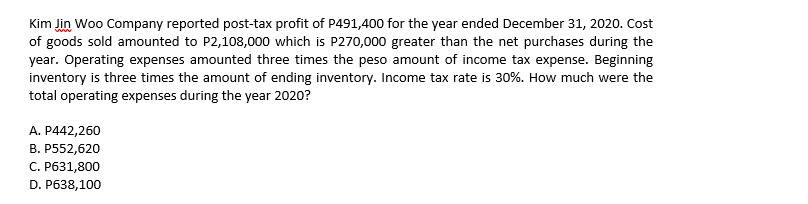

Kim Jin Woo Company reported post-tax profit of P491,400 for the year ended December 31, 2020. Cost of goods sold amounted to P2,108,000 which is P270,000 greater than the net purchases during the year. Operating expenses amounted three times the peso amount of income tax expense. Beginning inventory is three times the amount of ending inventory. Income tax rate is 30%. How much were the total operating expenses during the year 2020? A. P442,260 В. Р552,620 С. Рб31,800 D. P638,100

Kim Jin Woo Company reported post-tax profit of P491,400 for the year ended December 31, 2020. Cost of goods sold amounted to P2,108,000 which is P270,000 greater than the net purchases during the year. Operating expenses amounted three times the peso amount of income tax expense. Beginning inventory is three times the amount of ending inventory. Income tax rate is 30%. How much were the total operating expenses during the year 2020? A. P442,260 В. Р552,620 С. Рб31,800 D. P638,100

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 1RE: Brandt Corporation had sales revenue of 500,000 for the current year. For the year, its cost of...

Related questions

Question

Transcribed Image Text:Kim Jin Woo Company reported post-tax profit of P491,400 for the year ended December 31, 2020. Cost

of goods sold amounted to P2,108,000 which is P270,000 greater than the net purchases during the

year. Operating expenses amounted three times the peso amount of income tax expense. Beginning

inventory is three times the amount of ending inventory. Income tax rate is 30%. How much were the

total operating expenses during the year 2020?

А. Р442,260

B. P552,620

С. Рб31,800

D. P638,100

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College