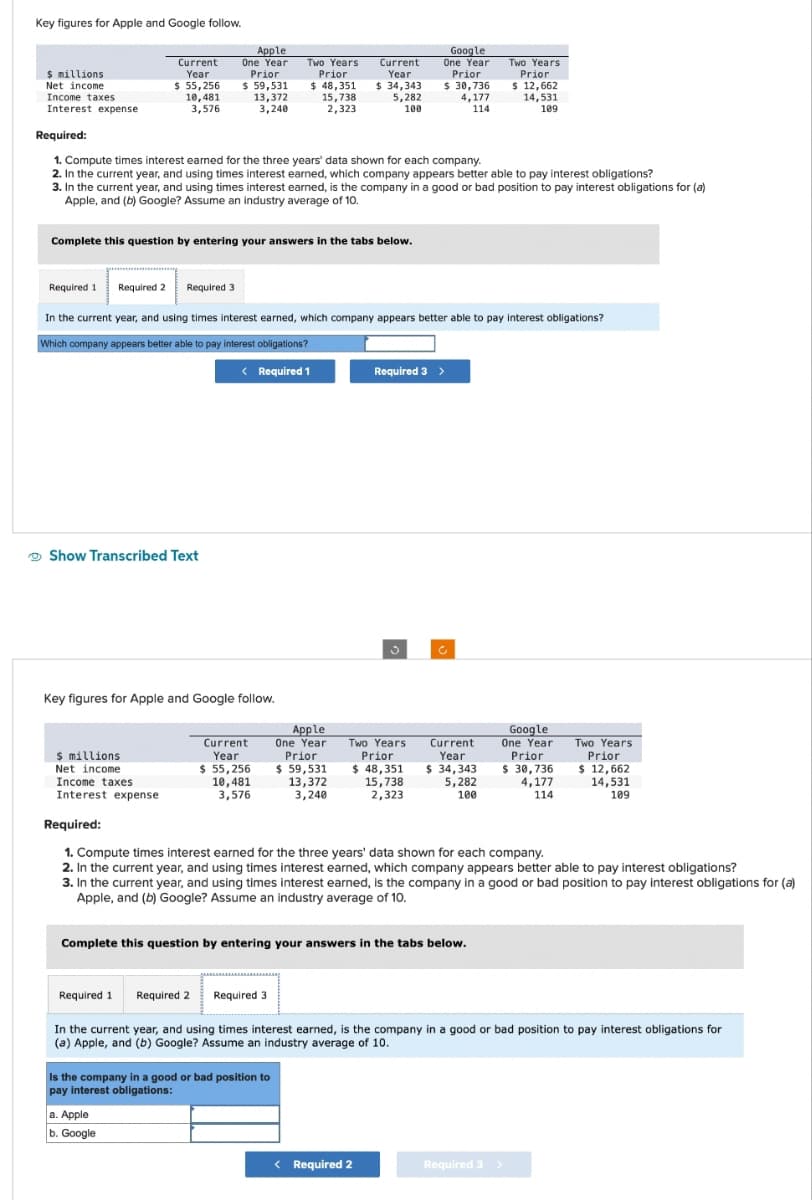

Complete this question by entering your answers in the tabs below.

$ millions

Net income

Required:

. Compute times interest earned for the three years' data shown for each company.

2. In the current year, and using times interest earned, which company appears better able to pay interest obligations?

3. In the current year, and using times interest earned, is the company in a good or bad position to pay interest obligations for (a)

Apple, and (b) Google? Assume an industry average of 10.

Income taxes

Interest expense

Apple

One Year

Prior

$ 59,531

13,372

3,240

Key figures for Apple and Google follow.

Required 1 Required 2 Required 3

In the current year, and using times interest earned, which company appears better able to pay interest obligations?

Which company appears better able to pay interest obligations?

Required 1

Two Years

Prior

$ 48,351

15,738

2,323

< Required 1

Required 2

a. Apple

b. Google

Current

Year

$ 55,256

10,481

3,576

Current

Year

$ 34,343

5,282

100

Required 3

Apple

One Year

Prior

$ 59,531

13,372

3,240

Is the company in a good or bad position to

pay interest obligations:

Google

One Year

Prior

$ 30,736

4,177

114

Complete this question by entering your answers in the tabs below.

Two Years

Prior

$ 48,351

15,738

2,323

Required 3 >

Required:

1. Compute times interest earned for the three years' data shown for each company.

2. In the current year, and using times interest earned, which company appears better able to pay interest obligations?

3. In the current year, and using times interest earned, is the company in a good or bad position to pay interest obligations for (a)

Apple, and (b) Google? Assume an industry average of 10.

< Required 2

Current

Year

$ 34,343

5,282

100

Two Years

Prior

$ 12,662

14,531

109

Google

One Year

Prior

$ 30,736

4,177

114

In the current year, and using times interest earned, is the company in a good or bad position to pay interest obligations for

(a) Apple, and (b) Google? Assume an industry average of 10.

Two Years

Prior

$ 12,662

14,531

109

Required 3 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning