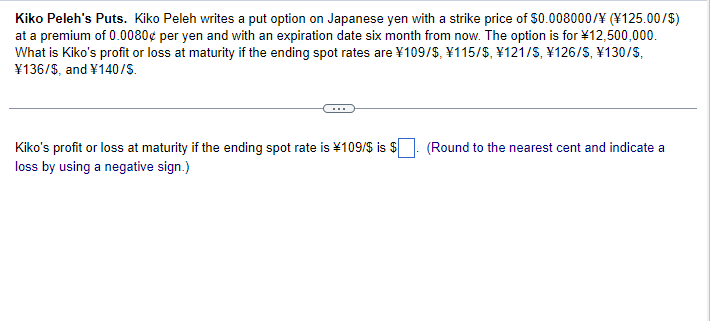

Kiko Peleh's Puts. Kiko Peleh writes a put option on Japanese yen with a strike price of $0.008000/¥ (¥125.00/$) at a premium of 0.0080¢ per yen and with an expiration date six month from now. The option is for ¥12,500,000. What is Kiko's profit or loss at maturity if the ending spot rates are ¥109/$, ¥115/$, ¥121/S, ¥126/S, ¥130/$, ¥136/$, and ¥140/S.

Q: Exercise 15-24 (Algo) Calculation of annual lease payments; residual value [LO15-2, 15-6] Each of…

A: Lease payments are regular, periodic payments made by a lessee to a lessor in exchange for the use…

Q: Wildhorse Co. is about to issue $488,000 of 6-year bonds paying an 11% interest rate, with interest…

A: Face value = $488,000Coupon rate = 11%Years to maturity =6 yearsYTM =10%

Q: Stuart Company is considering investing in two new vans that are expected to generate combined cash…

A: NPV or Net present value is the technique of capital budgeting fo evaluating the project on the…

Q: The common stock and debt of Northern Sludge are valued at $56 million and $23 million, respectively…

A: Here,Value of stock is $56 millionValue of Debt is $23 millionRequired return on stock is…

Q: Consider the following pure discount bonds with face value $1,000: Maturity Price 1 952.38 2 898.47…

A: The face value of the bond is $1,000.

Q: A bank bill with a face value of $100,000 was is earned if the bill is held until maturity? a.…

A: Bank bills are issued by the bank and these are issued by the bank on discount and that discount is…

Q: Question 4 4. Operating Leverage. Natural Bodyworks (NB) produces the popular Ab Stretcher that they…

A: Net Operating Income (NOI) is a measure of profitability that indicates the amount produced by the…

Q: The reward-to-risk ratio for Stock X is %. Do not round any intermediate work. Round your *final*…

A: If we evaluate the stock with the help of CAPM than we will compare the actual return from the stock…

Q: The risk-free rate is 3.6%, and the expected market return is 7.5%. A stock with a beta of 1.2 is…

A: Risk free Rate = rf = 3.6%Market Return = rm = 7.5%Beta = b = 1.2Current Price of Stock = p0 =…

Q: y received a separation payment of $25,000 from his former employer wh semi-annually. When he was…

A: Future value of the money is the amount of deposit done and amount of interest accumulated over the…

Q: Solomon Electronics is considering investing in manufacturing equipment expected to cost $340,000.…

A: Net present value(NPV) is the difference between present value of all cash inflows and ininitial…

Q: Katie Homes and Garden Co. has 13,700,000 shares outstanding. The stock is currently selling at $60…

A: A poison pill is a corporate action taken by the board of the company to counter the potential…

Q: Aaron Heath is seeking part-time employment while he attends school. He is considering purchasing…

A: Net Present Value is defined as the sum of the present values of all future cash inflows less the…

Q: Is the company growing? Explain. Be sure to include the percentages you got Annual Net Income…

A: Annual Net Income represents a company's total earnings over a fiscal year after all expenses,…

Q: A project will increase sales by $60,000 and cash expenses by $51,000. The project will cost $40,000…

A: Annual increase in sales = $60,000Annual cash expenses = $51,000Cost = $40,000useful life = 4…

Q: Select all that are true with respect to options discussed in this module: Group of answer choices…

A: Option-It is a financial instrument known as derivative that gives the option holder the right but…

Q: CDB stock is currently priced at $75. The company will pay a dividend of $5.29 next year and…

A: The dividend discount model states that the value of a stock today is the present value of all its…

Q: Exercise 15-24 (Algo) Calculation of annual lease payments; residual value [LO15-2, 15-6] Each of…

A: Here,Fair Value of Leasing Asset $68,000 $368,000 $93,000 $483,000Residual Value $68,000 $25,000…

Q: You have a 2 year 10% coupon bond with a principal of $1000. The spot rates are 5% and 10% for year…

A: Here,Face Value of Bond is $1,000Coupon Rate is 10%Coupon Payment in first year is 10% * 1000=…

Q: Given the following information on two fixed-rate fully amortized mortgages and consider the…

A: Refinancing refers to financing the already running loan which is financed with a higher rate of…

Q: Determine the following for Tram-Ropes Limited: A. Total Market value of the firm’s capital…

A: The market value of a firm and the concepts of cost of capital and the weighted average cost of…

Q: Assume that you are 30 years old today, and that you are planning on retirement at age 65. Your…

A: The present value (PV) of a future sum of money or stream of cash flows is the current value,…

Q: 17) Sun Woo wants to purchase an annuity that will pay him $1,000 a month for fifteen years. If he…

A: The Present Value of Ordinary Annuity refers to the concept which dictates the discounted value of a…

Q: A 6.30 percent coupon bond with 10 years left to maturity is priced to offer a yield to maturity of…

A: Bonds are the instrument used as an investment alternative for securing the amount of money at a…

Q: Here are data on two stocks, both of which have discount rates of 14%: Return on equity Earnings per…

A: Dividend per share is a useful tool because it helps investors determine how much income each piece…

Q: Project K costs $14,000, its expected cash inflows are $9,000 per year for 10 years and its WACC is…

A: An investment's or project's net present value indicates whether or not it will be beneficial to the…

Q: Germaine Metals is considering installing a new molding machine which is expected to produce…

A: NPV is also known as Net Present Value.. It is a capital budgeting technique which helps in decision…

Q: Better Mousetraps has developed a new trap. It can go into production for an initial investment in…

A: Inventory control is a process where the company manages the stock (product) of the company in an…

Q: What is the firm's new cost of equity? None of the choices New cost of equity is 26.05% New cost of…

A: The capital asset pricing model aids analysts and investors in calculating the expected return on…

Q: Suppose the following bond quotes for IOU Corporation appear in the financial page of today's…

A: YIELD(settlement, maturity, rate, pr, redemption, frequency, [basis])Settlement = Settlement…

Q: Suppose you have a project that has a 0.6 chance of doubling your investment in a year and a 0.4…

A: Standard deviation is computed by following formula-Standard deviation =

Q: Drill Problem 18-5 [LU 18-1 (3)) Selling price of hone $95.000 Down payment $ 6,000 Principal (loan)…

A: Selling price = $95,000Down payment = $6,000Principal (Loan) = $89,000Rate of interest = 7.5%Number…

Q: through the model of a lottery with a high and a low outcome, argue whether a CDO made of central…

A: Collateralized Debt Obligations (CDOs) are financial instruments that package a portfolio of various…

Q: Esfandairi Enterprises is considering a new three-year expansion project that requires an initial…

A: NPV is also known as Net Present Value.. It is a capital budgeting technique which helps in decision…

Q: The CEO of Harlem Hardware Supplies has submitted together a capital budget of $48,500,000 for the…

A: Retained earnings breakpoint is the amount of additional capital that may be raised while…

Q: Fabulous Fabricators needs to decide how to allocate space in its production facility this year. It…

A: Profitability index (PI), often referred to as the value investment ratio (VIR) or the profit…

Q: Calculate the correlation coefficient (PAB) for the following situation: (Round intermediate…

A: State of economyProbability of occurrenceExpected return on stock A in this stateExpected return on…

Q: A man is left with an inheritance from his father. He has an option to receive P2M at the end of 10…

A: An annuity is a type of investment contract or financial instrument that gives the receiver, or…

Q: You have been managing a $5 million portfolio that has a beta of 1.15 and a required rate of return…

A: Risk-free rate = 5%Beta for $5 million = 1.15Required return 14.775%Beta for $500,000 = 0.95

Q: Common stock value-Variable growth Newman Manufacturing is considering a cash purchase of the stock…

A: A model that helps to evaluate the value of the stock by discounting the dividend earned on the…

Q: Carnes Cosmetics Co.'s stock price is $37, and it recently paid a $1.50 dividend. This dividend is…

A: Price of stock is the present value of future dividends and value received in the future discounted…

Q: The value of a firm Multiple Choice equals the sum of the individual values of the firm's projects…

A: In this question, we are required to determine the correct statement regarding the value of a firm.

Q: If you deposit $8,000 in a bank account that pays 7% interest annually, how much will be in your…

A: Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: A stock's last dividend was $2.34 per share and the dividends are expected to grow 30% per year for…

A: The DDM refers to the model that considers the dividends paid as the best indicators of the…

Q: On January 1, 2017. Agronomist Inc. had a balance of $340,000 in the long-term investments account.…

A: Long term Investment is that which is purchase by the investor for long term holding. It is a non…

Q: Q: ram stimate the standard deviation of a bond's returns if it had the following annual returns…

A: When the yield that is attained from a bond investment is taken for every year, it is recognized as…

Q: 4. Operating Leverage. Natural Bodyworks (NB) produces the popular Ab Stretcher that they sell for…

A: Calculation of NOI at 4000 units.NOI = Sales- variable cost - fixed cost= (200*4000)-…

Q: Maddux Corporation has an EBIT of $835,000 per year that is expected to continue in perpetuity. The…

A: Company valuation or business valuation is the process of assessing the total economic value of a…

Q: a. What is the new divisor for the index? Note: Do not round intermediate calculations. Round your…

A: The division of a company's current shares into multiple shares is referred to as a stock split. The…

Q: MM Ferguson's market value of common stock is $35.4 million, and its risk-free debt is $13.1 million…

A: WACC is also known as Weighted Average Cost of Capital. It includes the cost of debt & cost of…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

- A speculator is considering the purchase of a 6-month Swiss franc call option on 50,000 francs with a strike price of $1.0885/SFr The premium is $0.0075/Sfr. The spot price is $1.0822/Sfr and the 60-day forward rate is $1.0880/SFr. The speculator believes the Franc will appreciate to $1.0994/Sfr over the next six months. What is the profit or loss if the franc appreciates only to the forward rate at the end of the 6 months? A. $170 B. -$235 C. $450 D -$375Assume the spot Swiss franc is $0.7000 and the six-month forward rate is $0.6950. What is the minimum price that a six-month American call option with a striking price of $0.6800 should sell for in a rational market? Assume the annualized six-month Eurodollar rate is 3.5 percent. (Do not round intermediate calculations.)Malibu, Inc., is a U.S. company that imports British goods. It plans to use call options to hedge payables of 100,000 pounds in 90 days. Three call options are available that have an expiration date 90 days from now. Fill in the number of dollars needed to pay for the payables (including the option premium paid) for each option available under each possible scenario. Spot Rate of Pound Exercise Price Exercise Price Exercise Price 90 Days = $1.71; = $1.76; = $1.80; Scenario from Now Premium = $.04 Premium = $.06 Premium = $.03 1 $1.65 2 1.74 3…

- Mender Co. will be receiving 700,000 Australian dollars in 180 days. Currently, a 180-day call option with an exercise price of $.74and a premium of $.02 is available. Also, a 180-day put option with an exercise price of $.72 and a premium of $.02 is available. Mender plans to purchase options to hedge its receivables position. Assume that the spot rate in 180 days is $.73. (1) Should the company use call options or put options? Why? (2) Calculate the amount received from the currency option hedge (after considering the premium paid). (3) Would the company have received more without hedging?Yoyo, a german company expects to pay US$10 million to a supplier in US. It is now December and the payment is due in March. The current spot rate is 1.2100. The company wants to use currency options to hedge the exposure. March currency put options are available and are for 125,000 euros, have a strike price of $1.2200 and the tick size is $0.0001. The cost of the option contract is 2.75 US cents per euro.Assuming that there is no basis,(i) Devise a hedging strategy for Yoyo using currency options.(ii) Advise on the action to be taken by Yoyo and the outcome in case the spot rate in March when the dollars must be paid is:(a) $1.2500 = €1 (b) $1.1800 = €1The current spot rate of Singapore dollar (SGD) is 0.50 USD/SGD. You bought a six-month European put option on SGD which has strike price of 0.55 USD/SGD and a premium 0.01 USD/SGD. Each put option contract trades 1,000,000 Singapore Dollars. Calculate your gain/loss in the put option contract if the market exchange rate turns out to be 0.52 USD/SGD on the contract maturity date. A. 20,000 USD gain. B. 10,000 USD loss. C. 40,000 USD gain. D. 10,000 USD gain.

- American Express sells a call option on euros (contract size is €500,000) at a premium of $0.04 per euro. If the exercise price is $0.91 and the spot price of the euro at date of expiration is $0.93, what is American express’s profit or loss on this call option?Three months ago, you sold a put option contract on Swiss franc with a strike price of $.60/SF and an option price of $.0060 per SF. Contract size is 10,000 SF. The option expires today when the value of Swiss franc is $.625. What is your total profit or loss on your investment? A. -$310 B. -$60 C. $0 D. $60Assume that the Japanese yen is trading at a spot price of 92.04 cents per 100 yen. Further assume that the premium of an American call (put) option with a strike price of 93 is 2.10 (2.20) cents. Calculate the intrinsic value and the time value of the call and put options.

- There is a European call option on the dollar with strike price of Kc = 94 pence per dollar and a European put option on the dollar with a strike price of Kp = 100 pence per dollar. Both have a notional N = 1 and both expire at date T. The current (date t) price of one dollar is St = 100 pence. The current prices of call option is 27.5 (55/2) pence and the price of the put option is 8.33 (25/3) pence. The sterling interest rate for borrowing and lending between dates t and T is 20% (1/5) and the corresponding dollar interest rate is 25% (1/4). Whatarethecurrent (datet) intrinsic and time value of the call and put options?You purchased a put option on Australian dollars for RM0.02 per unit. The strike price was RM4.25, and the spot rate at the time the option was exercised was RM4.38. Assuming that there are 13,830 units in the Australian dollar option.Would you exercise the option? What will your net profit on the put option?Doctor Dumpkins is bullish on the British pound so he sells a one-month put for $0.03. The strike price of the call is $1.24. On the expiration day, the spot price of the British pound is $1.27. Calculate the break-even price, the option payoff at expiration, and the net profit at expiration.