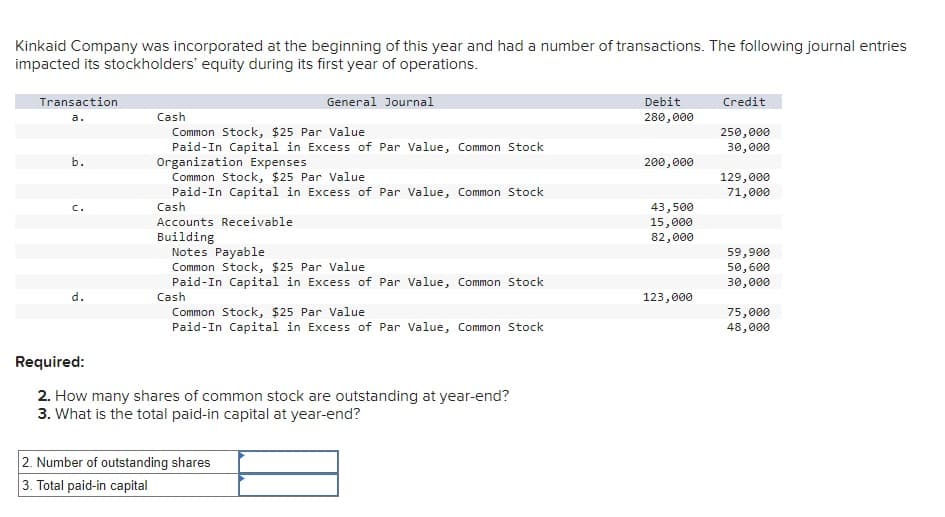

Kinkaid Company was incorporated at the beginning of this year and had a number of transactions. The following journal entries impacted its stockholders' equity during its first year of operations. Transaction General Journal a. Cash Debit 280,000 Credit Common Stock, $25 Par Value 250,000 b. Paid-In Capital in Excess of Par Value, Common Stock Organization Expenses 30,000 200,000 Common Stock, $25 Par Value 129,000 Paid-In Capital in Excess of Par Value, Common Stock 71,000 C. Cash 43,500 Accounts Receivable 15,000 Building 82,000 Notes Payable 59,900 Common Stock, $25 Par Value 50,600 Paid-In Capital in Excess of Par Value, Common Stock 30,000 d. Cash 123,000 Common Stock, $25 Par Value 75,000 Paid-In Capital in Excess of Par Value, Common Stock 48,000 Required: 2. How many shares of common stock are outstanding at year-end? 3. What is the total paid-in capital at year-end? 2. Number of outstanding shares 3. Total paid-in capital

Kinkaid Company was incorporated at the beginning of this year and had a number of transactions. The following journal entries impacted its stockholders' equity during its first year of operations. Transaction General Journal a. Cash Debit 280,000 Credit Common Stock, $25 Par Value 250,000 b. Paid-In Capital in Excess of Par Value, Common Stock Organization Expenses 30,000 200,000 Common Stock, $25 Par Value 129,000 Paid-In Capital in Excess of Par Value, Common Stock 71,000 C. Cash 43,500 Accounts Receivable 15,000 Building 82,000 Notes Payable 59,900 Common Stock, $25 Par Value 50,600 Paid-In Capital in Excess of Par Value, Common Stock 30,000 d. Cash 123,000 Common Stock, $25 Par Value 75,000 Paid-In Capital in Excess of Par Value, Common Stock 48,000 Required: 2. How many shares of common stock are outstanding at year-end? 3. What is the total paid-in capital at year-end? 2. Number of outstanding shares 3. Total paid-in capital

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter10: Stockholder's Equity

Section: Chapter Questions

Problem 5MCQ

Related questions

Question

Manji

Transcribed Image Text:Kinkaid Company was incorporated at the beginning of this year and had a number of transactions. The following journal entries

impacted its stockholders' equity during its first year of operations.

Transaction

General Journal

a.

Cash

Debit

280,000

Credit

Common Stock, $25 Par Value

250,000

b.

Paid-In Capital in Excess of Par Value, Common Stock

Organization Expenses

30,000

200,000

Common Stock, $25 Par Value

129,000

Paid-In Capital in Excess of Par Value, Common Stock

71,000

C.

Cash

43,500

Accounts Receivable

15,000

Building

82,000

Notes Payable

59,900

Common Stock, $25 Par Value

50,600

Paid-In Capital in Excess of Par Value, Common Stock

30,000

d.

Cash

123,000

Common Stock, $25 Par Value

75,000

Paid-In Capital in Excess of Par Value, Common Stock

48,000

Required:

2. How many shares of common stock are outstanding at year-end?

3. What is the total paid-in capital at year-end?

2. Number of outstanding shares

3. Total paid-in capital

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning