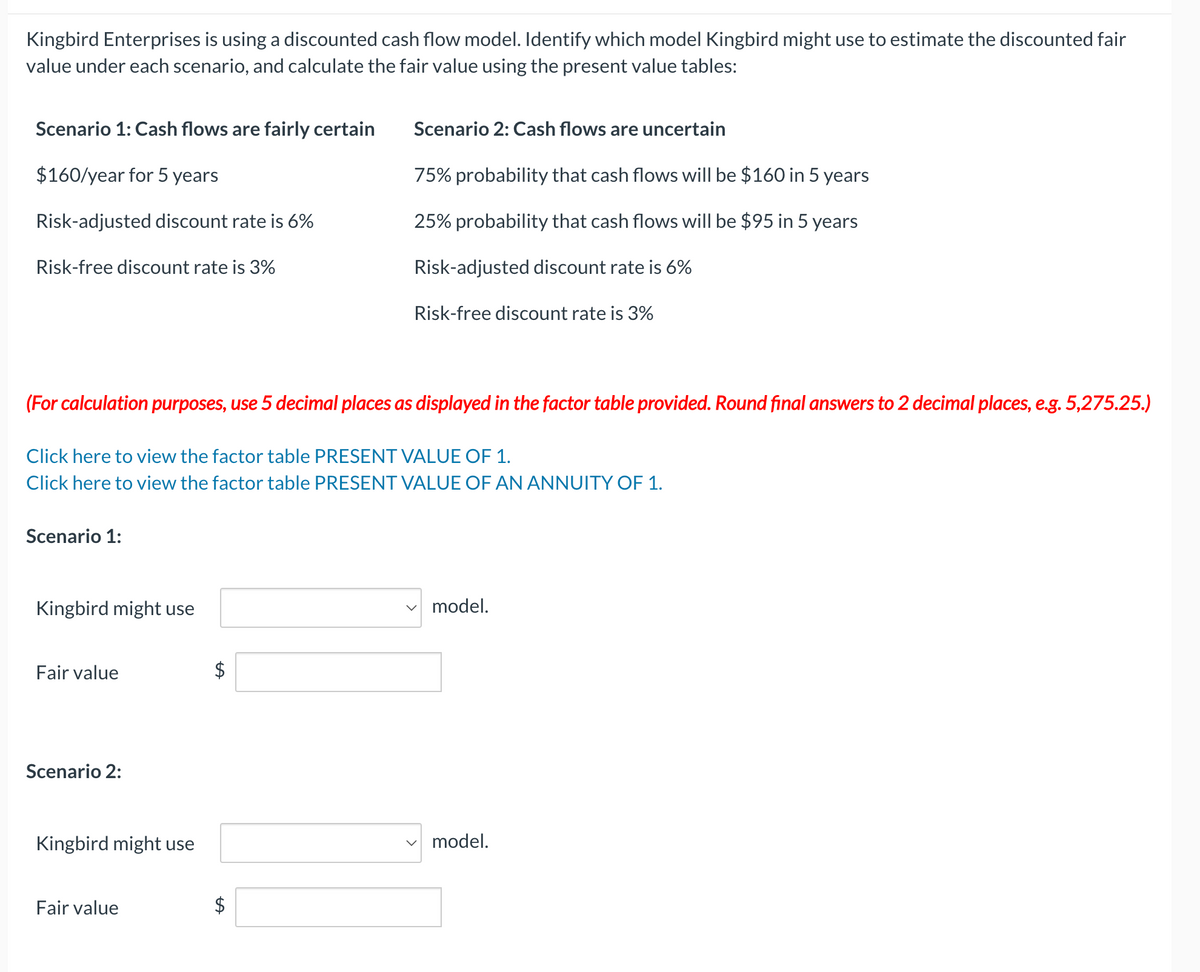

Kingbird Enterprises is using a discounted cash flow model. Identify which model Kingbird might use to estimate the discount value under each scenario, and calculate the fair value using the present value tables: Scenario 1: Cash flows are fairly certain $160/year for 5 years Risk-adjusted discount rate is 6% Risk-free discount rate is 3% Scenario 2: Cash flows are uncertain 75% probability that cash flows will be $160 in 5 years 25% probability that cash flows will be $95 in 5 years Risk-adjusted discount rate is 6% Risk-free discount rate is 3%

Kingbird Enterprises is using a discounted cash flow model. Identify which model Kingbird might use to estimate the discount value under each scenario, and calculate the fair value using the present value tables: Scenario 1: Cash flows are fairly certain $160/year for 5 years Risk-adjusted discount rate is 6% Risk-free discount rate is 3% Scenario 2: Cash flows are uncertain 75% probability that cash flows will be $160 in 5 years 25% probability that cash flows will be $95 in 5 years Risk-adjusted discount rate is 6% Risk-free discount rate is 3%

Chapter23: Corporate Restructuring

Section: Chapter Questions

Problem 11P

Related questions

Question

pls answer the following question. thanks

Transcribed Image Text:Kingbird Enterprises is using a discounted cash flow model. Identify which model Kingbird might use to estimate the discounted fair

value under each scenario, and calculate the fair value using the present value tables:

Scenario 1: Cash flows are fairly certain

$160/year for 5 years

Risk-adjusted discount rate is 6%

Risk-free discount rate is 3%

(For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round final answers to 2 decimal places, e.g. 5,275.25.)

Scenario 1:

Click here to view the factor table PRESENT VALUE OF 1.

Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1.

Kingbird might use

Fair value

Scenario 2:

Kingbird might use

Fair value

$

Scenario 2: Cash flows are uncertain

75% probability that cash flows will be $160 in 5 years

25% probability that cash flows will be $95 in 5 years

Risk-adjusted discount rate is 6%

LA

Risk-free discount rate is 3%

$

✓ model.

model.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College