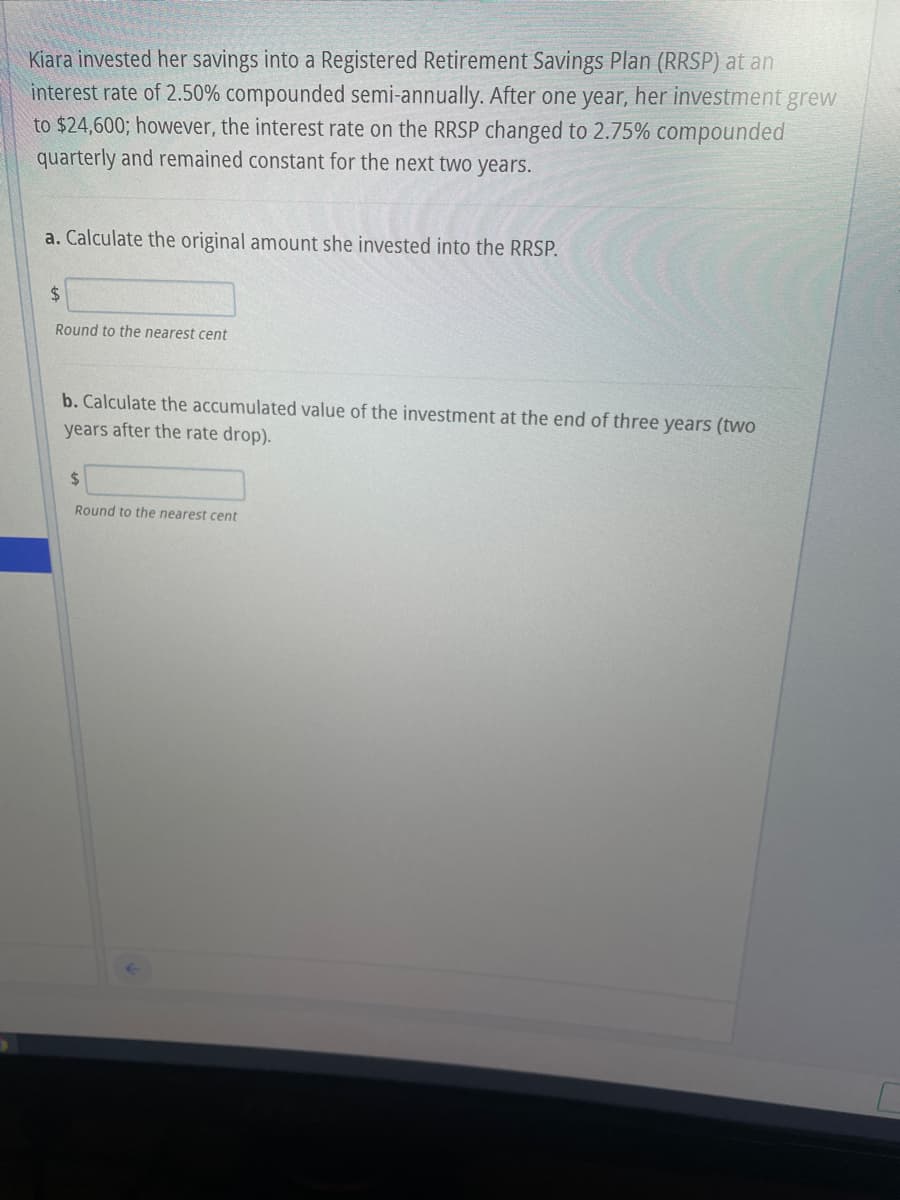

Kiara invested her savings into a Registered Retirement Savings Plan (RRSP) at an interest rate of 2.50% compounded semi-annually. After one year, her investment grew to $24,600; however, the interest rate on the RRSP changed to 2.75% compounded quarterly and remained constant for the next two years. a. Calculate the original amount she invested into the RRSP. $ Round to the nearest cent b. Calculate the accumulated value of the investment at the end of three years (two years after the rate drop). $ Round to the nearest cent

Kiara invested her savings into a Registered Retirement Savings Plan (RRSP) at an interest rate of 2.50% compounded semi-annually. After one year, her investment grew to $24,600; however, the interest rate on the RRSP changed to 2.75% compounded quarterly and remained constant for the next two years. a. Calculate the original amount she invested into the RRSP. $ Round to the nearest cent b. Calculate the accumulated value of the investment at the end of three years (two years after the rate drop). $ Round to the nearest cent

Chapter9: Sequences, Probability And Counting Theory

Section9.4: Series And Their Notations

Problem 56SE: To get the best loan rates available, the Riches want to save enough money to place 20% down on a...

Related questions

Question

Transcribed Image Text:Kiara invested her savings into a Registered Retirement Savings Plan (RRSP) at an

interest rate of 2.50% compounded semi-annually. After one year, her investment grew

to $24,600; however, the interest rate on the RRSP changed to 2.75% compounded

quarterly and remained constant for the next two years.

a. Calculate the original amount she invested into the RRSP.

$

Round to the nearest cent

b. Calculate the accumulated value of the investment at the end of three years (two

years after the rate drop).

$

Round to the nearest cent

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill